Mortgage Fraud: A Warning

Potential mortgage borrowers need to be on high alert when completing an application—tell the truth and nothing but or it will cost you dearly. Providing false information on a mortgage application is fraud even if you are encouraged by a lender to ‘just leave that information out.’

INSIDER PRO TIPS

Tips to protect yourself:

- Never lie on a mortgage application—don’t inflate your salary or anything else. Be 100% truthful or your lender could insist that you repay your entire loan or foreclose on your home.

- Never omit information—if you have a bankruptcy, disclose it and ignore any advice to the contrary. You don’t want the FBI knocking on your door.

- Do not work with anyone who suggests that you alter facts on your application.

- Do not sign any paperwork that doesn’t look accurate or is not complete.

- Understand the paperwork before you sign because it is your responsibility to know what you are signing.

What Is the Worst That Can Happen?

Under federal law, lying on your mortgage application is punishable by prison time and/or a fine of up to one million dollars.

(1) the information provided in this application is true and correct as of the date set forth opposite my signature and that any intentional or negligent misrepresentation of this information contained in this application may result in civil liability, including monetary damages, to any person who may suffer any loss due to reliance upon any misrepresentation that I have made on this application, and/or in criminal penalties including, but not limited to, fine or imprisonment or both under the provisions of Title 18, United States Code, Sec. 1001

- End of Content -

← Previously

Next Up →

Buyer Alert

Keep track of your progress and discover content next in line.

