Fixed Rate

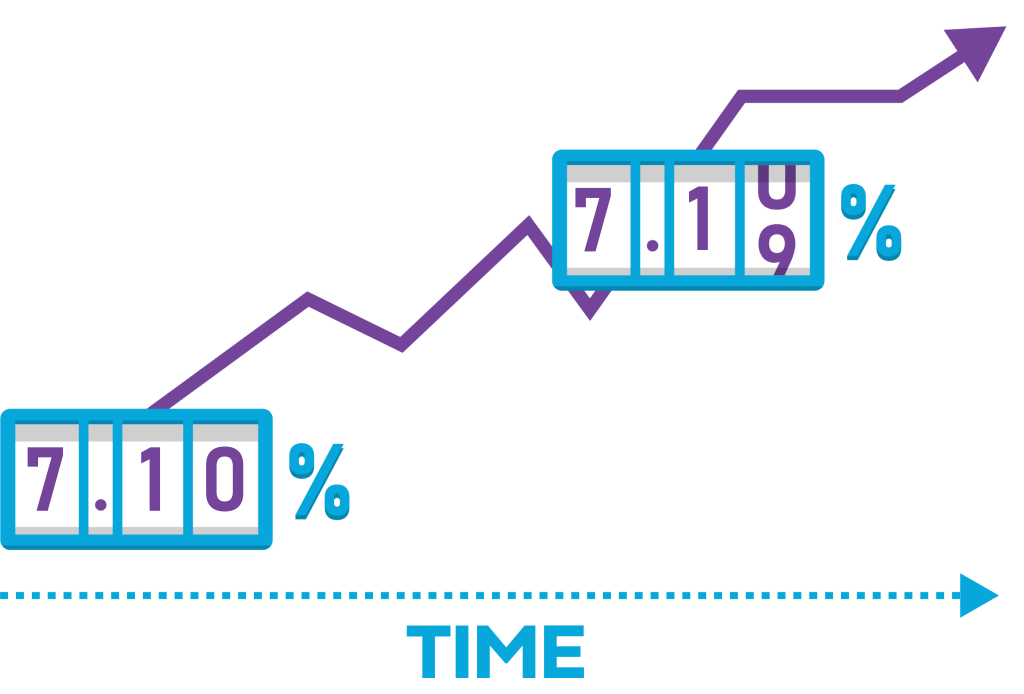

Your interest rate remains constant for the life of your loan. Many borrowers prefer this type of mortgage loan because there are no surprises and it makes the budgeting of monthly expenses easier. The interest rate can be higher on these loans, but you will not have the fluctuating mortgage payments that come with some other loan types.