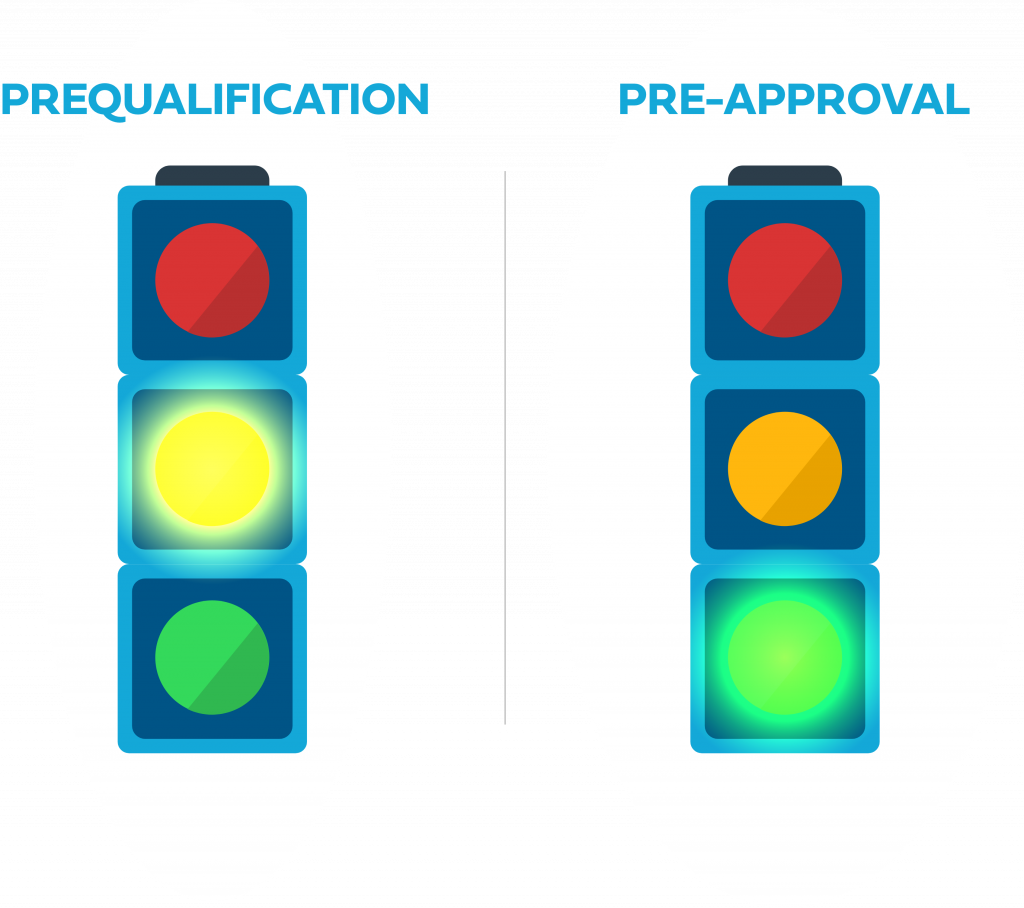

Prequalification vs. Preapproval

Prequalification

Think of prequalification as the first-step in receiving approval. Prequalification gives you an estimate on how much of a loan you may receive. Pre-approval is the next step and it is a tentative commitment from your lender that they will back your loan.

Pre-Approval

Pre-approvals are contingent in nature. If your credit score is impacted negatively during this time it can jeopardize your approval. Do not make any significant purchases, apply for new credit, switch jobs or participate in any other behavior that could put your mortgage loan approval at risk.

When you are ready to begin looking for your next home, request a pre-approval letter from your lender. There are steps your lender will follow to ensure that they can provide you with a pre-approval letter:

- Your real estate agent will likely ask for proof of your pre-approval prior to showing you any properties. A pre-approval letter lets your realtor know that you are financially able to purchase a home. It also empowers you to immediately make an offer on a home when you find one that fits your needs.

- When a pre-approval letter accompanies your offer, a seller will take you seriously. Most buyers will not even consider accepting an offer from you if you are not pre-approved.

- End of Content -

← Previously

Next Up →

Mortgage Essentials

Keep track of your progress and discover content next in line.

What Are the Common Types of Mortgage Loans?

