Next Moves

Congrats for Taking the Steps You Need to Learn Your Way Home!

You’re probably thinking what’s next? You have all of this knowledge and you’re ready to find a new home. We got you. The BestQualify team outlined key moves you can make now and put your new found know-how to work for you.

Register for a Live Webinar

If you haven’t attended a webinar yet, now is a perfect time. It’s a good refresher on the BestQualify method of home ownership and you have an opportunity to ask questions. We know that you’ve already reviewed your credit history and identified what you need to do to improve your score. Now it’s time to make the next moves on your journey to home ownership.

Choose a Lender

INSIDER PRO TIPS

- Interview lenders in your area and make a choice

- Choose a BestQualify approved lender

- Get preapproved before you shop for homes

- Ask your lender about any new buyer programs they offer (programs vary by state)

- Ask about government-backed loans and determine if one may be right for you

Choose a Realtor

INSIDER PRO TIPS

- Interview multiple licensed realtors to ensure you have high comfort and trust levels with your choice

- A realtor with strong local knowledge is a big plus

- Exceptional communication skills will prove to be invaluable

- Ask your lender for a realtor recommendation

QUESTIONS?

We’ve got answers.

Attend our free LIVE webinar conducted by one of our credit pros, or speak to a lender today!Table of Contents:

Home Buyers

- What Are the Common Types of Mortgage Loans?

- How Much Should I Save for a Down Payment & Closing Costs?

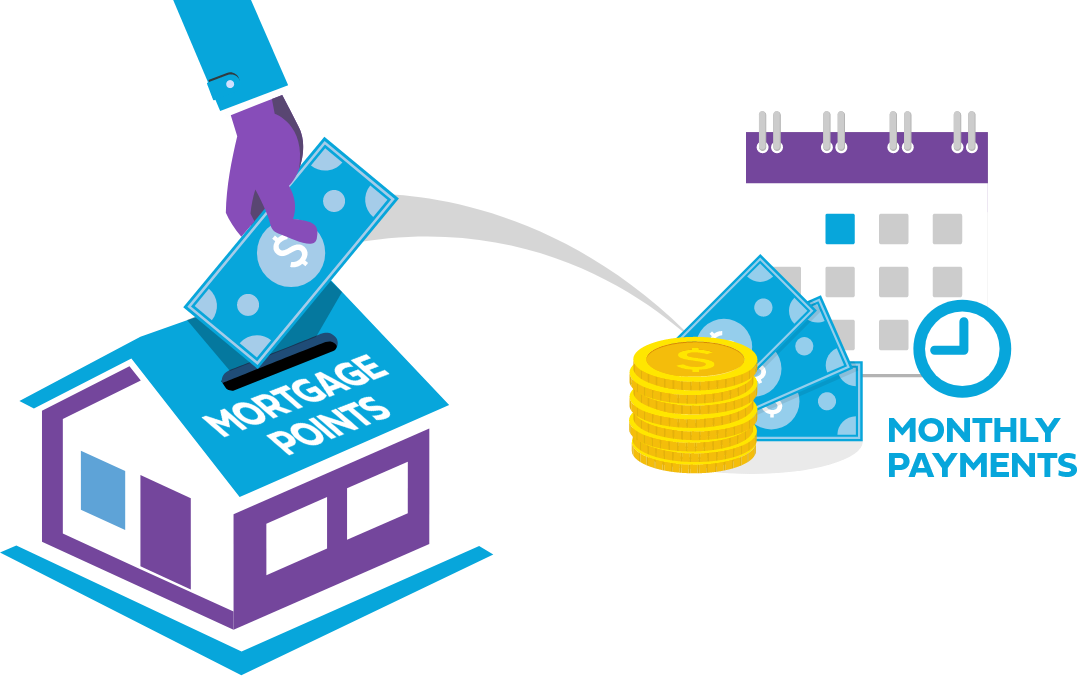

- What Are Mortgage Points?

