Foreclosures vs. Shortsales

Foreclosures and Shortsales… What’s the Difference?

Shortsales and foreclosures are options for borrowers who are experiencing financial challenges due to job loss or other event. Both options will negatively impact the borrower’s credit score, credit report and tax return.

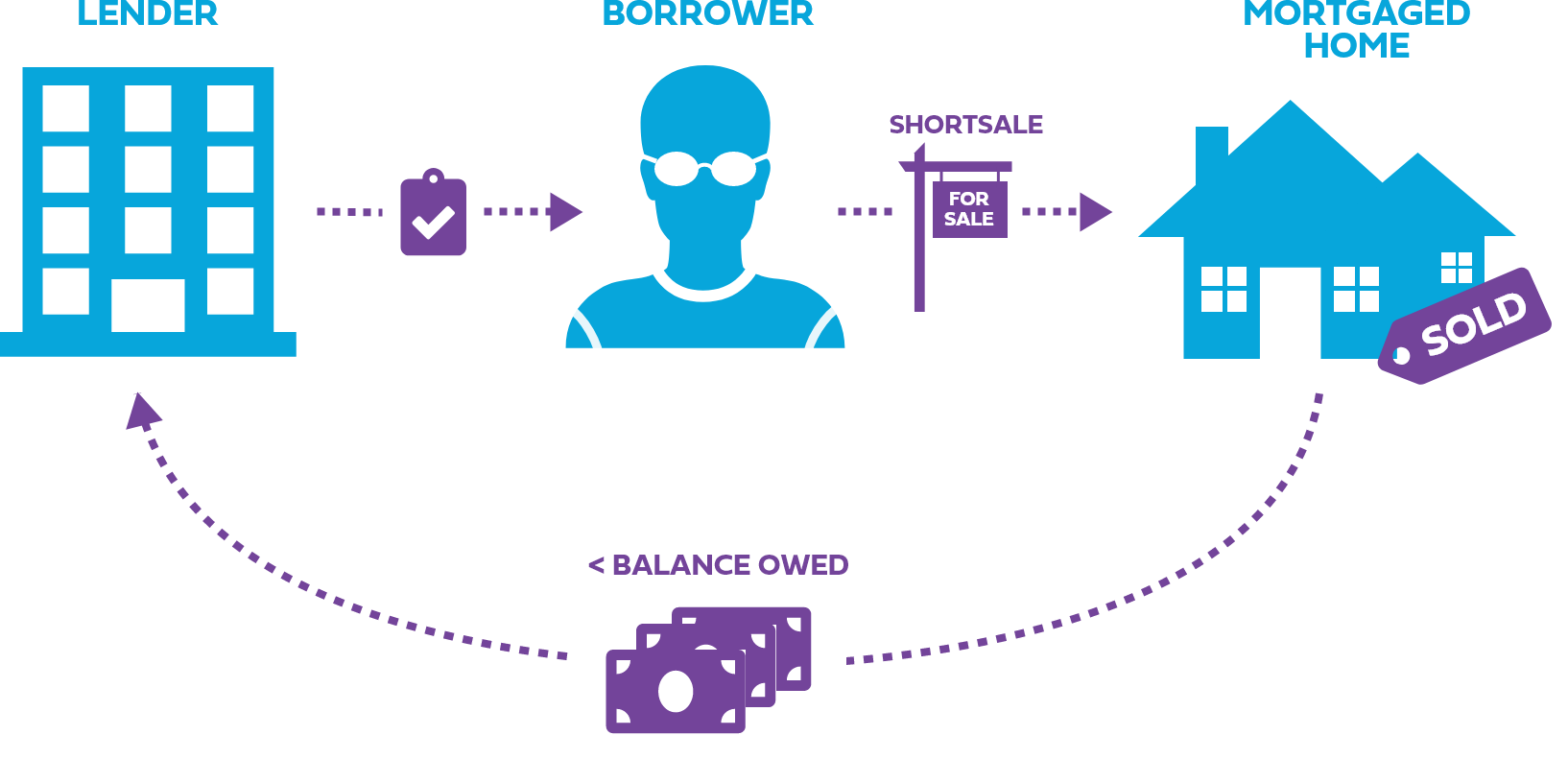

