What Is a Trigger Lead?

Trigger Leads, a Controversial Practice

In short, trigger leads are rightfully viewed by mortgage experts, including the BestQualify team, as a corrupt and malicious practice that preys upon home buyers.

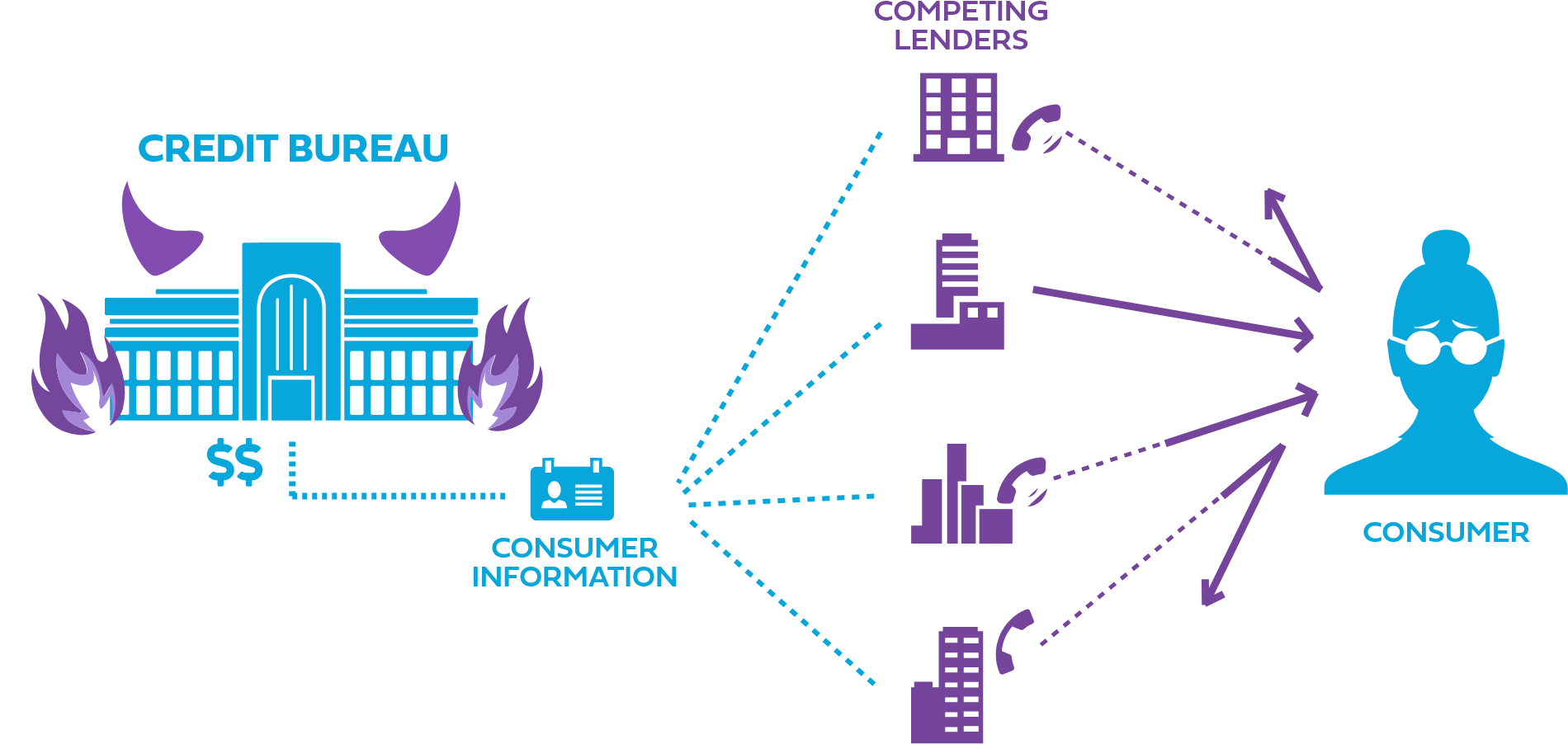

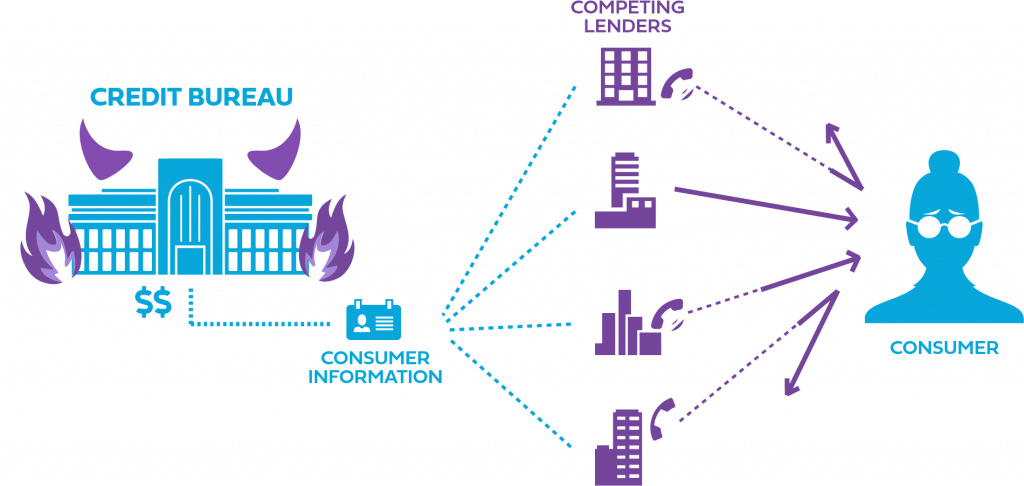

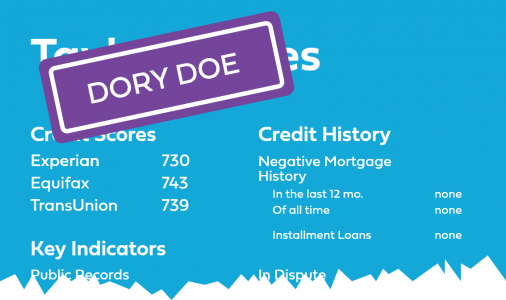

The national credit bureaus (Experian, TransUnion, and Equifax) are responsible for gathering financial data regarding the payment history and tradelines of potential borrowers who have applied for credit. These bureaus are the culprits behind the trigger lead machine that inundates borrowers with unsolicited phone calls, direct mail, and other forms of evasive contact.

When you apply for a mortgage loan, your credit report is requested from the credit bureaus. Experian, TransUnion, and Equifax will then sell your application information to other lenders which makes them aware that you are actively seeking a mortgage loan. The lenders that pay for your application data, will contact you with offers that compete directly with your chosen lender.

Is This Practice Legal?