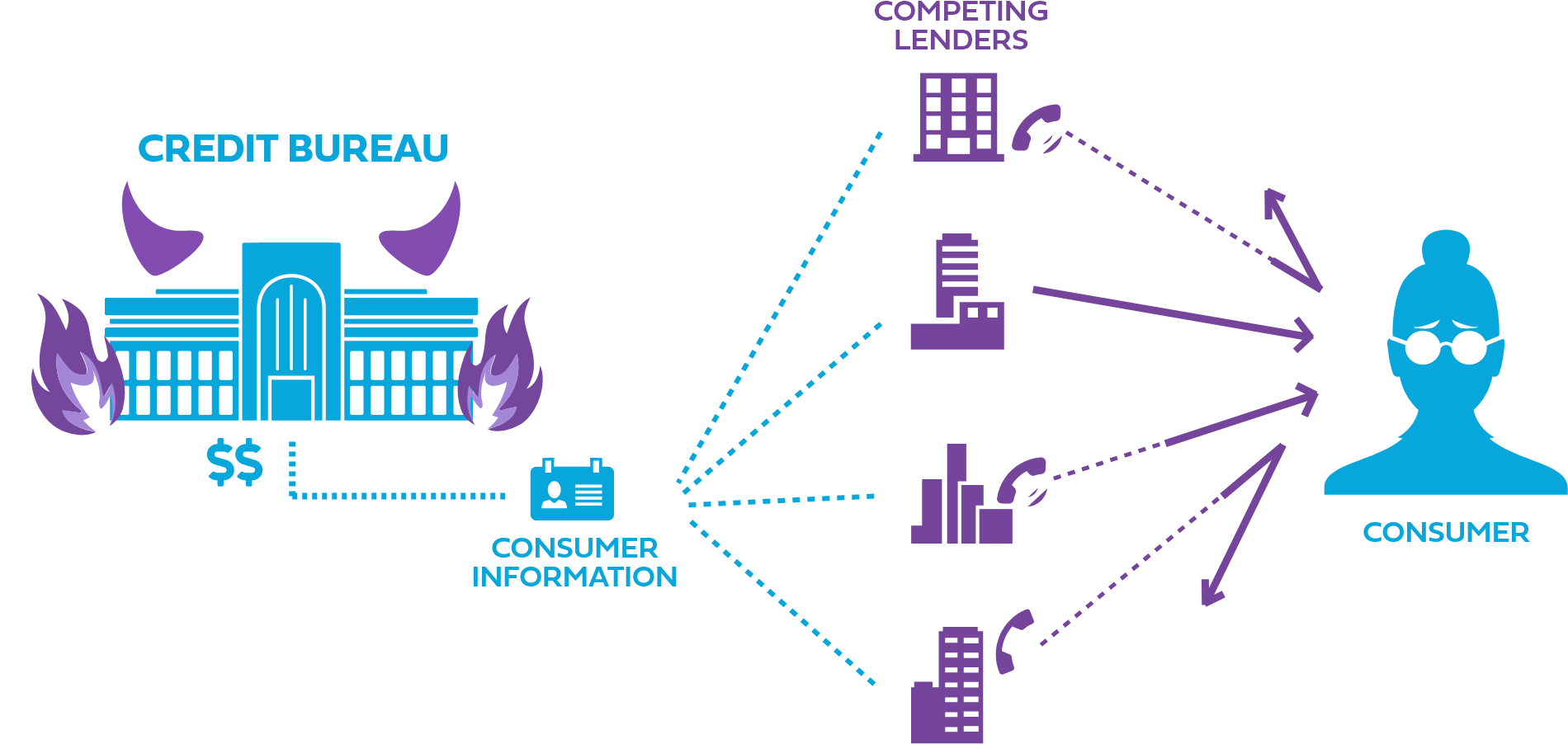

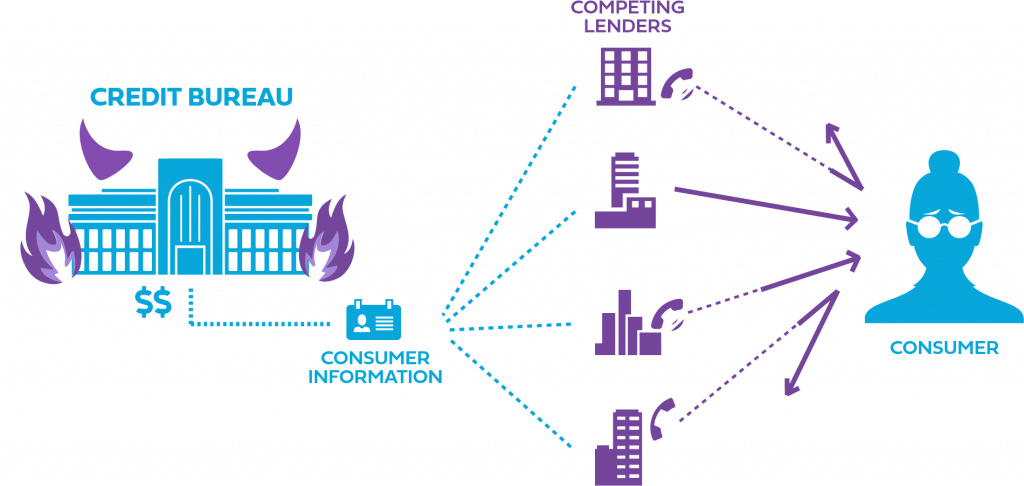

What Is a Trigger Lead?

How Do I Find a Reputable Credit Repair Company?

