Do Other Scoring Models Exist?

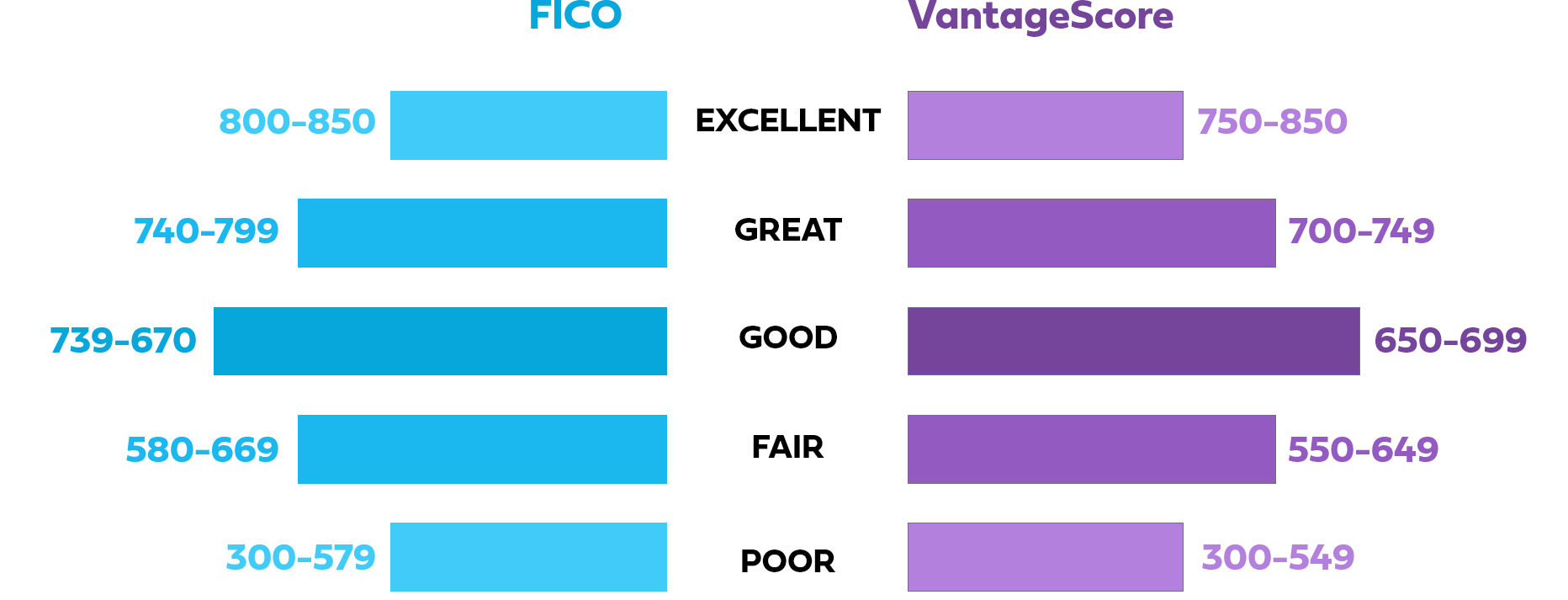

The FICO model did not have any competition until the VantageScore® model was introduced in 2006 by the credit bureaus—Equifax®, Experian®, and TransUnion®.

Both models use consumer credit data to develop scores.

Both models use consumer credit data to develop scores and use the same scoring range.

The main difference is that FICO is used in mortgage lending and VantageScore is not.

FICO

- Includes paid collection accounts when determining score

- Acknowledges all late dates

- Requires one open, active account that has a credit history minimum of six months

- Most widely used scoring model by creditors and lenders

- Inquires that are considered ‘rate shopping’ have little or no score impact

- Range 300-850 (mortgage FICO scores)

VantageScore

- Does not count paid collections

- Leans more on mortgage late payment dates, than other tradelines

- Generates score with one bureau reporting, one month history, active or derogatory

- Also called ‘FAKO’ or ‘educational’ scores

- Used by Credit Karma, bureaus

- Credit inquiries have more impact

- The range was 501-900 but recently changed to match FICO score range

- A VantageScore above 660 is considered good

- A VantageScore above 780 is considered excellent

- End of Content -

← Previously

Next Up →

Score & Credit Basics

Keep track of your progress and discover content next in line.