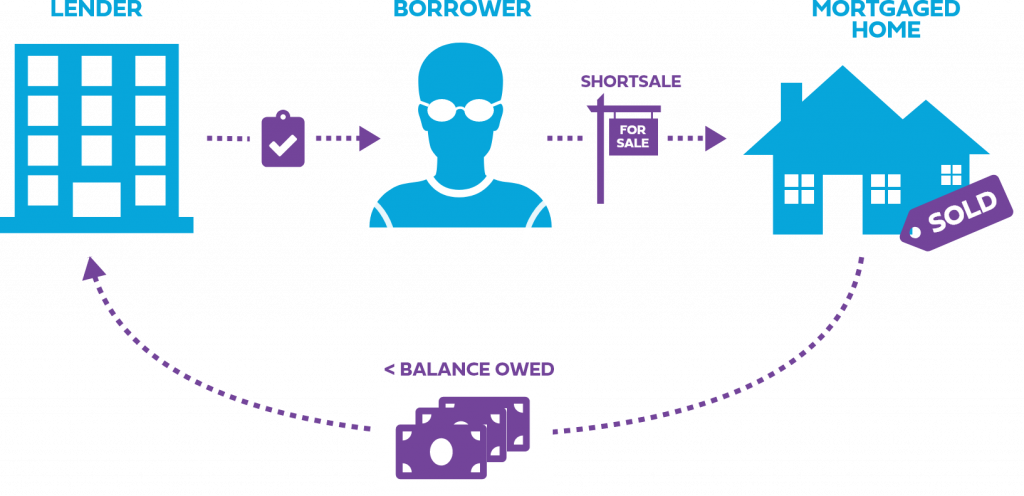

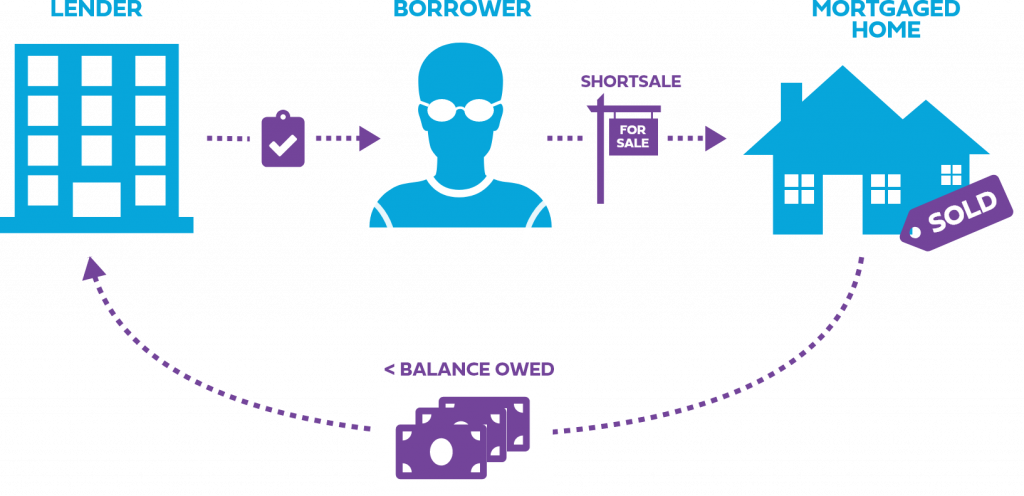

Shortsales

A short sale is when a lender allows the borrower to sell their home for less than the balance owed. Choosing a short sale over a foreclosure is often the better choice because it is less detrimental to credit than a foreclosure.

