What Is a FICO® Score?

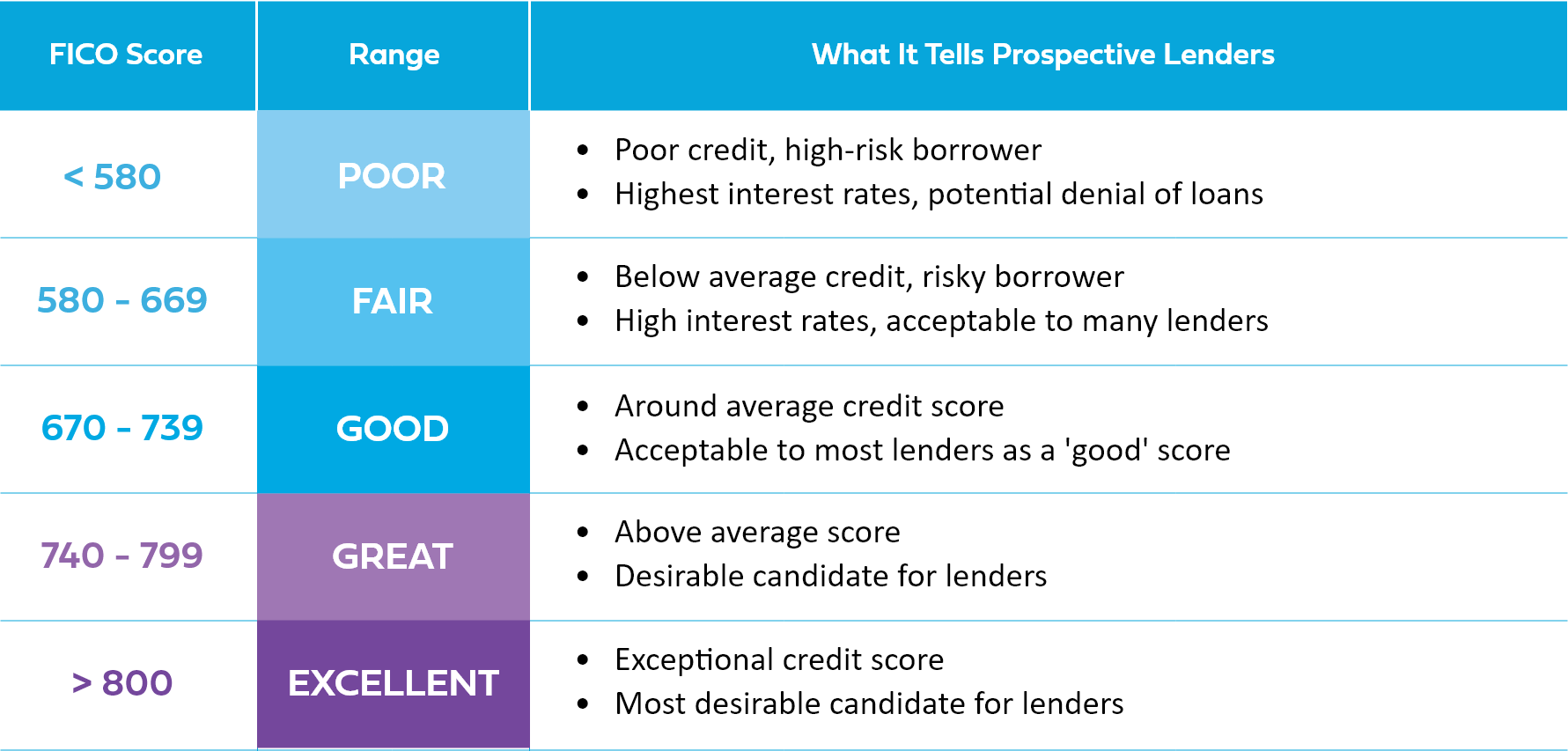

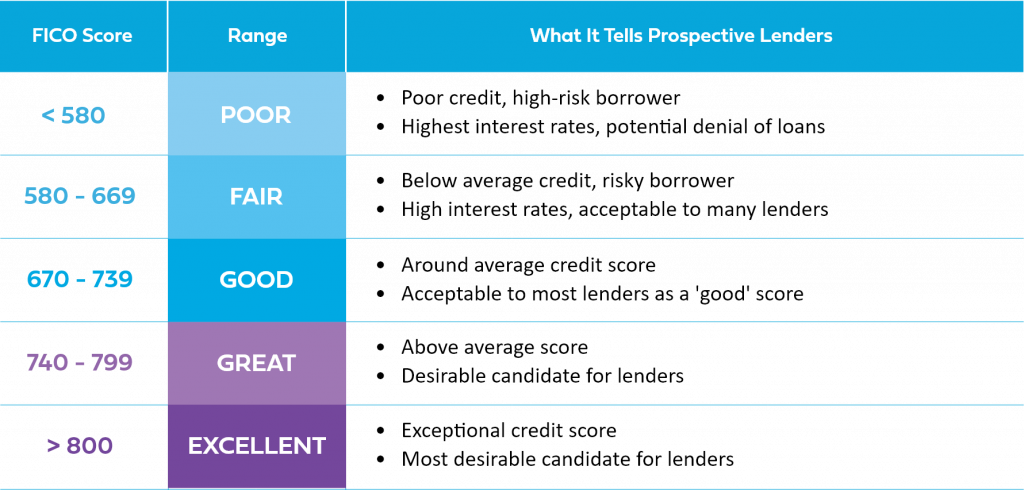

FICO, originally known as the Fair, Isaac, and Company, is a data analytics company based in San Jose, California. The main focus of the company is credit scoring services. The FICO score is a measure of consumer credit risk and has been in use since 1989 when the company debuted the first credit score. Today, FICO holds more than 130 patents for its various technologies.

What factors are used to determine my FICO® score?

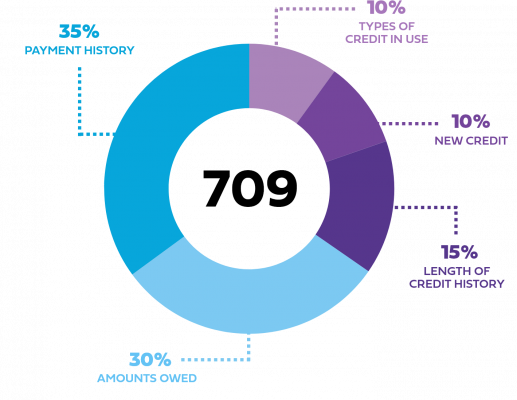

FICO Scores are calculated using different pieces of credit data in your credit report. The data is then grouped into five categories and each is measured individually.

INSIDER PRO TIPS

For Maintaining a Healthy Score

- Pay your bills on time. If you don’t, it will damage your score significantly

- If you missed a payment, ensure to make your account current and ask for a ‘late date’ removal

- Do not pay less than the monthly amount due on your mortgage or any other accounts

- Keep your credit card balances as low as possible

- Do not close any credit cards

- Keep applications for new credit to a minimum

- Monitor your credit report to ensure there are no discrepancies or signs of fraud

- End of Content -

← Previously

Next Up →

Score & Credit Basics

Keep track of your progress and discover content next in line.

What Exactly Is a Credit Score and How is it Determined?

What is a Credit Report?

When, Where & Why Should I Check My Credit?

What Is an Inquiry?

Previously

What Is a Tradeline?

Currently

What Is a FICO® Score?

Next Up...