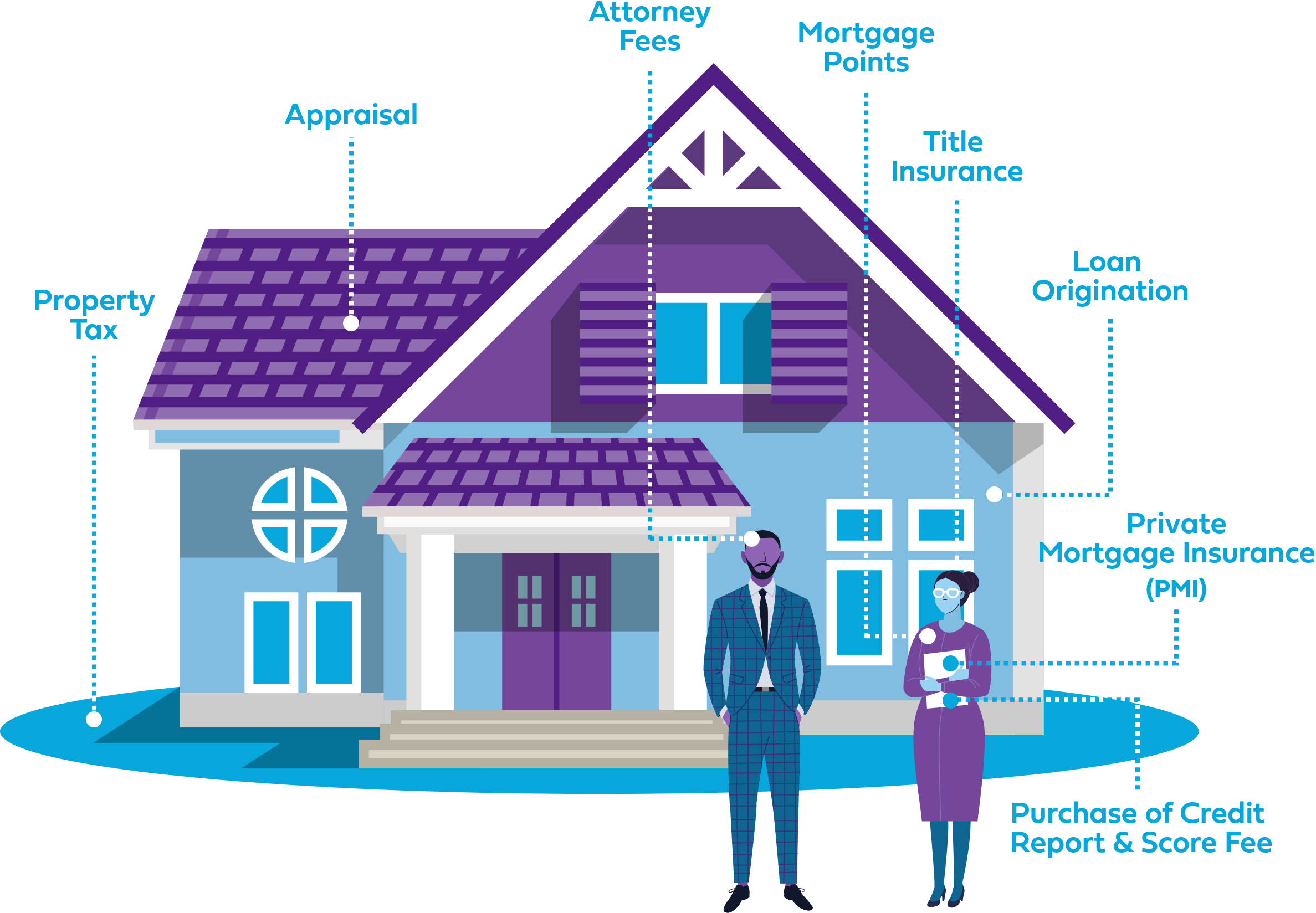

- What Costs Are Included in My Mortgage Payment?