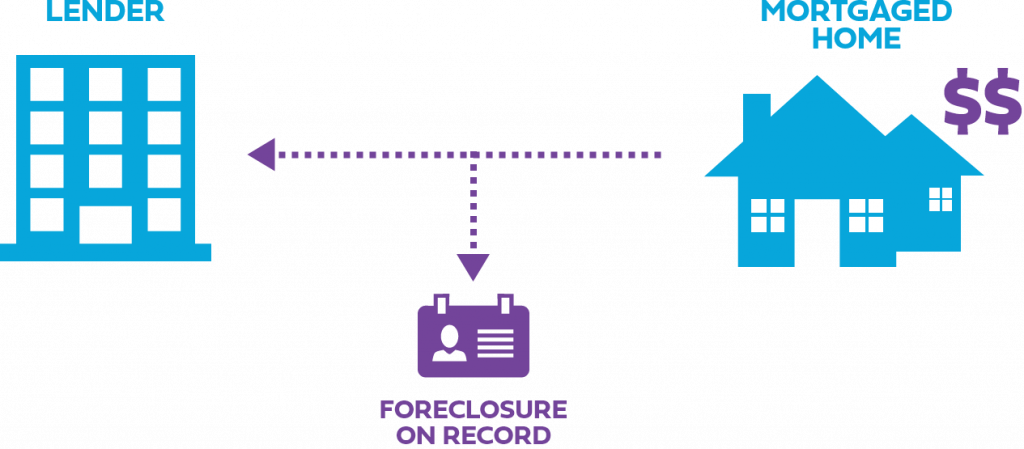

Foreclosures

The foreclosure process is when a lender repossess the borrower’s home. This often happens against the borrower’s will. Foreclosures remain on the borrower’s credit file for seven years which makes it difficult to receive approval for a new mortgage loan.

- End of Content -

← Previously

Next Up →

Mortgage Essentials

Keep track of your progress and discover content next in line.

What Are the Common Types of Mortgage Loans?

