For Mortgage Lenders

Stop Paying

for Credit Reports

Eliminate your out-of-pocket credit reporting costs and put yourself in front of scores of consumers every month.

- Attract new buyers with your own personalized BestQualify Pro page.

- Save thousands every year by cutting credit reporting costs.

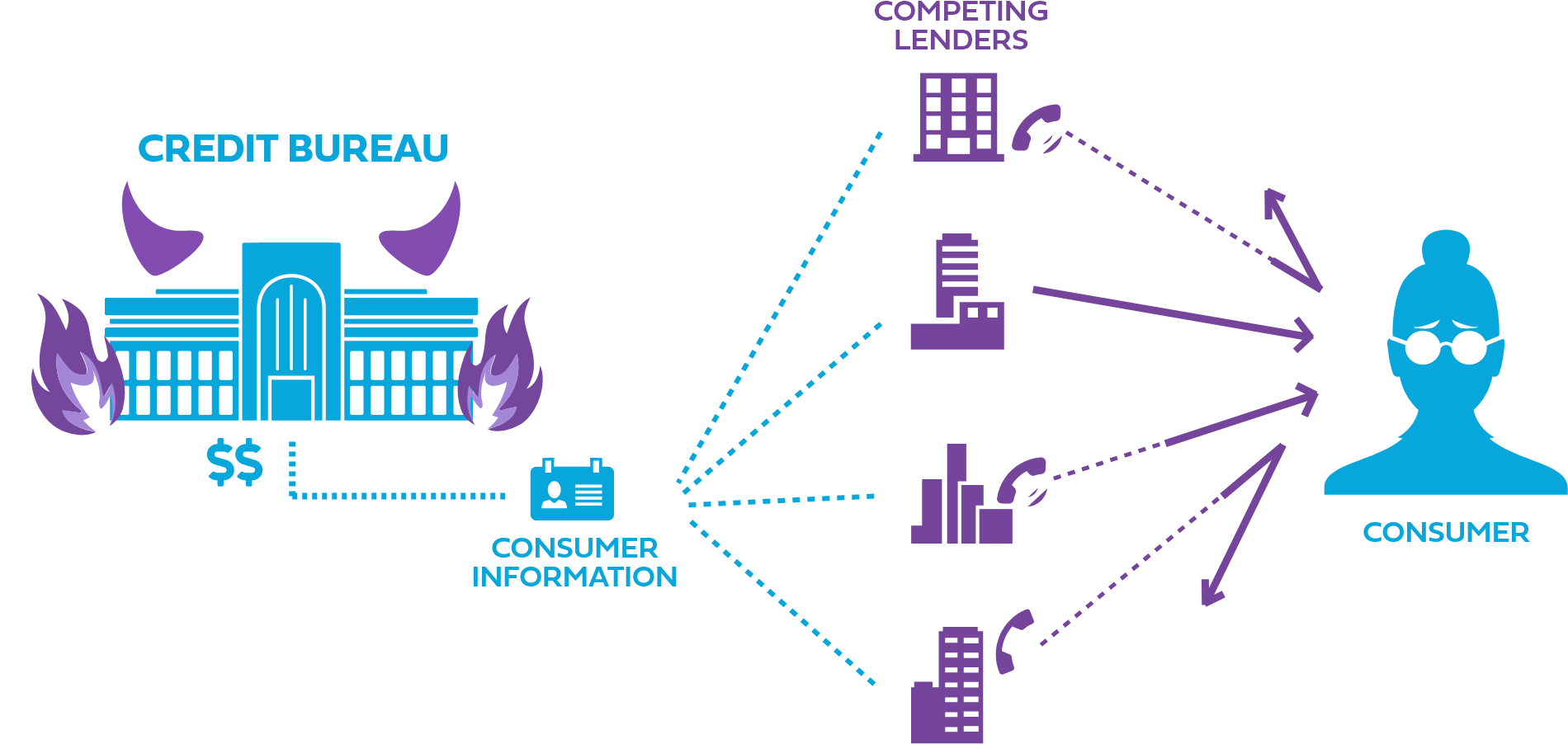

- Trigger Proof your business and buyers from Trigger Lead abuses.

- Use our easy-to-use lending tools that are approved by Fannie Mae Day 1 Certainty®.

- Meet all compliance requirements with our automated tools and resources.