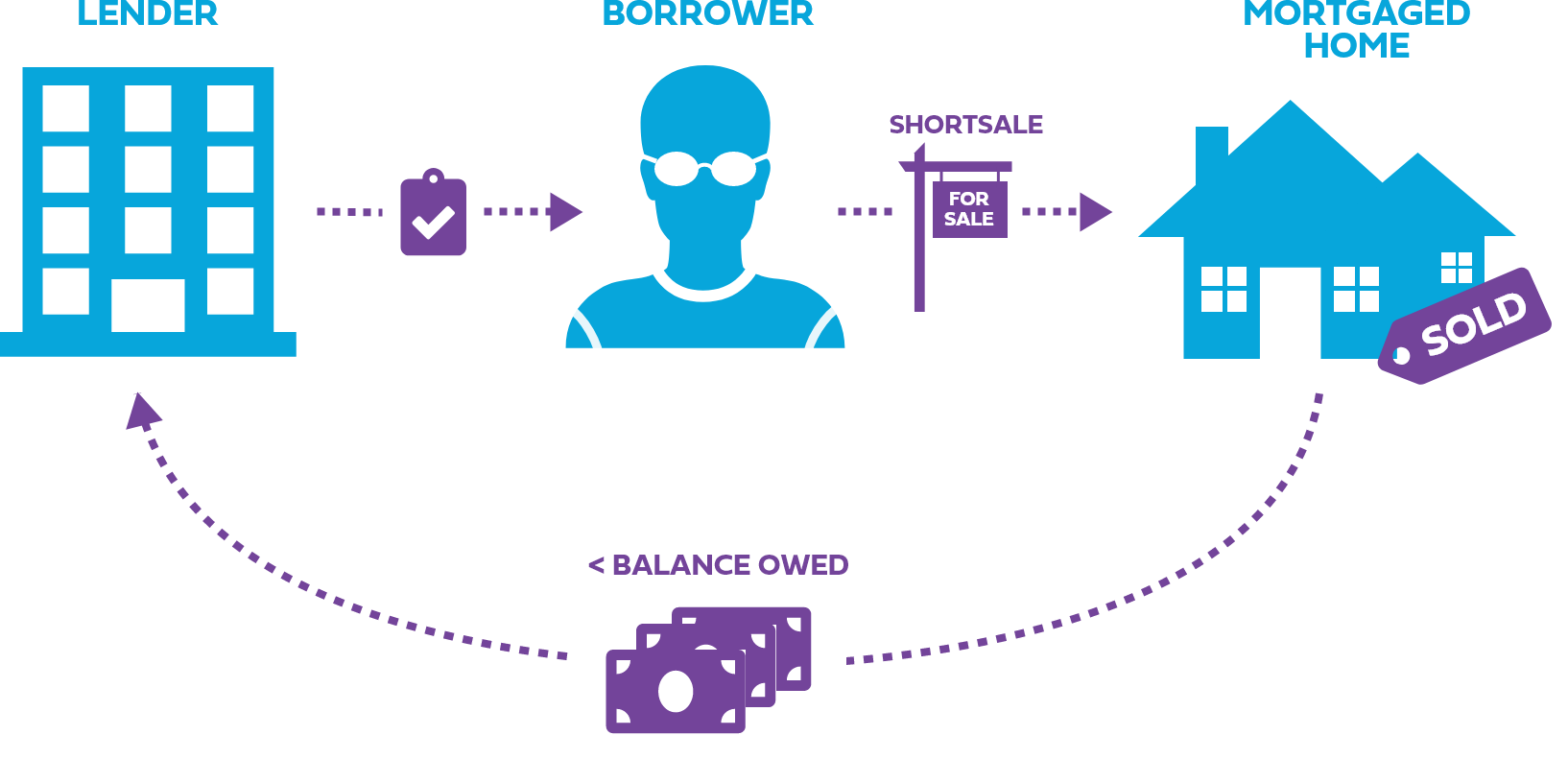

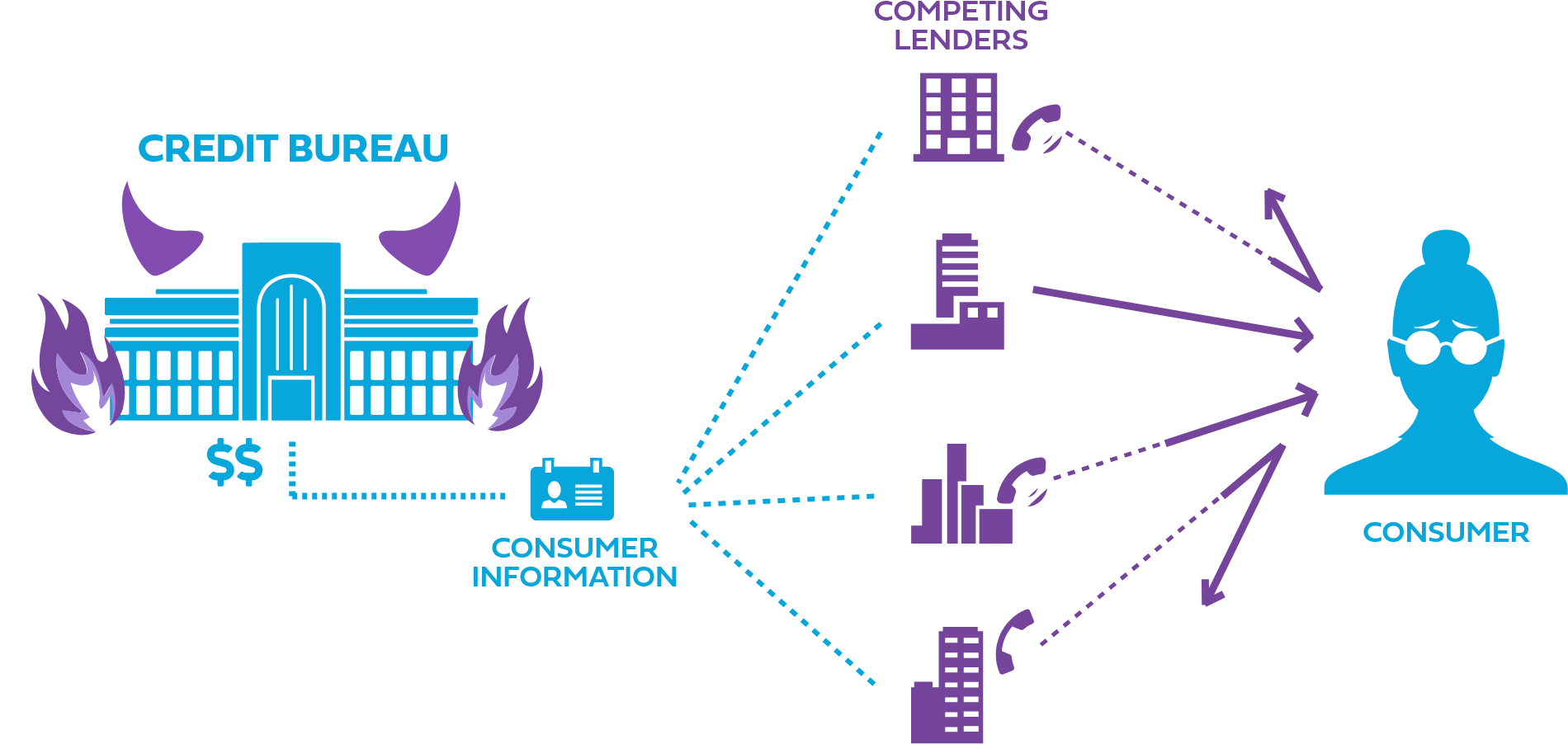

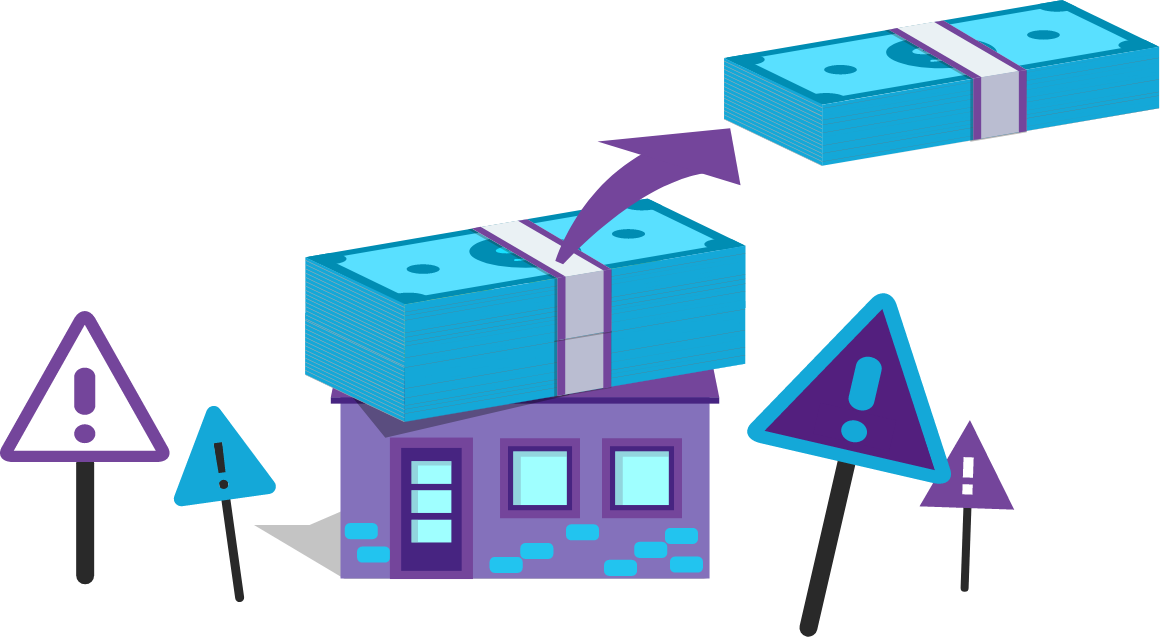

- Foreclosures vs. Shortsales

- Prequalification vs. Preapproval

- Navigating a Challenging Housing Market