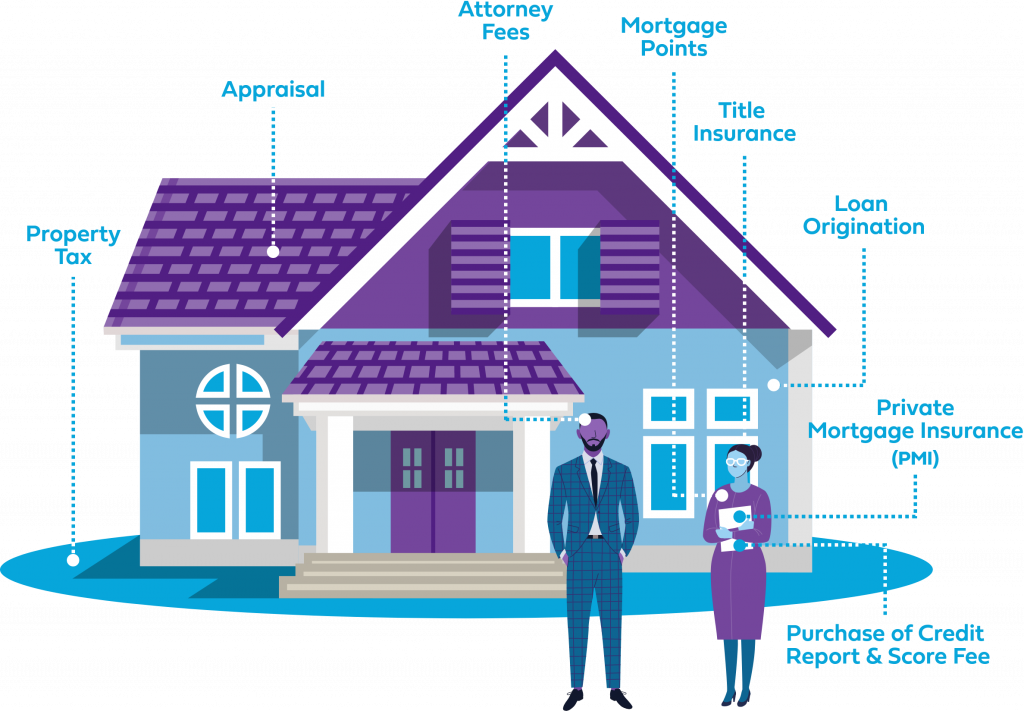

How Much Should I Save for a Down Payment & Closing...

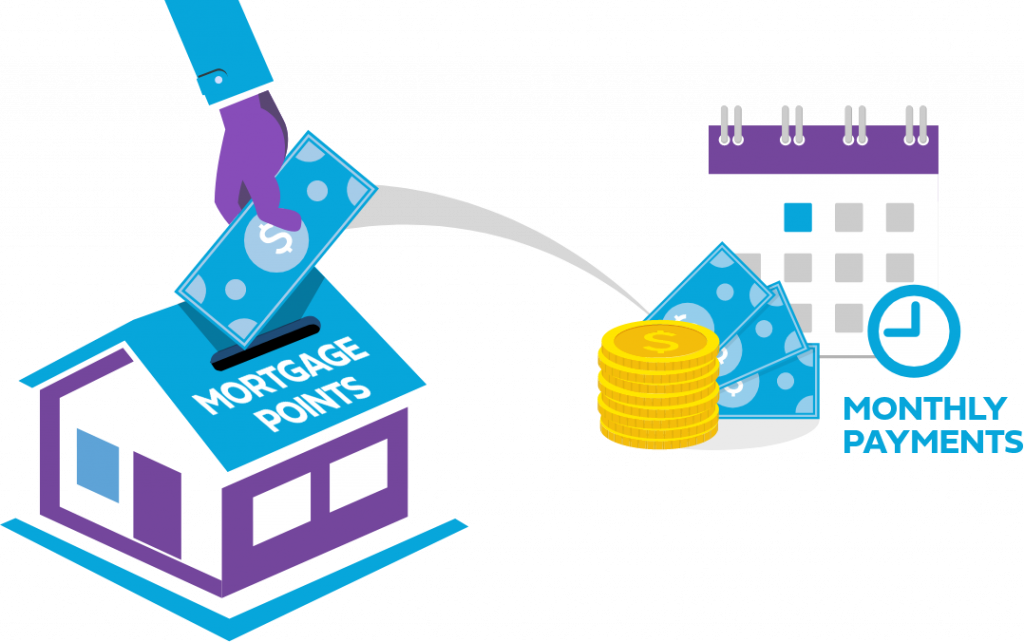

What Are Mortgage Points?

