What Exactly Is a Credit Score and How is it Determined?

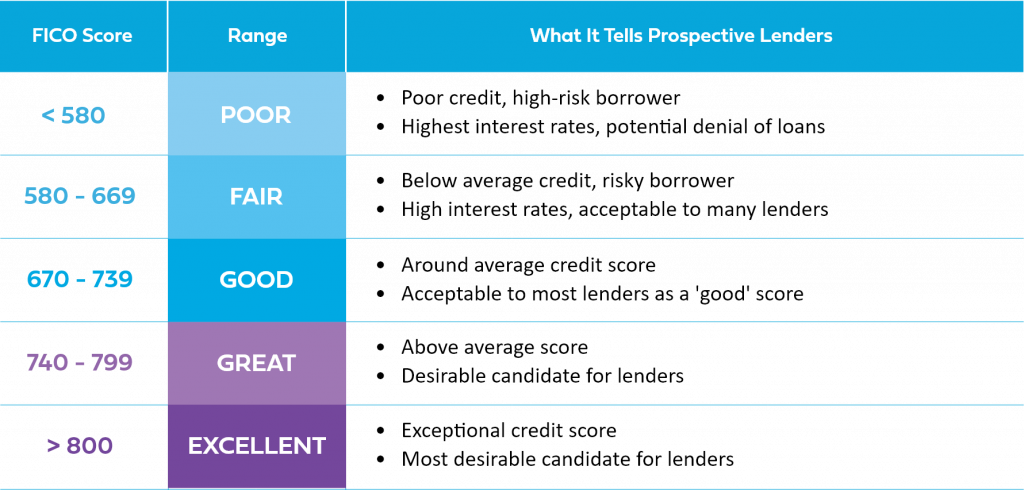

At one time or another, we’ve all learned that having a high credit score will get us the best rates possible on just about anything including a mortgage. The higher the score, the better the terms.