What Exactly Is a Credit Score and How is it Determined?

What is a Credit Report?

When, Where & Why Should I Check My Credit?

What Is an Inquiry?

What Is a Tradeline?

Previously

What Is a FICO® Score?

Currently

Do Other Scoring Models Exist?

Next Up...

Can My Credit Score Be Improved?

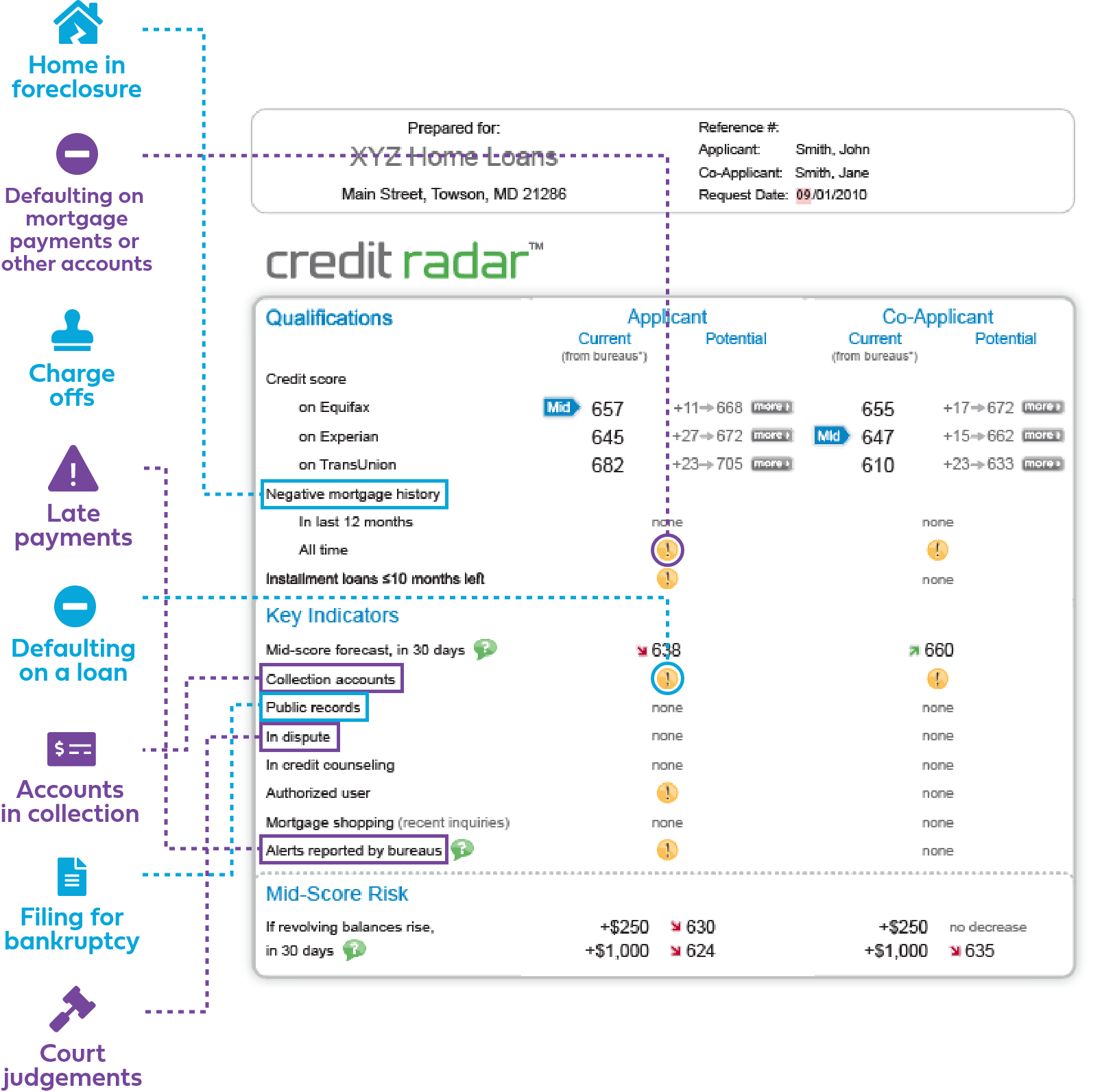

Common Reasons Why Your FICO® Score Is Low