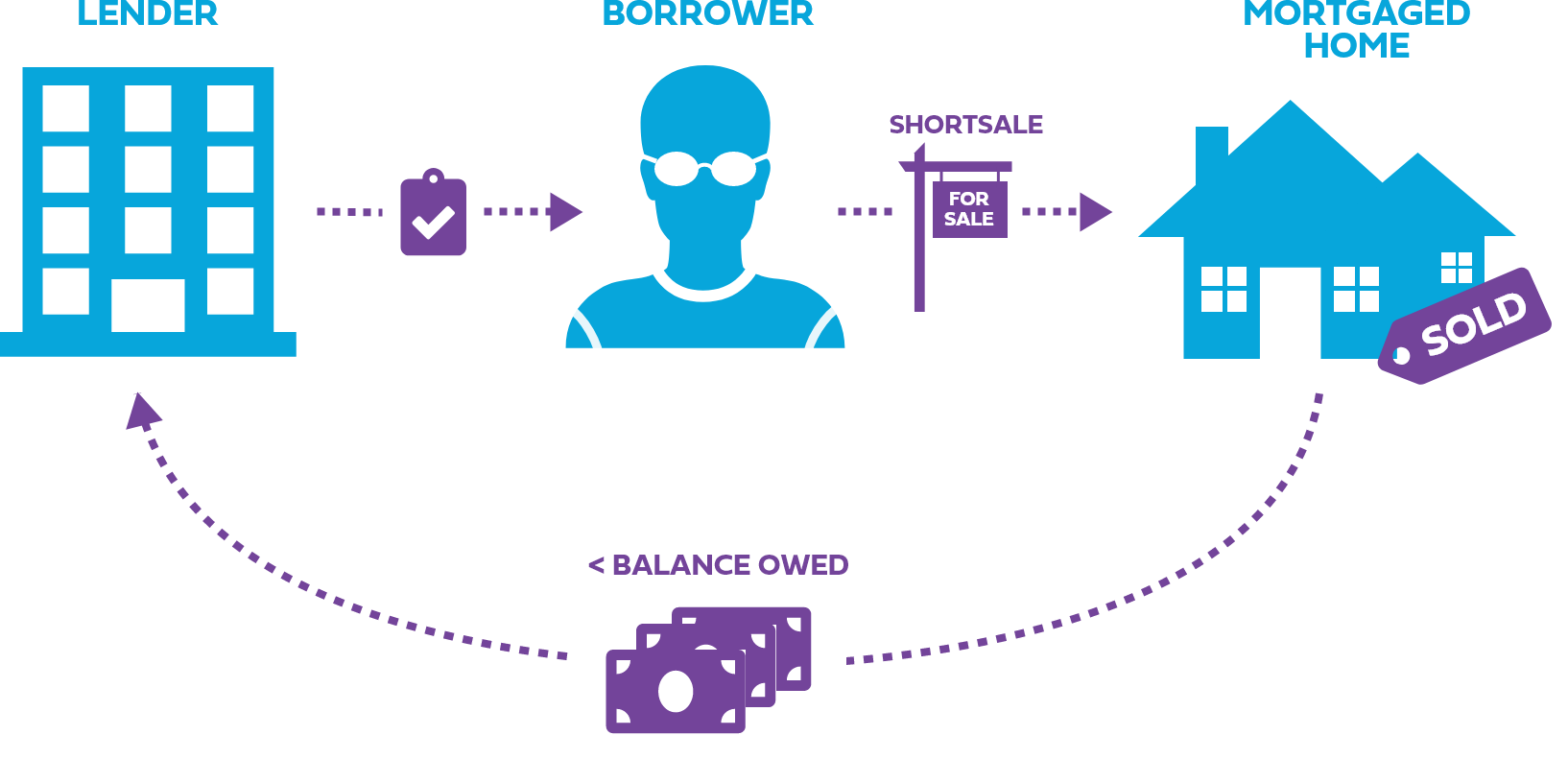

Mortgage Relief

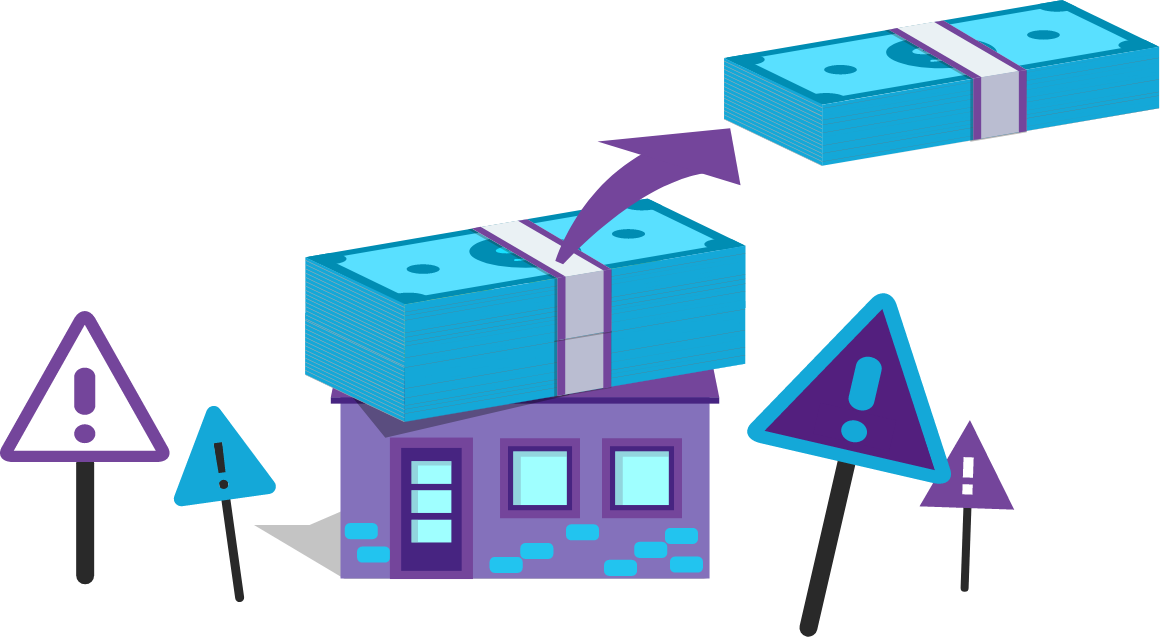

