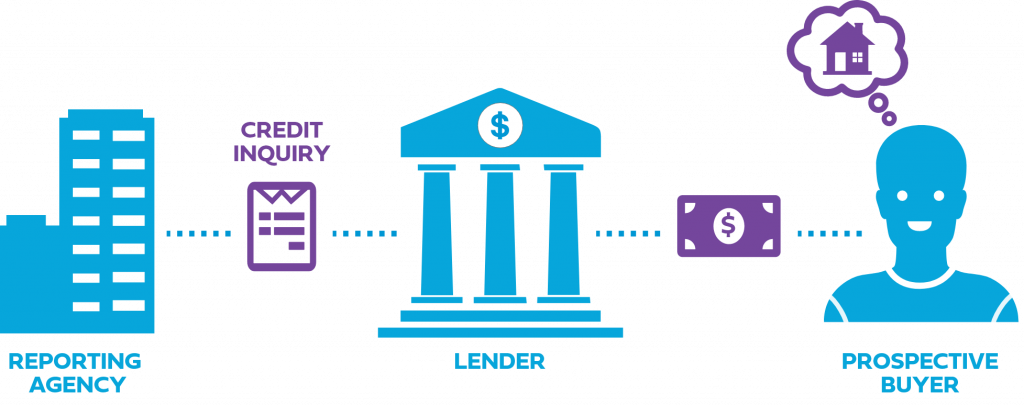

What Is an Inquiry?

A credit inquiry is a request for a specific individual’s credit report from a reporting agency. Banks and other lenders will request the credit report of a potential buyer to determine if they are eligible for a mortgage or other type of loan.

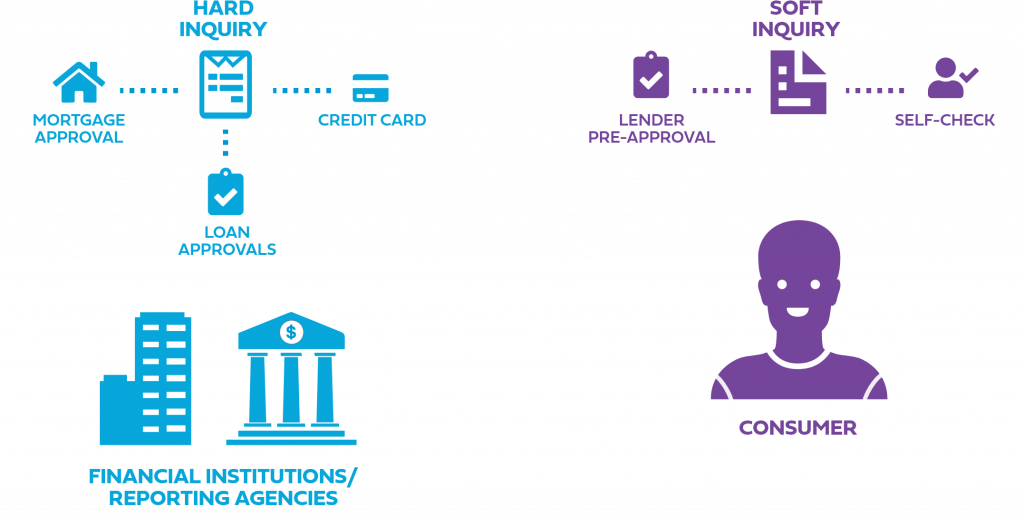

What Is the Difference Between a Soft Inquiry and a Hard Inquiry?

Both of these inquiry types can appear on your credit report,

but only HARD inquiries affect your score.

Hard inquiries occur when you apply for a mortgage, credit card, or another type of loan. Hard inquiries will stay on your credit report for up to two years. It’s important to understand that an inquiry is considered a public record, and because of this, it cannot be removed.

Keep in mind, if you have more than a few hard inquiries in a short period, you may be viewed as high-risk. Soft inquiries occur when you check your credit or when a lender checks your credit to pre-approve you for a loan.

- End of Content -

← Previously

Next Up →

Score & Credit Basics

Keep track of your progress and discover content next in line.

What Exactly Is a Credit Score and How is it Determined?

What is a Credit Report?

Previously

When, Where & Why Should I Check My Credit?

Currently

What Is an Inquiry?

Next Up...

What Is a Tradeline?

What Is a FICO® Score?

Do Other Scoring Models Exist?

Can My Credit Score Be Improved?

Common Reasons Why Your FICO® Score Is Low