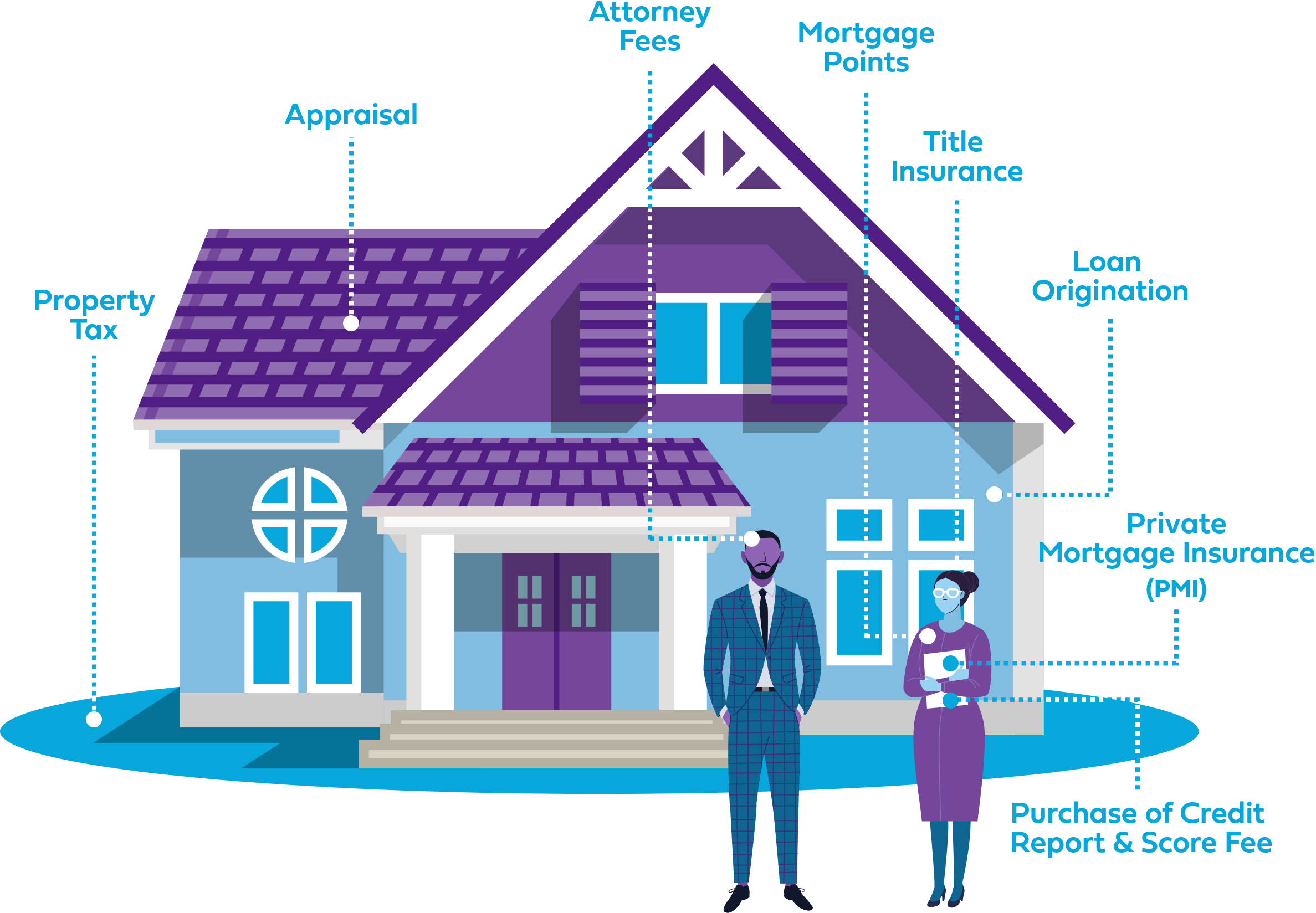

What Costs Are Included in My Mortgage Payment?