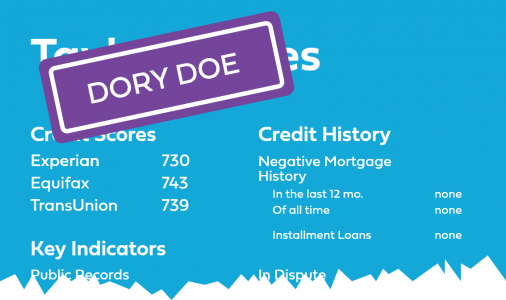

Purchasing Tradelines

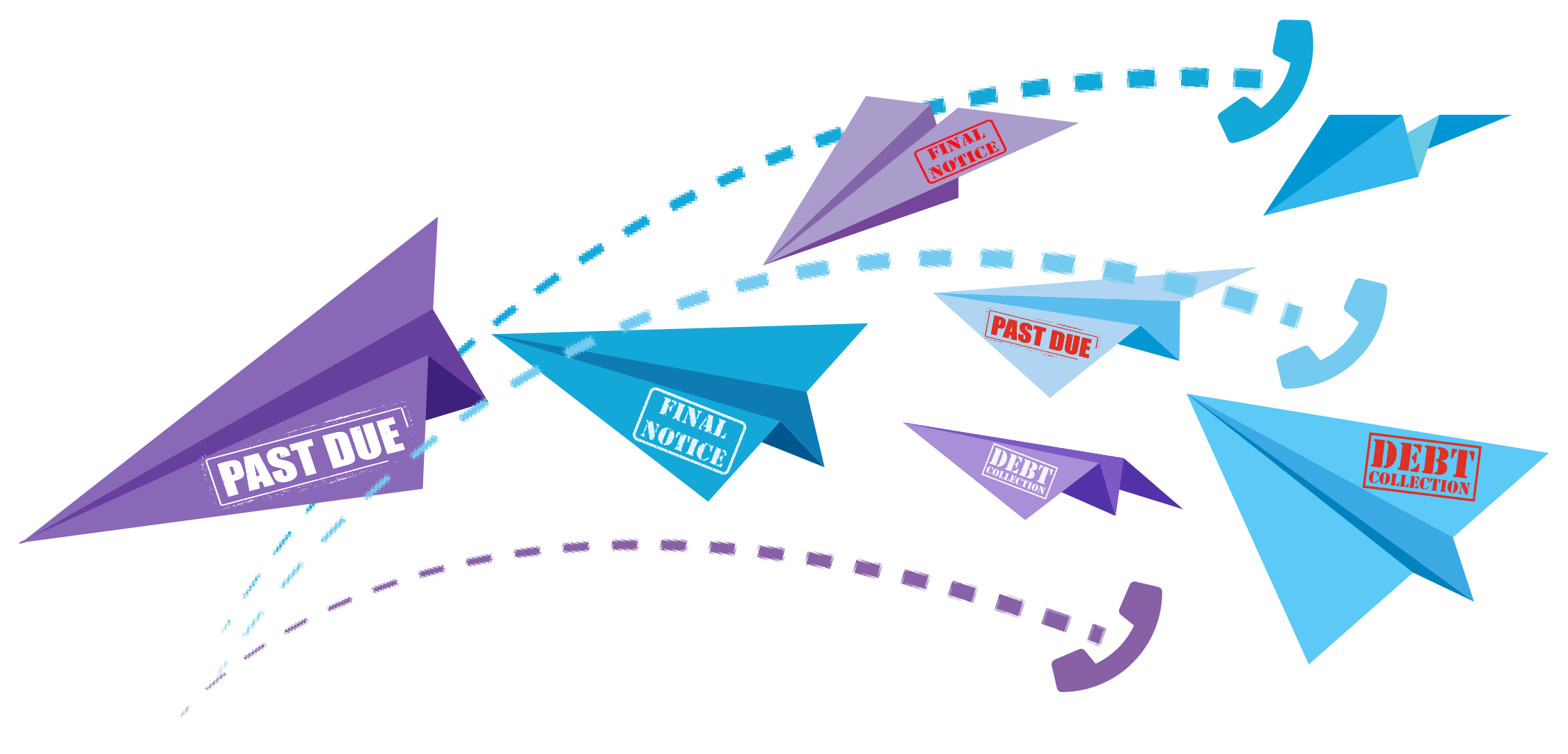