BQ Pro Page

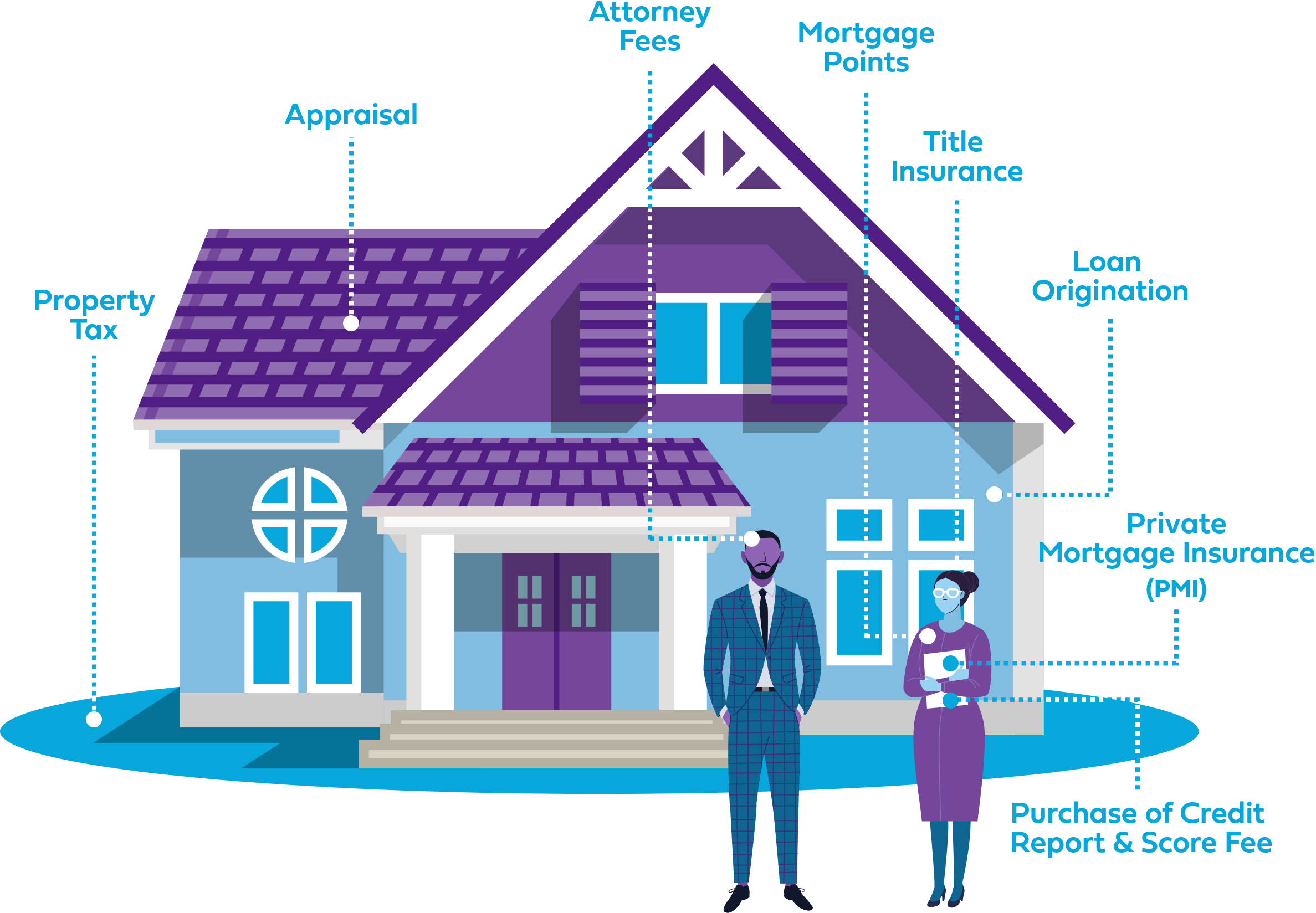

Your free Pro Page gives your buyers access to expertly-curated content to help them become more credit-savvy and qualify for the best rates and terms!

“The overall experience with my BQ Pro page has been great! I love how easily accessible it is for my clients. They find the profile beneficial because it provides financial education on obtaining a mortgage.”

