What Is a Credit Report?

There is a lot of misinformation about what a credit report is and what it actually contains. It’s like a report card from your creditors—it provides information about your payment history and if you pay your bills on time. It does not include sensitive personal information and requesting it will not hurt your credit. Simply put, your credit report only features information that helps a lender determine if your loan should be approved.

If you are deemed to be worth the risk by a lender, you may get very favorable rates depending on credit report history and what your overall score is. Most people are surprised with they learn what is actually in their report vs. what they think is in their report.

The bottom line is that you need to know what is actually there in order to make decisions on how to improve your score and credit history. Being informed gives you the opportunity to make the needed changes and to take care of any discrepancies that may be present.

What can you expect when you see your report? Only information that determines your ‘creditworthiness.’

Information Included

- Your name, address and phone number

- Social Security number

- Date of birth

- Employment information

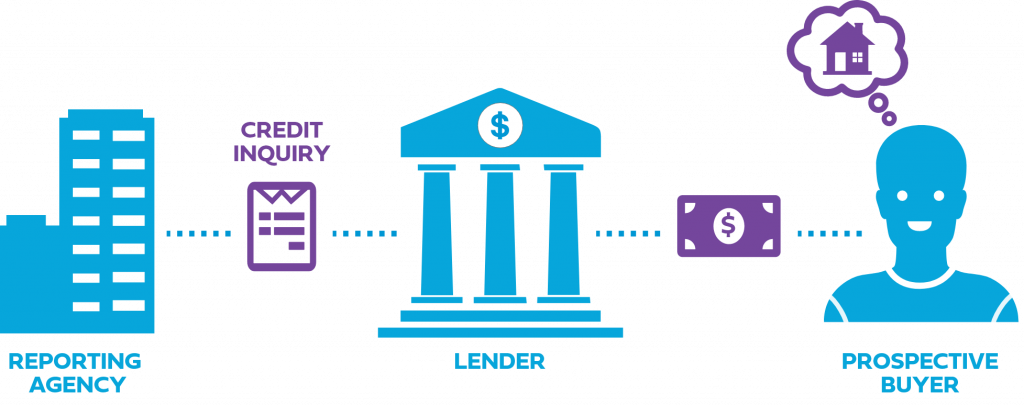

- Credit inquiries

- How much you are in debt to your creditors

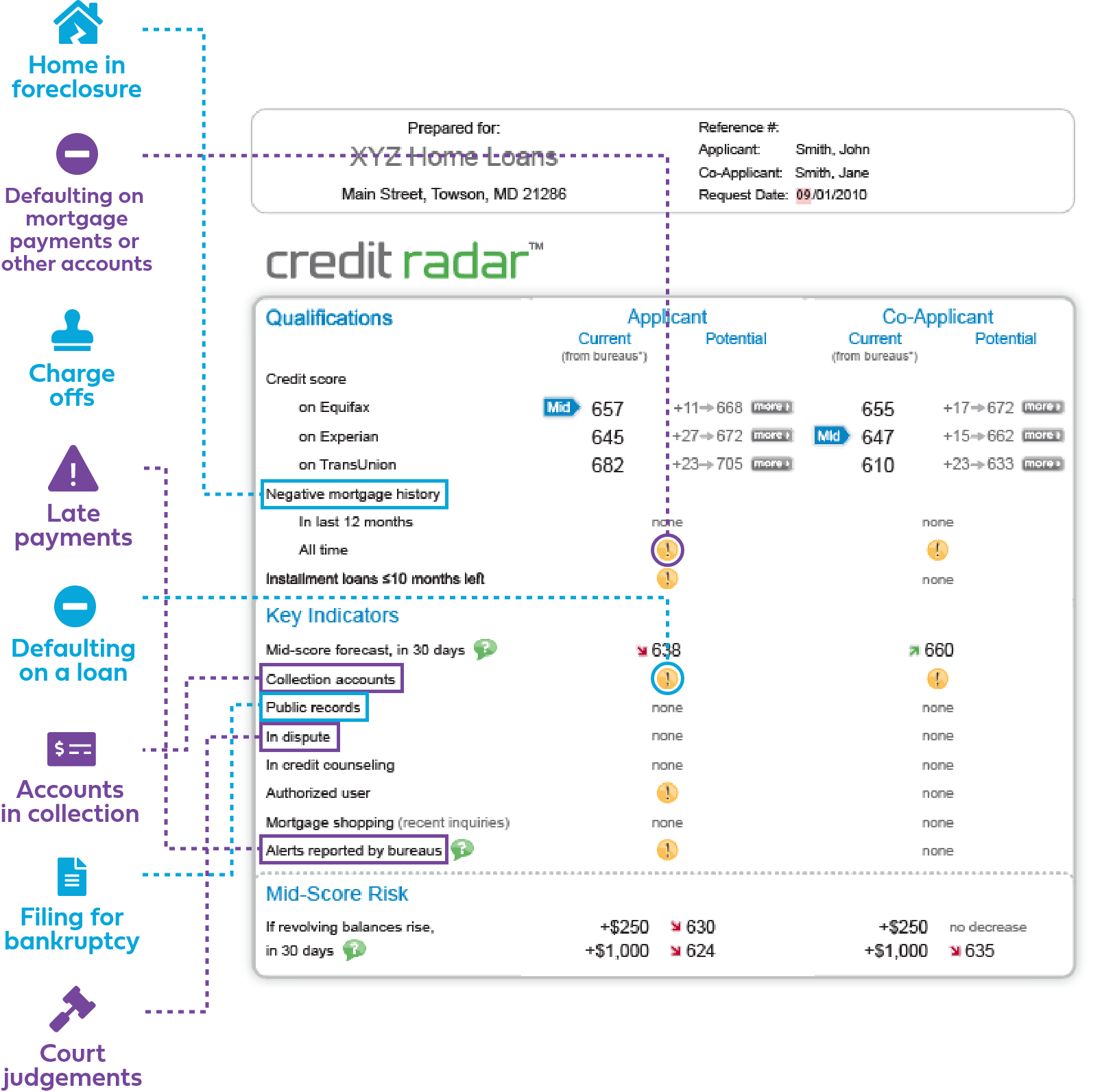

- Any current delinquent accounts

- Provides information about your payment history and if you pay your bills on time

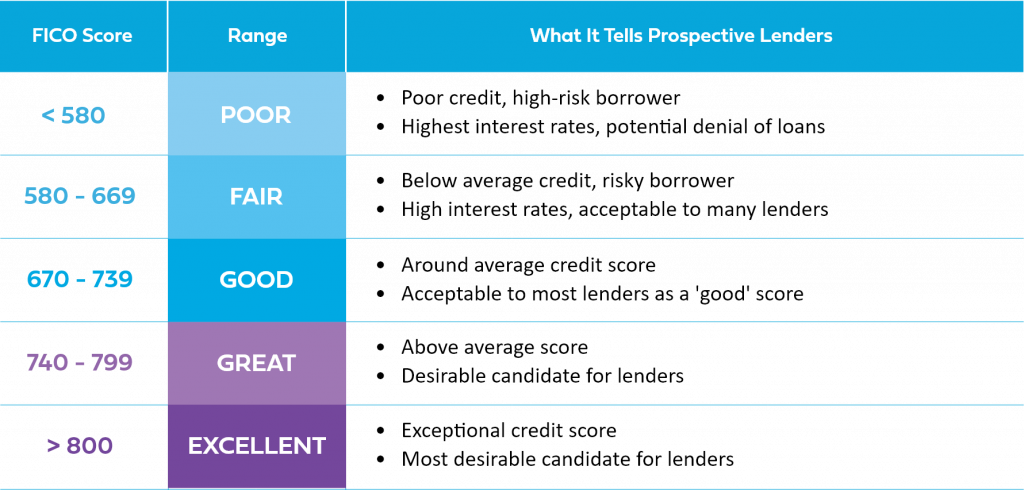

- The score models used to determine your score—FICO, Vantage etc.

- Credit account history

- Public information—bankruptcy, civil judgements, foreclosure, repossession etc. (varies by state)

NOT Included

- Gender

- Race

- National origin

- Religion

- Marital status

- Political affiliation

- Income

- Bank account balances

- Medical history

- Criminal records

- Public assistance status

Score & Credit Basics

Keep track of your progress and discover content next in line.

What Exactly Is a Credit Score and How is it Determined?

What is a Credit Report?

When, Where & Why Should I Check My Credit?

What Is an Inquiry?

What Is a Tradeline?

What Is a FICO® Score?

Do Other Scoring Models Exist?

Can My Credit Score Be Improved?

Common Reasons Why Your FICO® Score Is Low