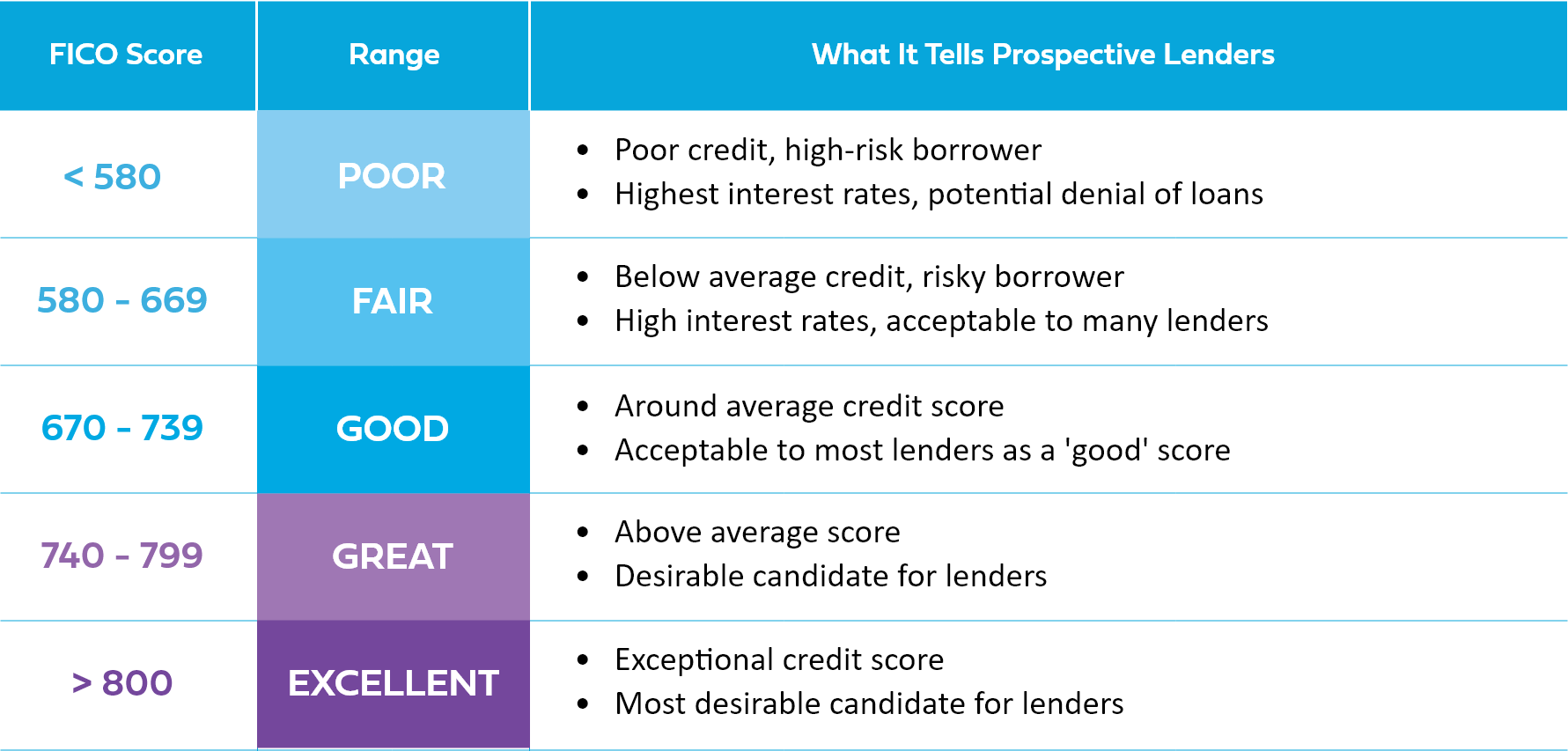

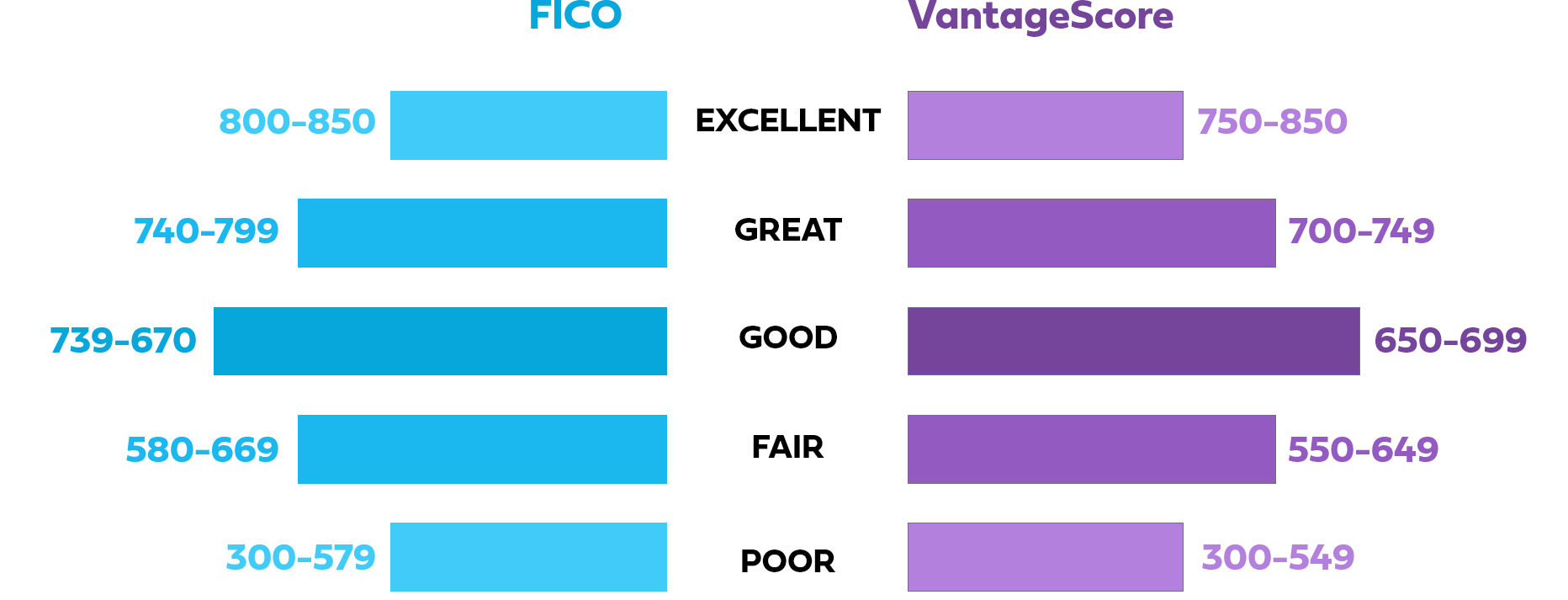

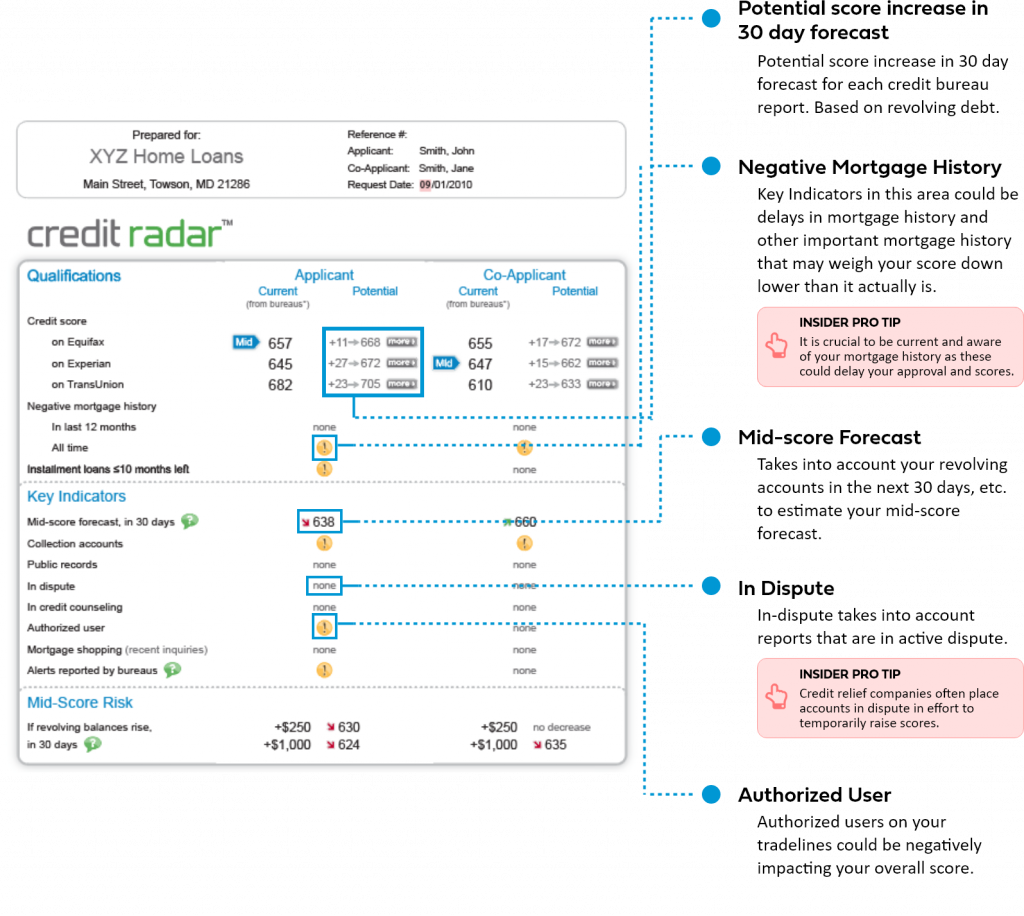

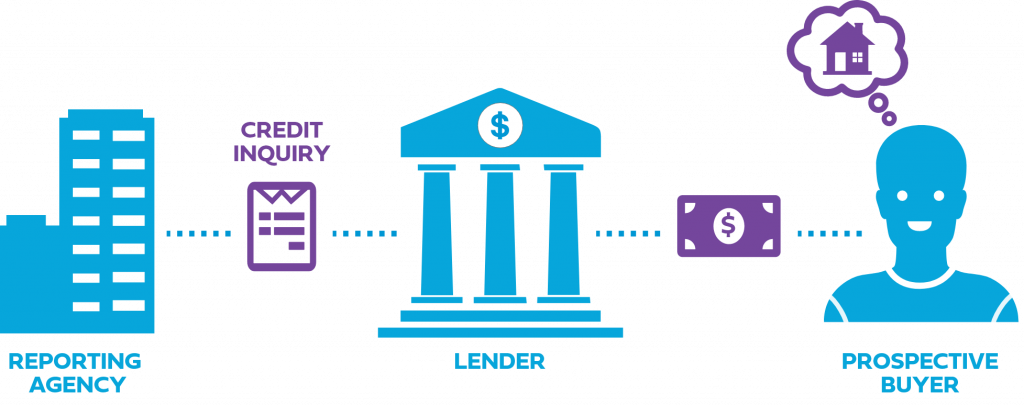

A FICO® credit score is a number that ranges between 300 and 850 and it determines your ‘creditworthiness’ as a consumer. Your score is based on your credit history—how many open accounts you have, total debt levels, and your repayment history. Lenders use your credit score to predict the probability that you will repay them on schedule as agreed.

Simply put, your credit score determines if you’re on the path to homeownership or if you may need to rent for a longer period of time.

What Are The Four

Most Common Types of Credit?

Some or all of these credit types may look familiar to you. It’s crucial that everyone who is trying to improve their credit be aware of credit in its most common forms.

- Revolving Credit

An example would be a credit card. Credit cards are considered revolving credit because the user has a limit as to how much can be spent.

- Charge Cards

When you purchase a charge card, the full amount is due every month. There are often annual fees associated with these. An example of a widely-used charge card is American Express®.

