Shannon Connelly

NMLS #269764

Sr. Mortgage Loan Originator

Learn More about your mortgage professional:

Read More

I’m a Lafayette local – lived here for 28 fantastic years. When I’m not crunching numbers or sealing deals, you’ll find me spending quality time with my husband, our two awesome daughters, and our two lovable dogs. Cooking is my jam, and I love diving into a good book or taking a refreshing swim. I’m a live music junkie, and I absolutely adore traveling, especially if it means visiting my daughters wherever they may be at the moment. Looking for a mortgage? Whether it’s your first home or your next, I’m here to guide you through all your options and find the perfect fit for you. Let’s chat and get started on making your dream home a reality!

- https://www.ulending.net/

- 5750 Johnston St Ste 102, Lafayette, LA 70503

Shannon Connelly

NMLS #269764

Sr. Mortgage Loan Originator

Certifications: n/a

Learn More about your mortgage professional:

Read More

I’m a Lafayette local – lived here for 28 fantastic years. When I’m not crunching numbers or sealing deals, you’ll find me spending quality time with my husband, our two awesome daughters, and our two lovable dogs. Cooking is my jam, and I love diving into a good book or taking a refreshing swim. I’m a live music junkie, and I absolutely adore traveling, especially if it means visiting my daughters wherever they may be at the moment. Looking for a mortgage? Whether it’s your first home or your next, I’m here to guide you through all your options and find the perfect fit for you. Let’s chat and get started on making your dream home a reality!