Previously

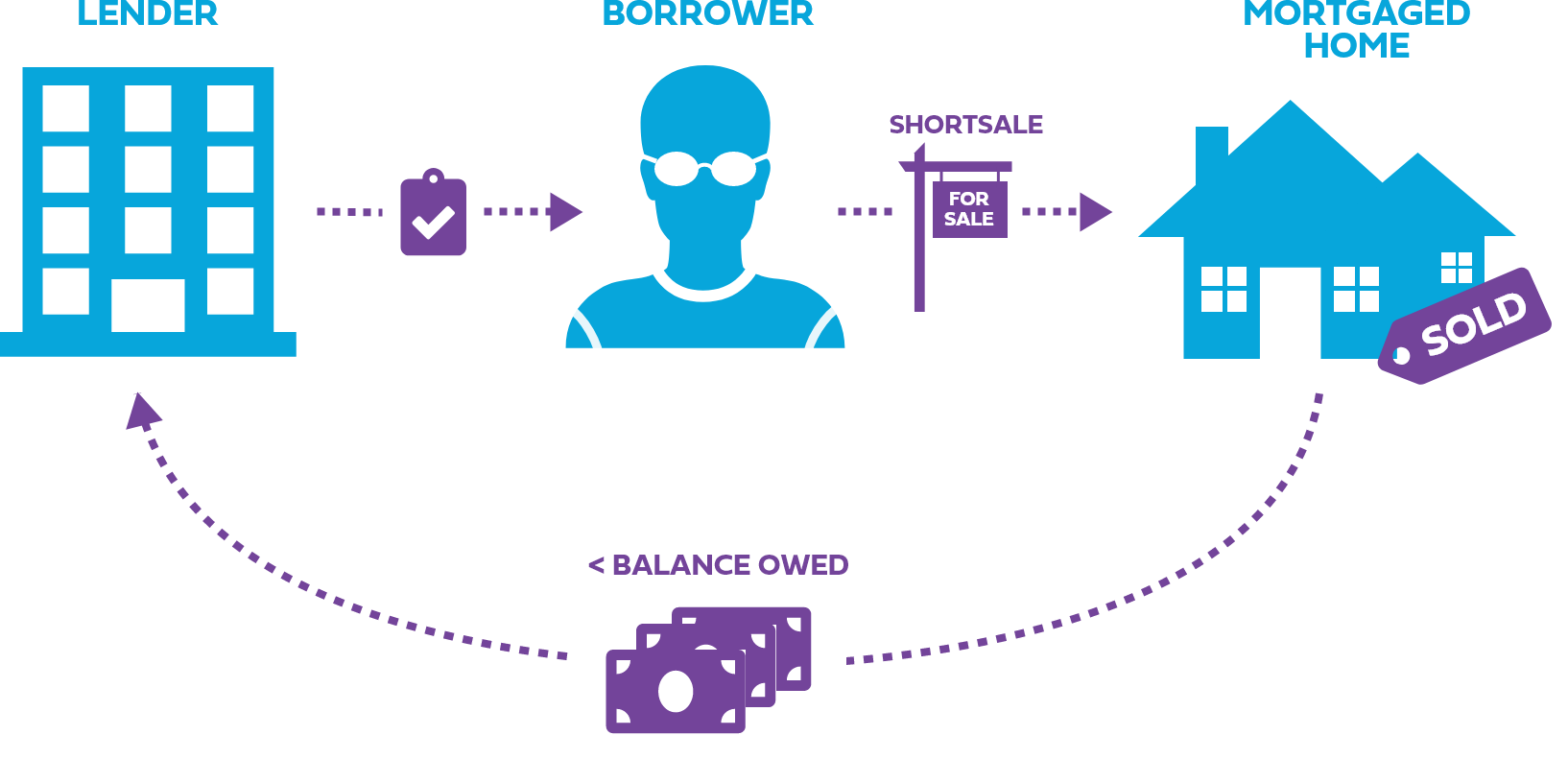

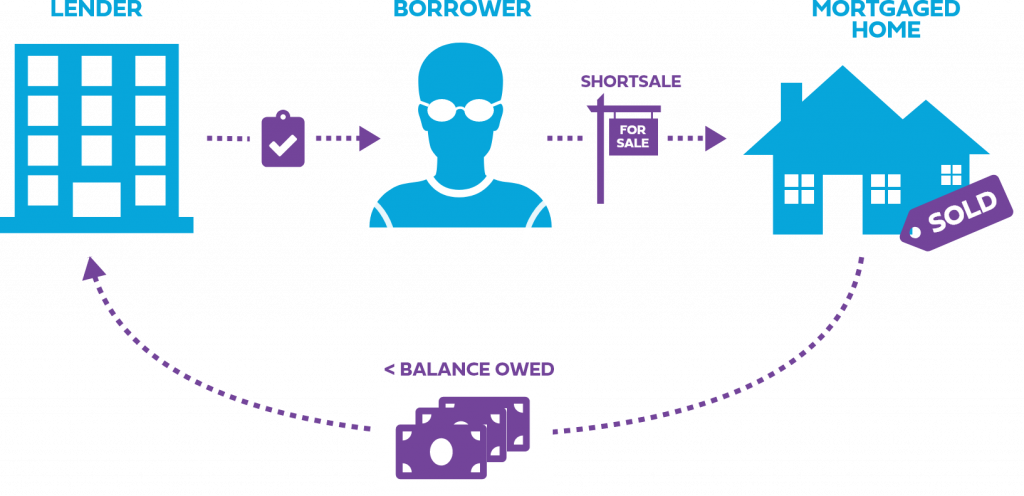

Foreclosures vs. Shortsales

Currently

Prequalification vs. Preapproval

Next Up...

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

Learned all of

Mortgage Essentials?

Test your Credit IQ with our short, 9 question quiz.

Learn Your Way Home