- Installments

An installment loan allows you to make payments for a product or service over a specific period. The term of the loan can be short or up to 30 years depending on the agreement. A mortgage and car loan are examples of installment credit.

- Non-installment

This credit type does not have payments. It is due in one lump sum typically, in a short period.

- End of Content -

← Previously

Next Up →

Score & Credit Basics

Keep track of your progress and discover content next in line.

What Exactly Is a Credit Score and How is it Determined?

What is a Credit Report?

When, Where & Why Should I Check My Credit?

What Is an Inquiry?

What Is a Tradeline?

What Is a FICO® Score?

Do Other Scoring Models Exist?

Can My Credit Score Be Improved?

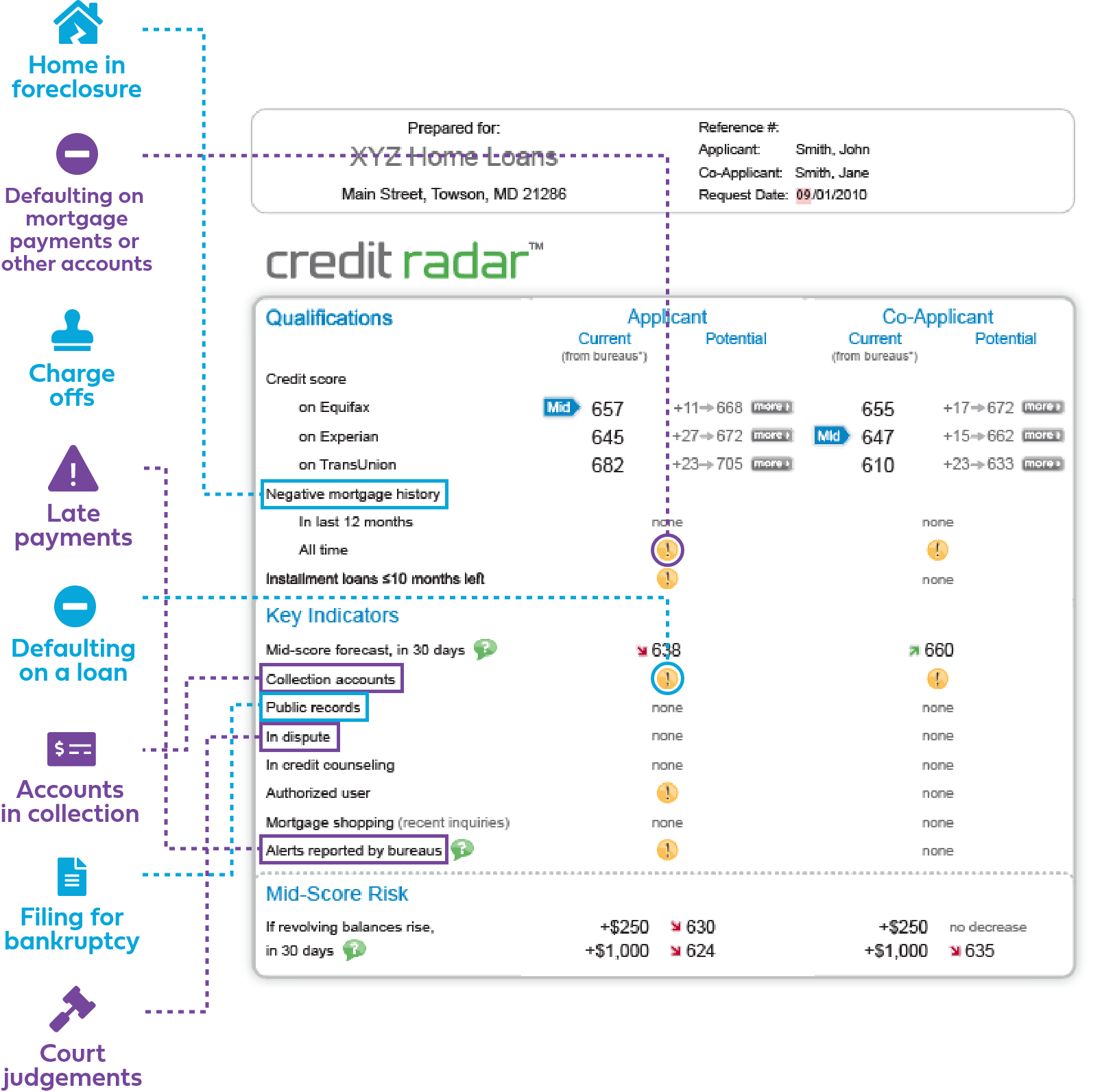

Common Reasons Why Your FICO® Score Is Low