- https://www.ulending.net/

- 5750 Johnston St Ste 102, Lafayette, LA 70503

credit expertise curated, just for you

Learn Your Way Home

Trending Topics

Browse All

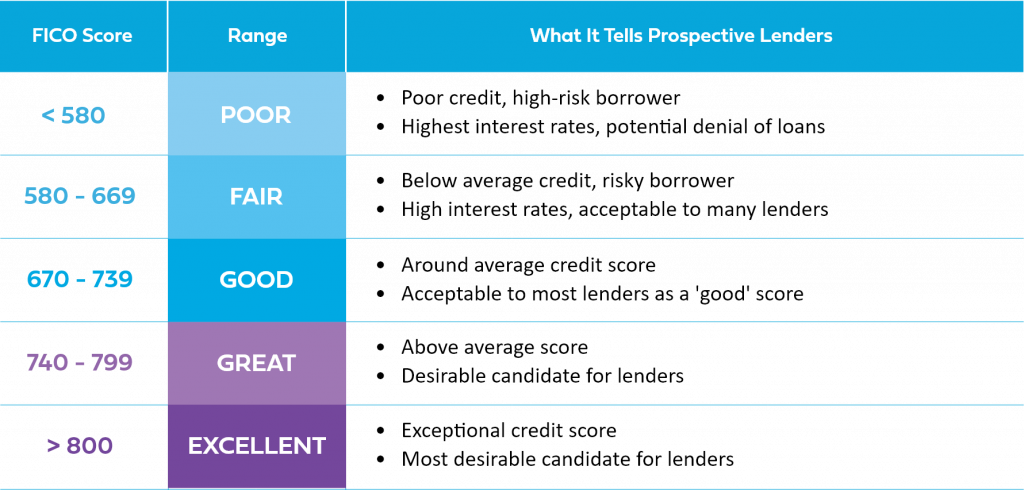

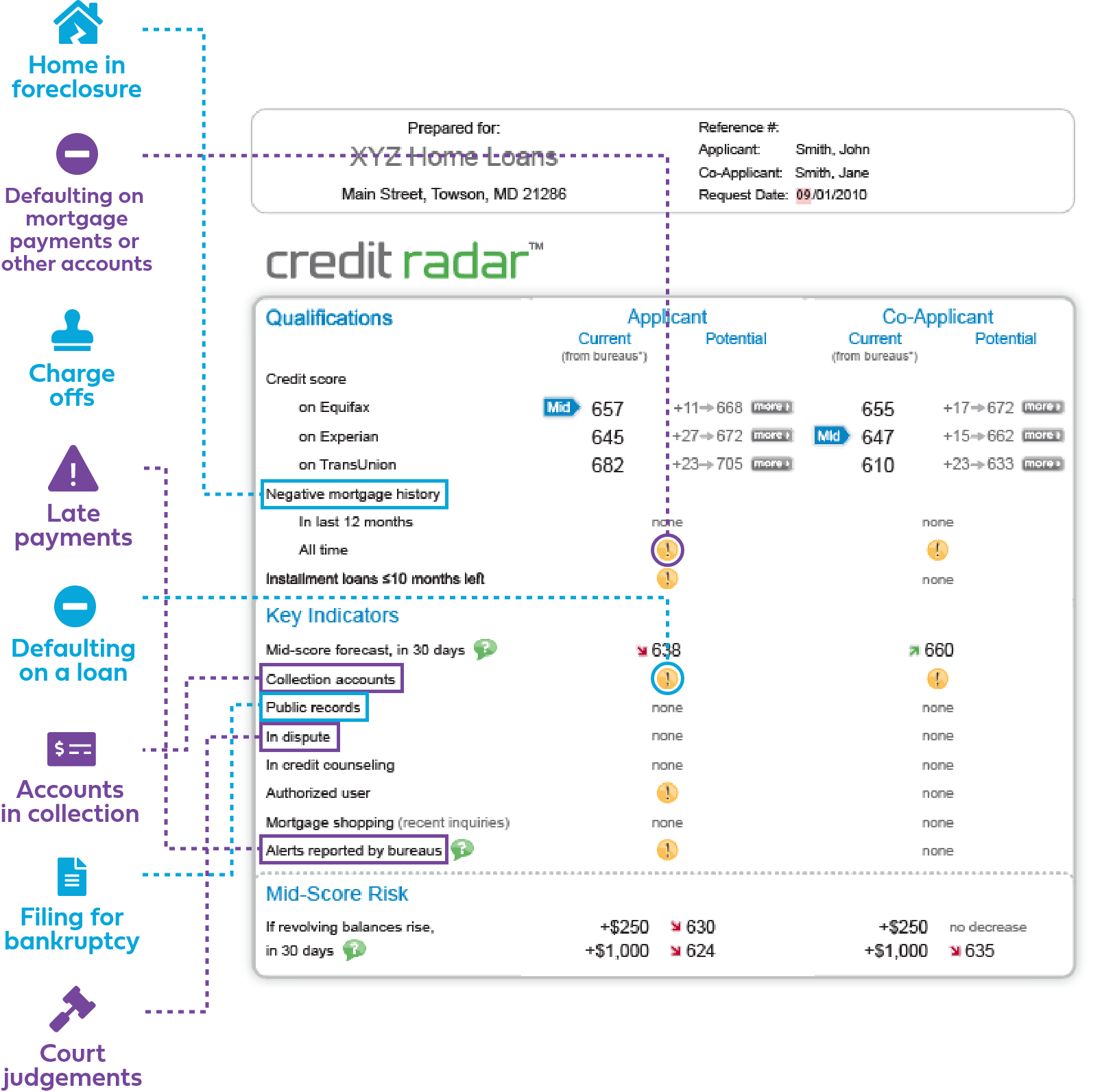