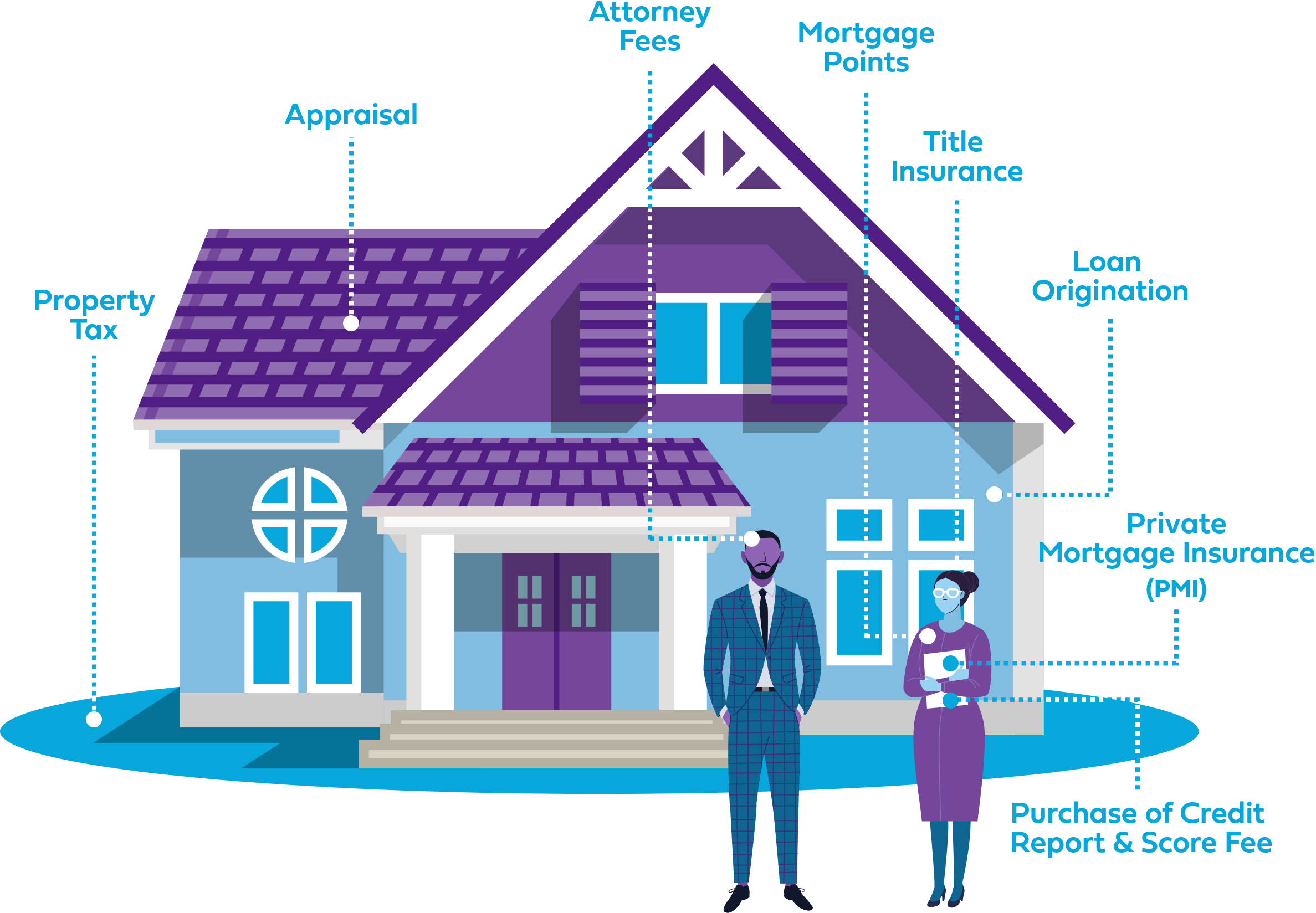

How Much Should I Save for a Down Payment & Closing...

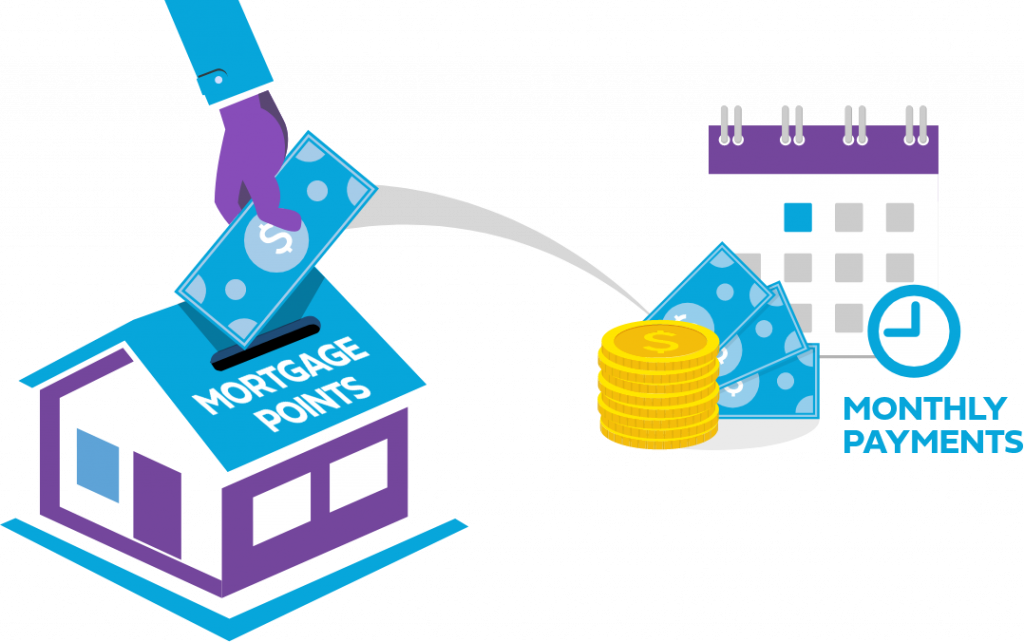

What Are Mortgage Points?