S. Price

BestQualify Mortgage Pro

Better Pricing, More Buyers and More Closed

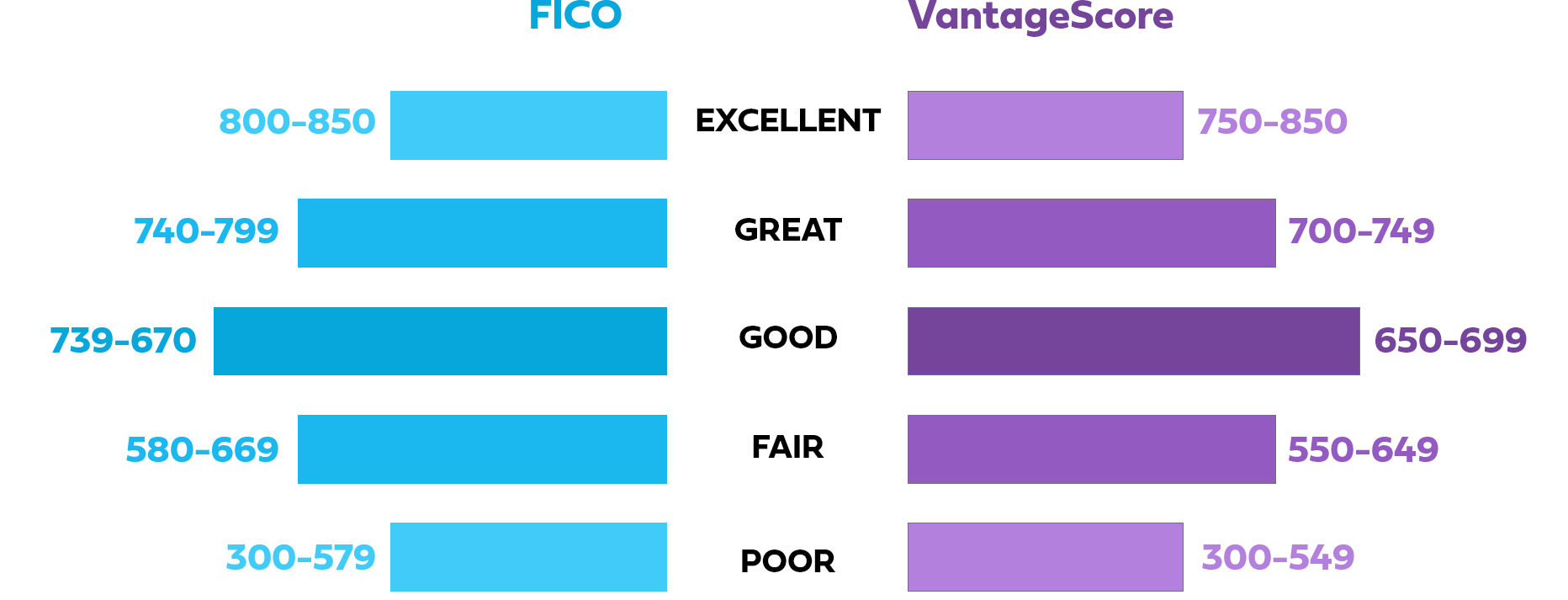

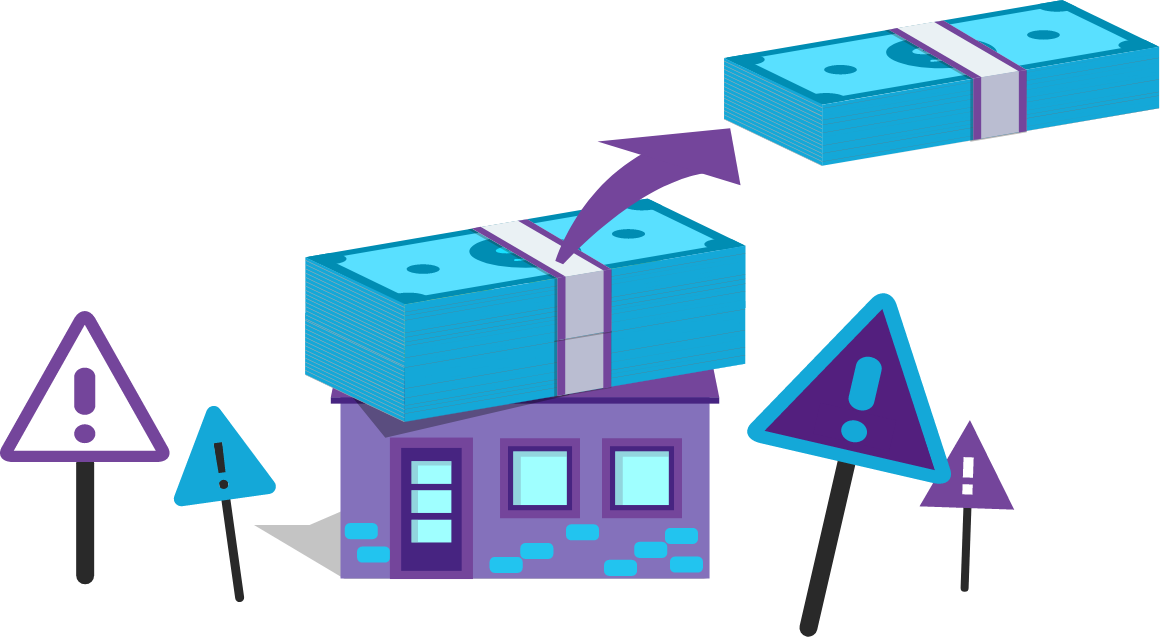

Stop wasting time, money (and opportunities) on generic score improvement tools. Score Express™, part of our BestQualify℠ suite of lender tools, delivers the highest borrower FICO® score improvement available anywhere.