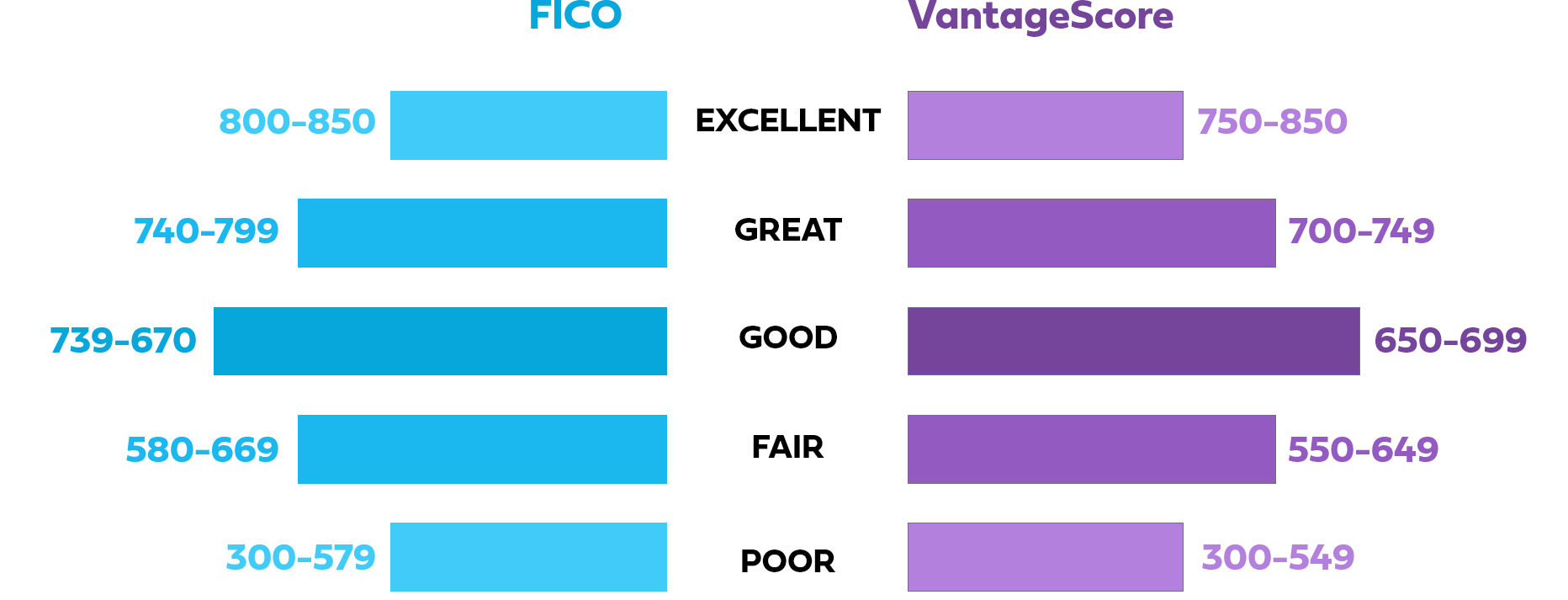

Do Other Scoring Models Exist?

Can My Credit Score Be Improved?

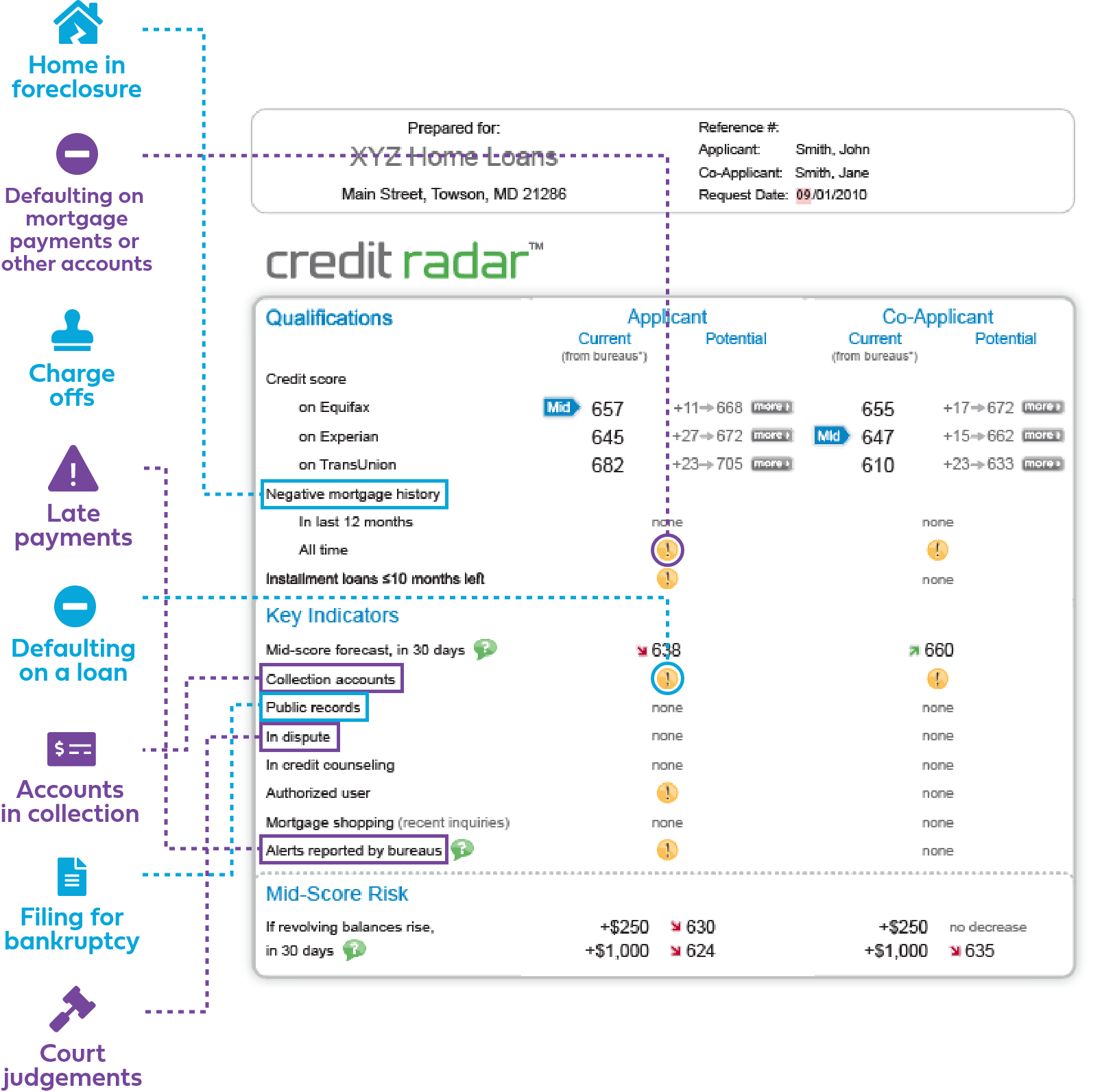

Common Reasons Why Your FICO® Score Is Low