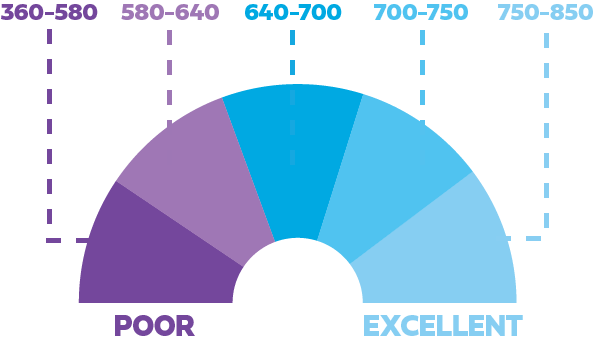

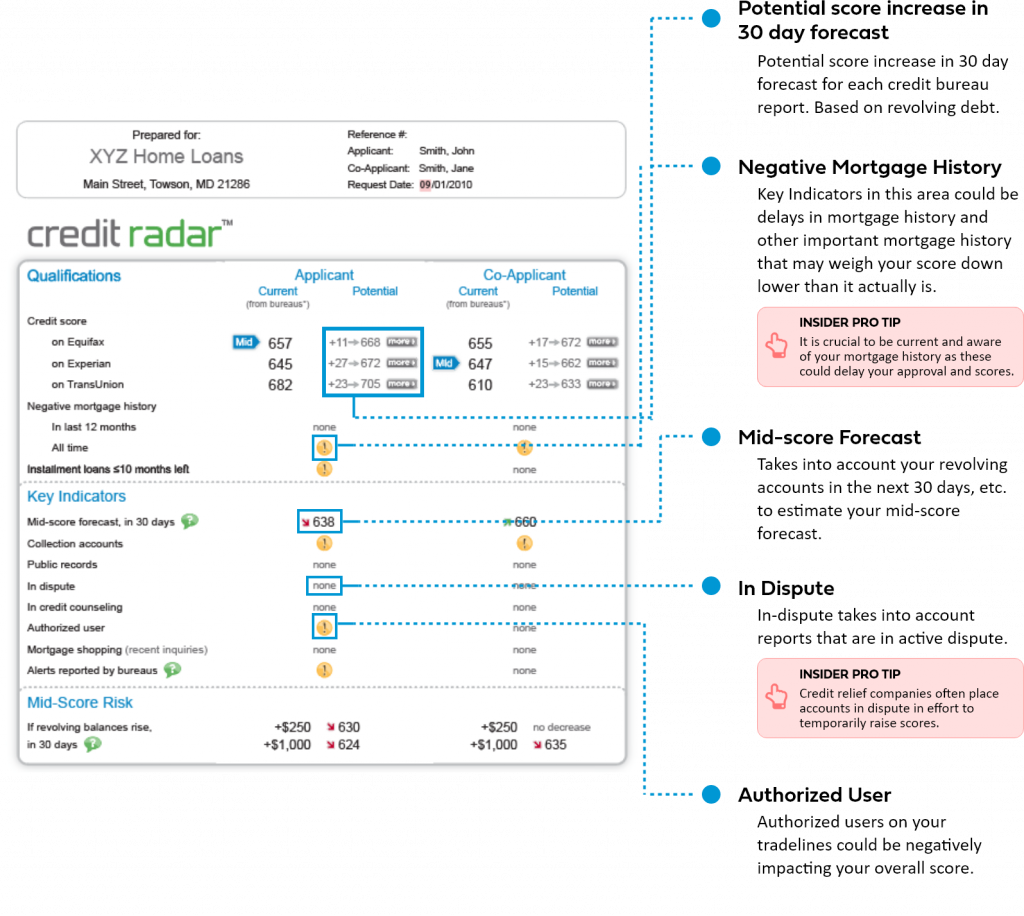

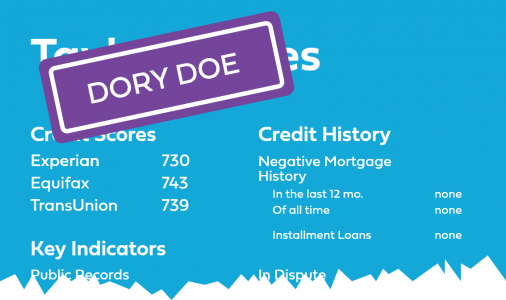

Score & Credit Basics

Learn all about credit scores, credit reports, scoring models and more.