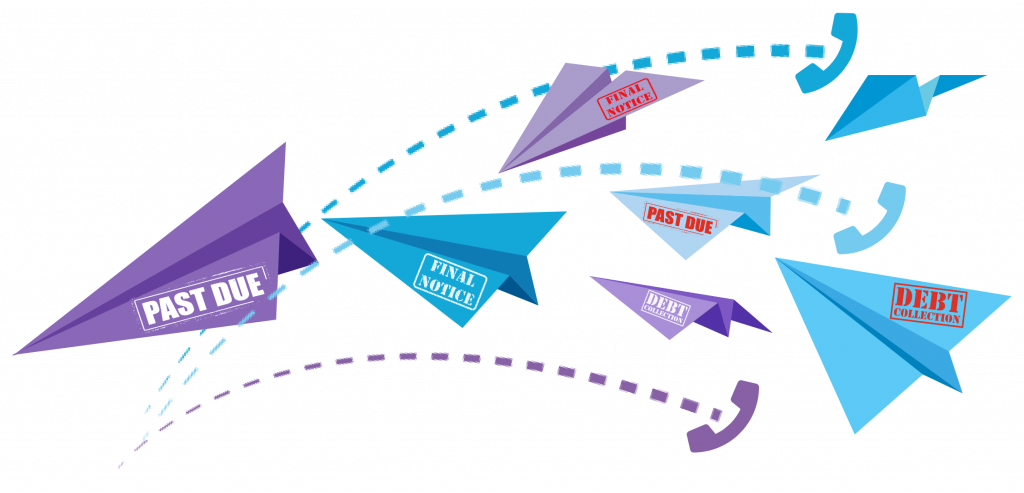

Disreputable Debt Collection Practices

Mortgage Fraud: A Warning