Previously

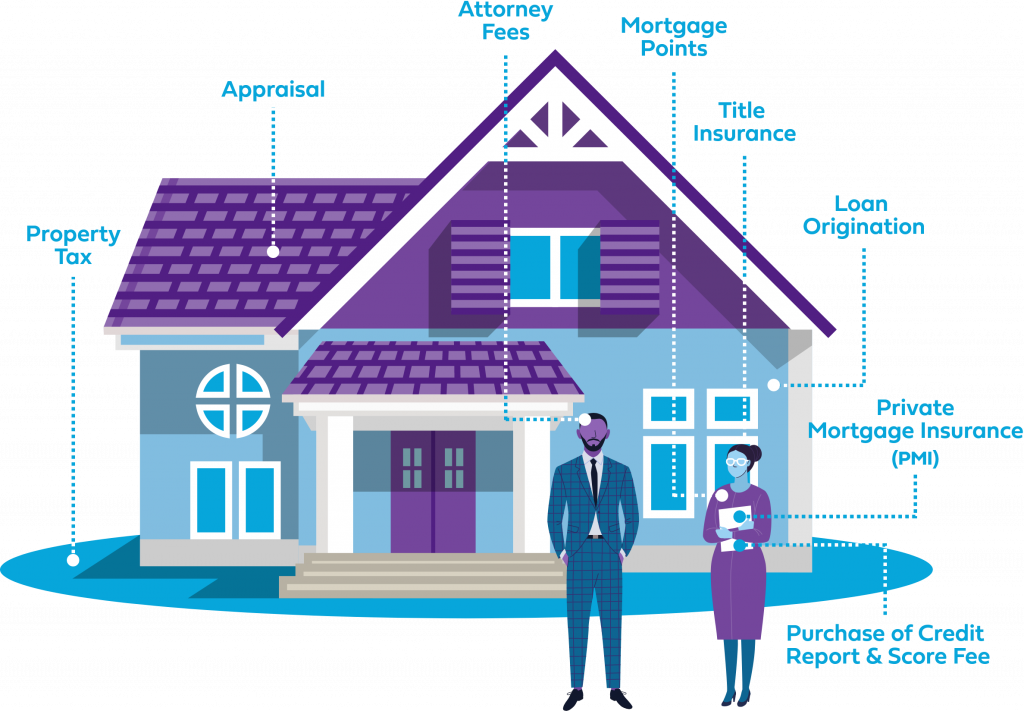

What Costs Are Included in My Mortgage Payment?

Currently

Foreclosures vs. Shortsales

Next Up...

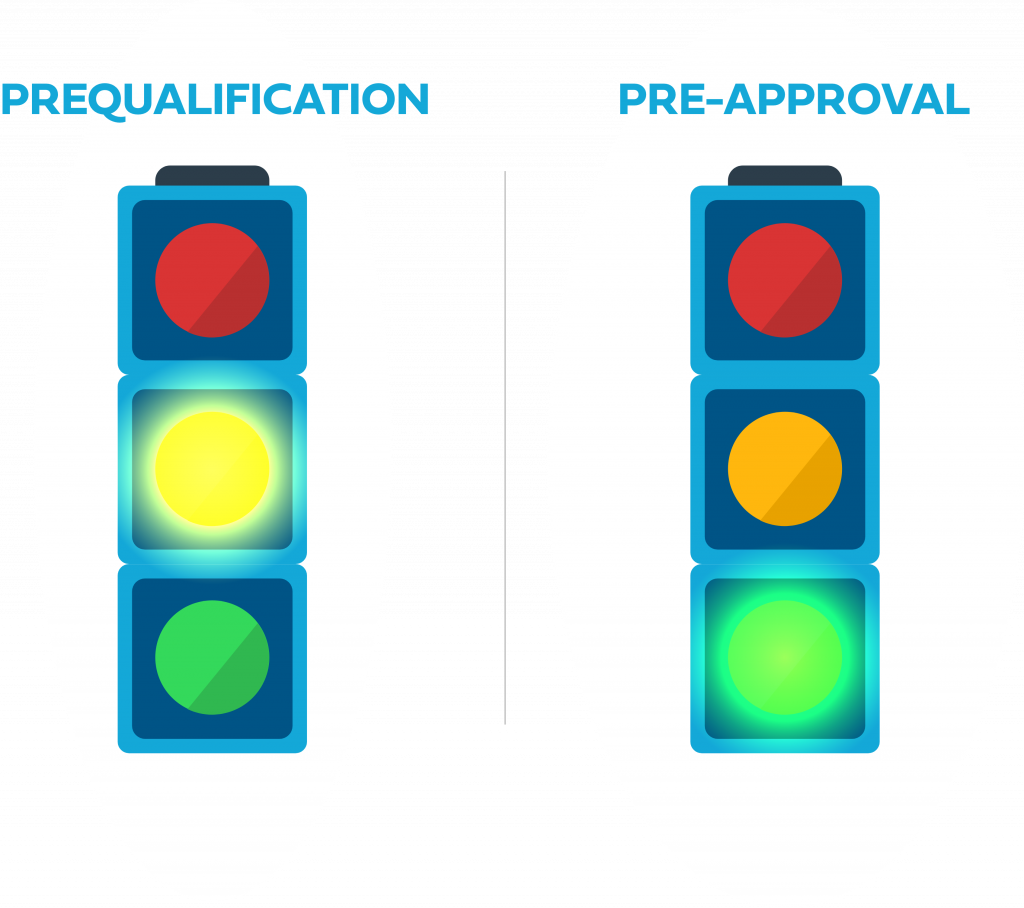

Prequalification vs. Preapproval

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

Learned all of

Mortgage Essentials?

Test your Credit IQ with our short, 9 question quiz.

Learn Your Way Home