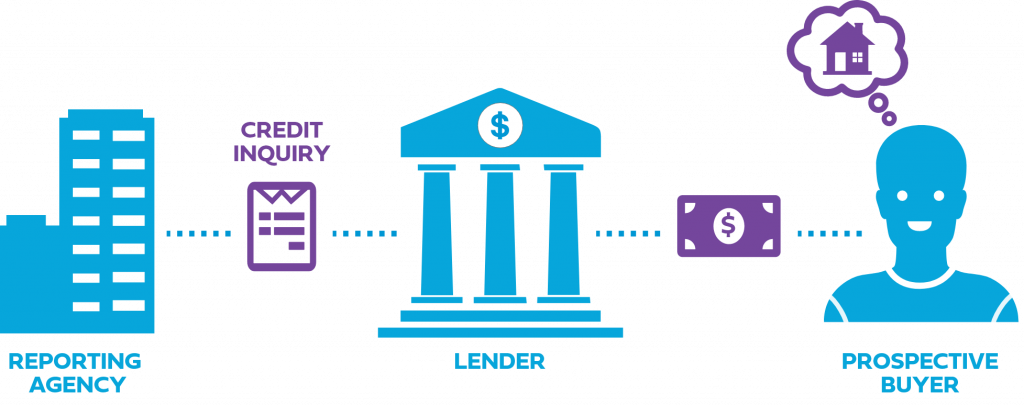

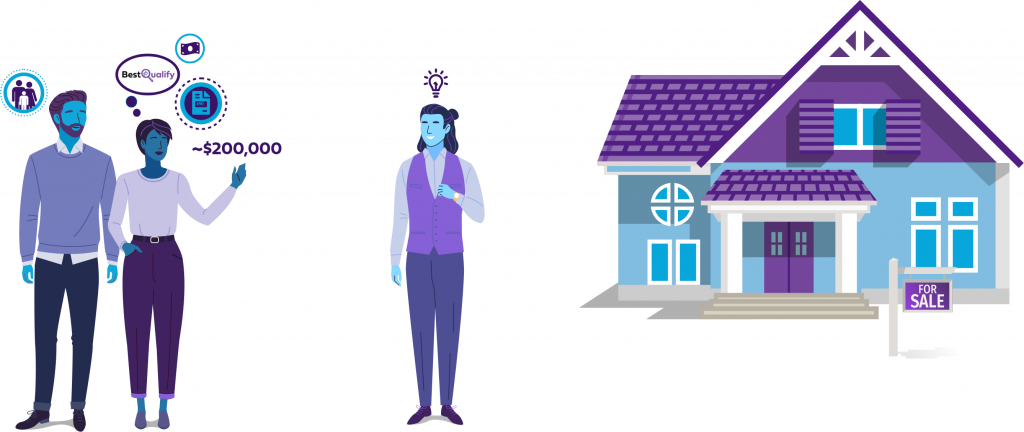

Mortgage Essentials

Learn all about mortgage rates, types of loans, cost breakdown, and more.

What Are the Common Types of Mortgage Loans?

How Much Should I Save for a Down Payment & Closing...

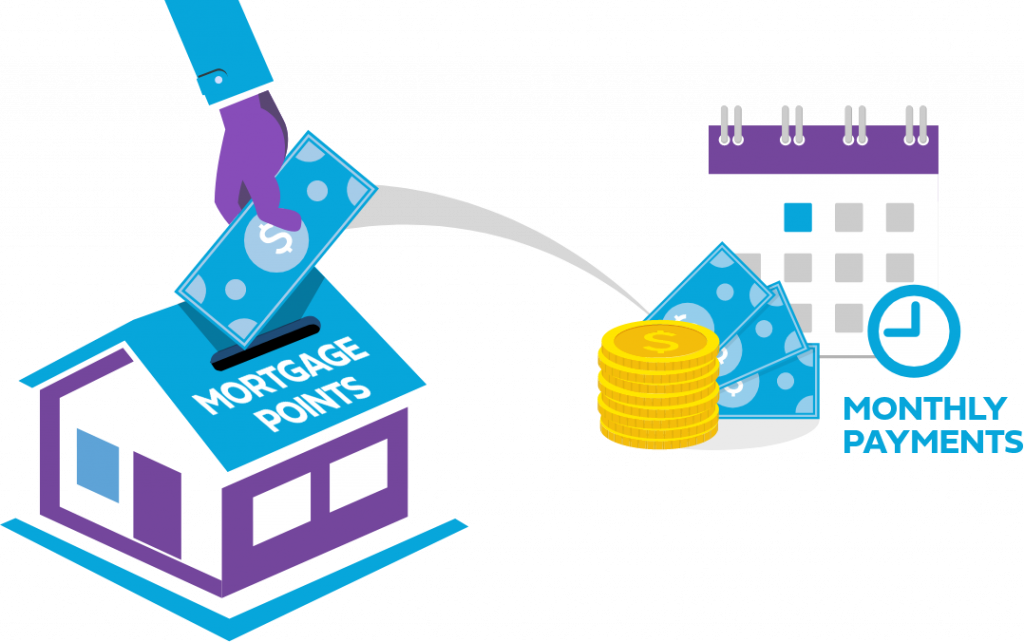

What Are Mortgage Points?