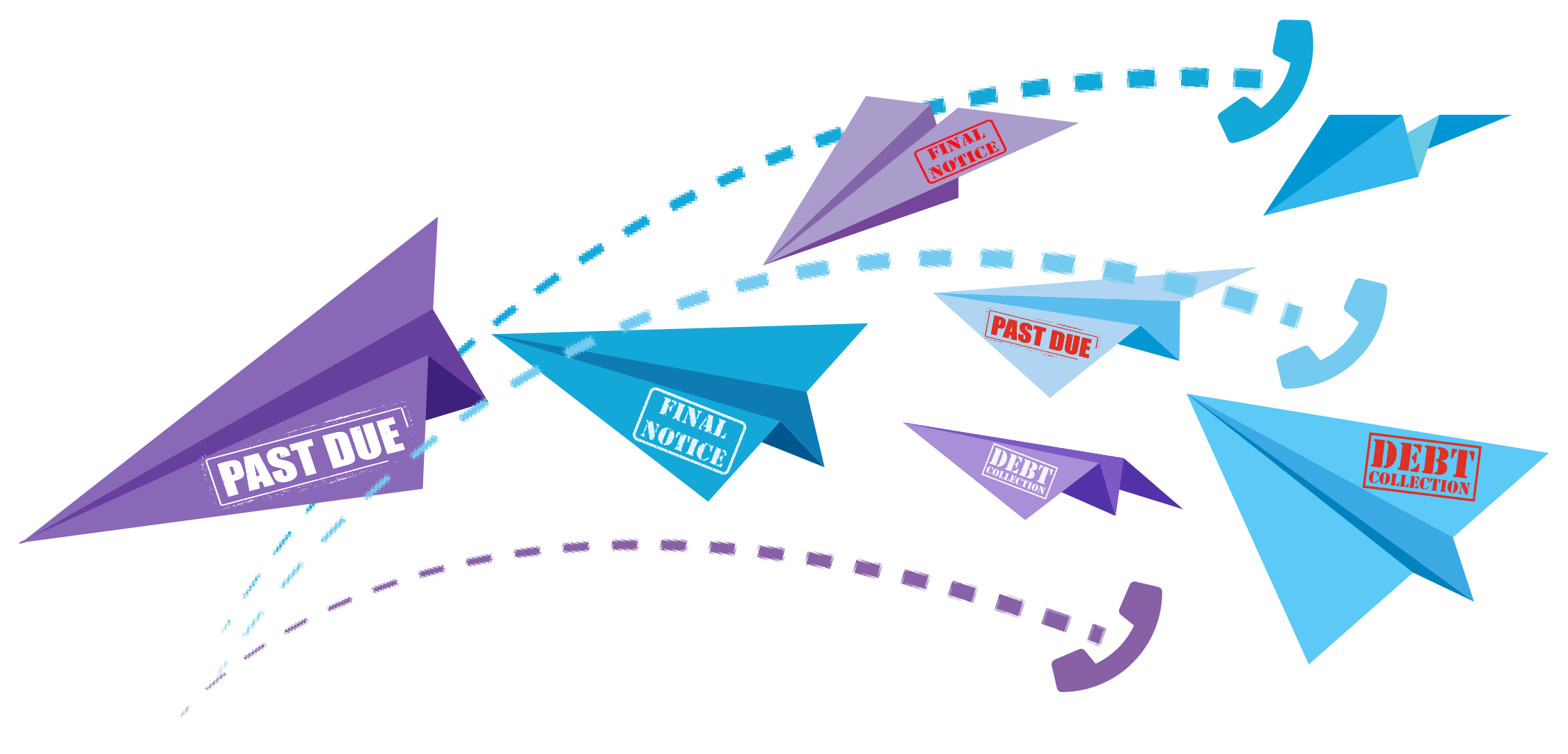

Unfortunately, yes and it happens fast. Often, within a day or two of submitting your application, you will start receiving phone calls from competing lenders. Many applicants mistakenly think that their lender has sold their application information. This is false and most lenders will warn you that the flood of solicitations is coming.

Can I Do Anything to Stop It?

There is an opt-out option, but this does not stop unwanted contact promptly. Mortgage applicants can remove themselves from most marketing programs by calling 888-5-OPTOUT or by registering at optoutprescreen.com. The downside is that the opt-out process takes up to five days to be activated so it does very little in protecting consumers from the onslaught of trigger leads. Many consumers have reported being subjected to the trigger lead program even after they have opted out.

- End of Content -

← Previously

Buyer Alert

Keep track of your progress and discover content next in line.

Currently

What Is a Trigger Lead?

Next Up...

How Do I Find a Reputable Credit Repair Company?

Mortgage Relief

Purchasing Tradelines

Disreputable Debt Collection Practices

Mortgage Fraud: A Warning