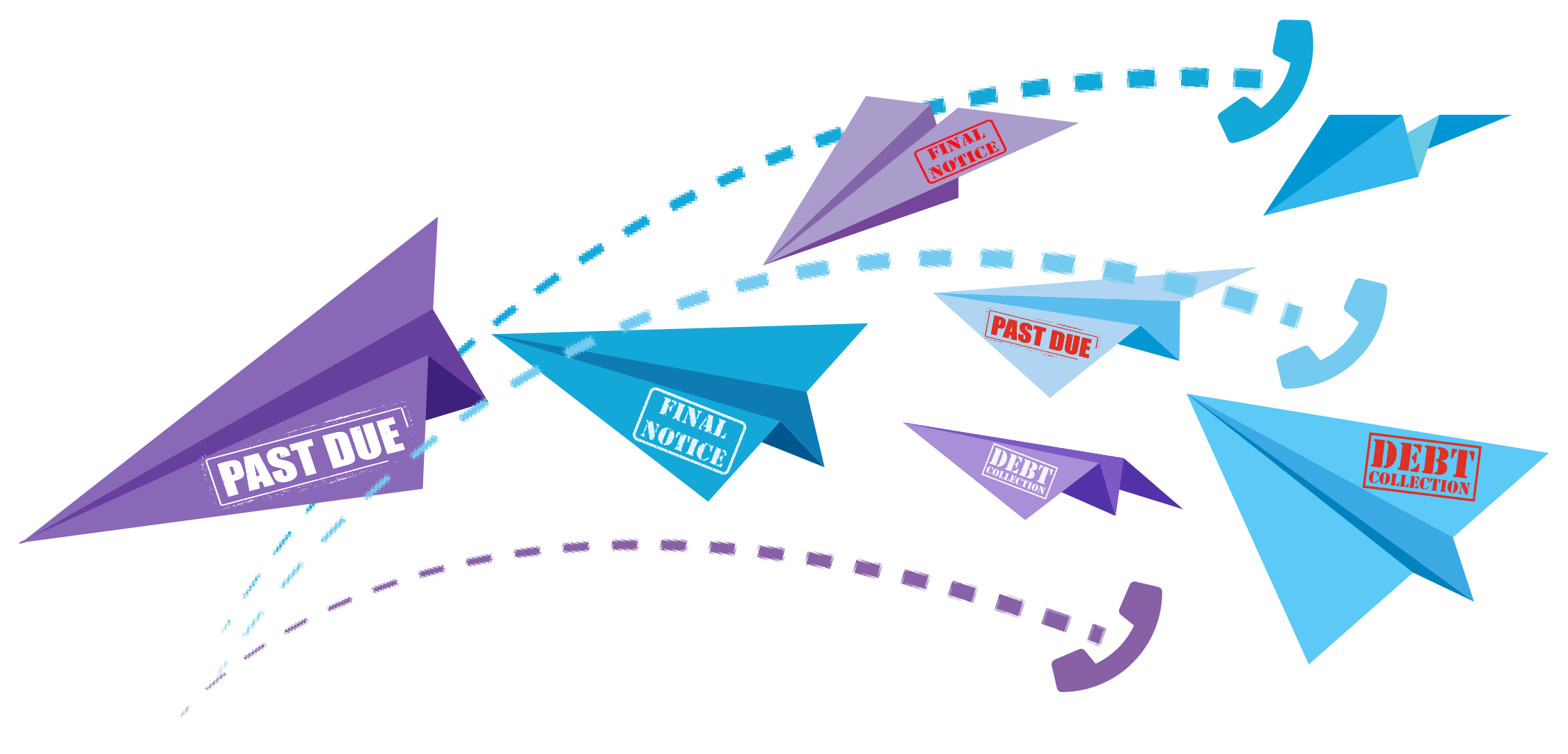

- Common New Home Buyer Mortgage Fails

Table of Contents: Home Buyers

- What Are the Common Types of Mortgage Loans?

- How Much Should I Save for a Down Payment & Closing Costs?

- What Are Mortgage Points?

- What Costs Are Included in My Mortgage Payment?

- Foreclosures vs. Shortsales

- Prequalification vs. Preapproval

- Navigating a Challenging Housing Market

- Common New Home Buyer Mortgage Fails