TABLE OF CONTENTS

Credit IQ

Test your credit IQ by answering the questions provided by our insider pros. We understand that it’s a lot of information to remember, so take the test as many times as you need! It will help you to discover which sections of the site you may need to revisit. Go ahead and try…you know more than you think.

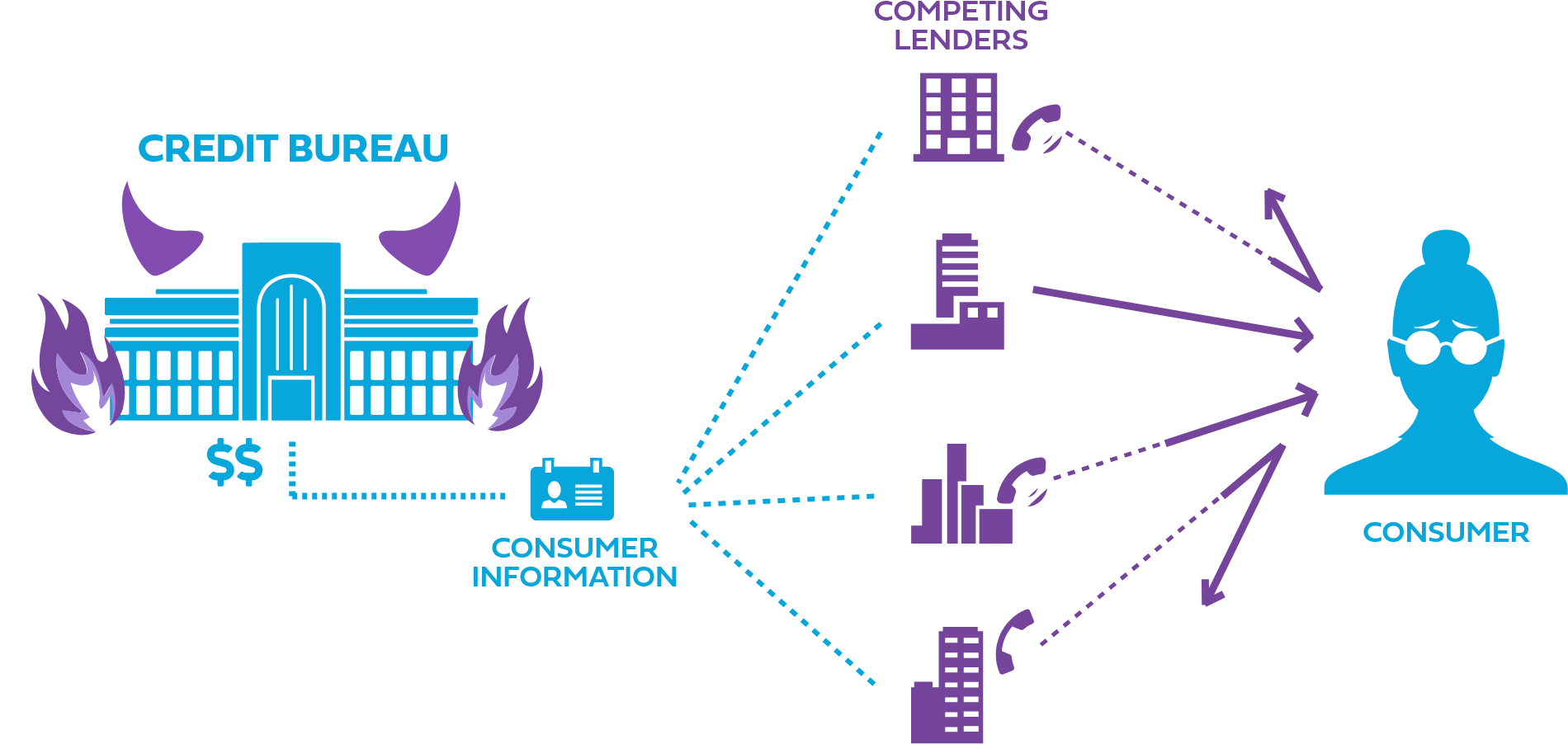

Score & Credit Basics

0%

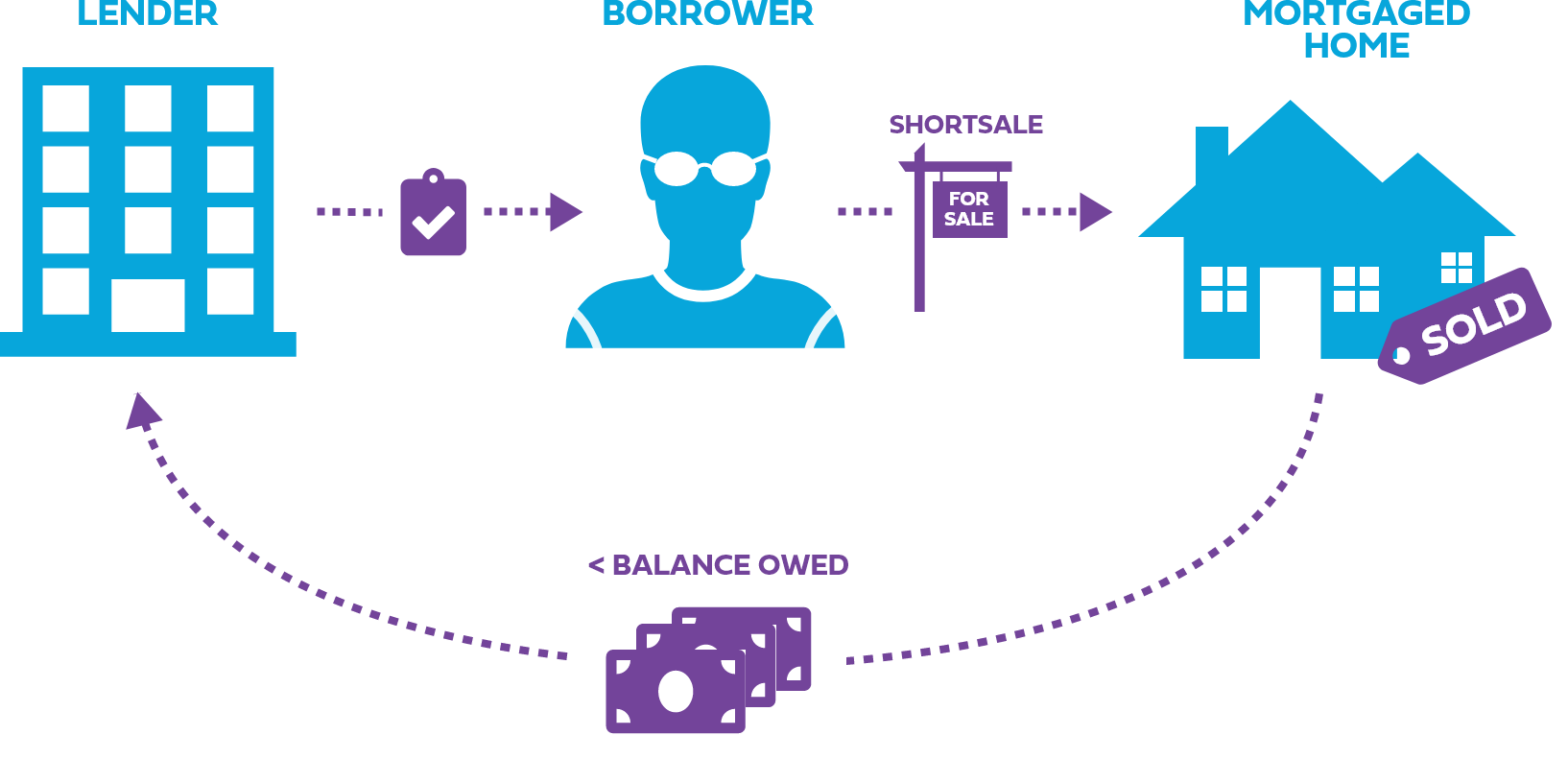

Mortgage Essentials

0%

Buyer Alert

0%