- ScoreNavigator™ – Monitors every applicant file for opportunities to improve buyer pricing.

- Credit Insight File Reviews – Free, real-time access to the most experienced team of credit score analysts in the mortgage industry. A clear path to success for every borrower.

- Score Express™, delivers a huge competitive advantage. Gain an entire price tier advantage over competing lenders (average FICO increase of 23.9 points in 72 hours or less.)

Stop Paying for Credit Reports

Give us a call at 800.445.4922, option 1 or submit the form below. We’re excited to help you attract more buyers with BestQualify!

FAQs

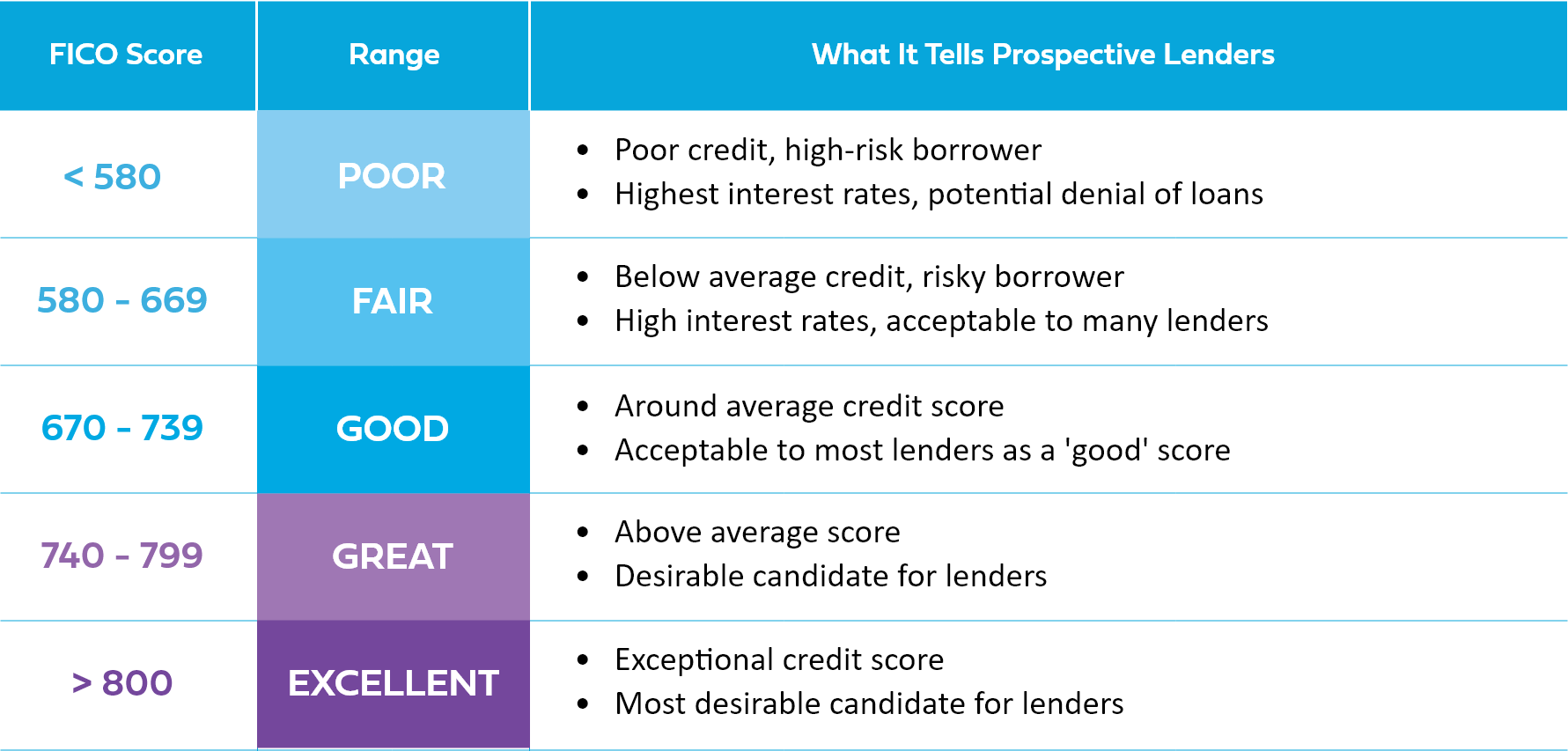

Consumers utilize the find a lender/realtor tool featured on the BestQualify site. Additionally, we digitally market directly to prospective borrowers nationwide providing instant access to their credit summary including FICO scores and customized score-improvement action plan.

Directing consumers to BestQualify before they apply for a mortgage or search for a home will make your job easier. They will be educated and knowledgeable about how to improve their credit to qualify for the best rates and terms possible.