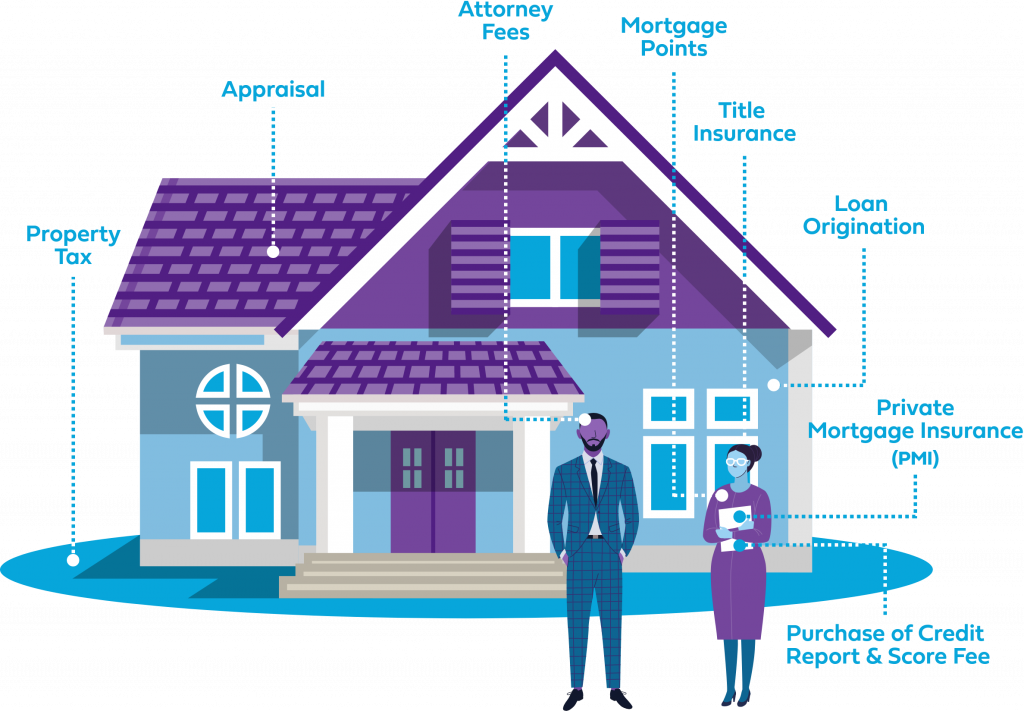

What Costs Are Included in My Mortgage Payment?

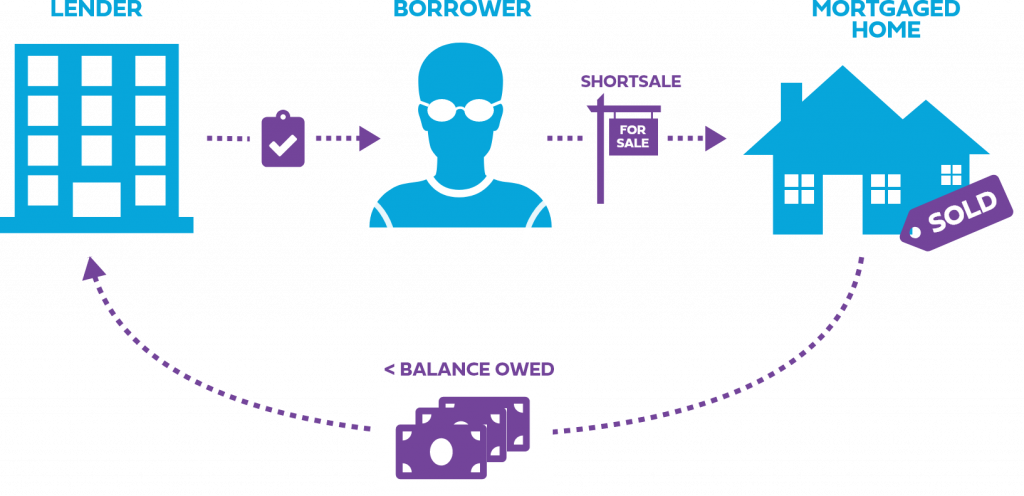

Foreclosures vs. Shortsales

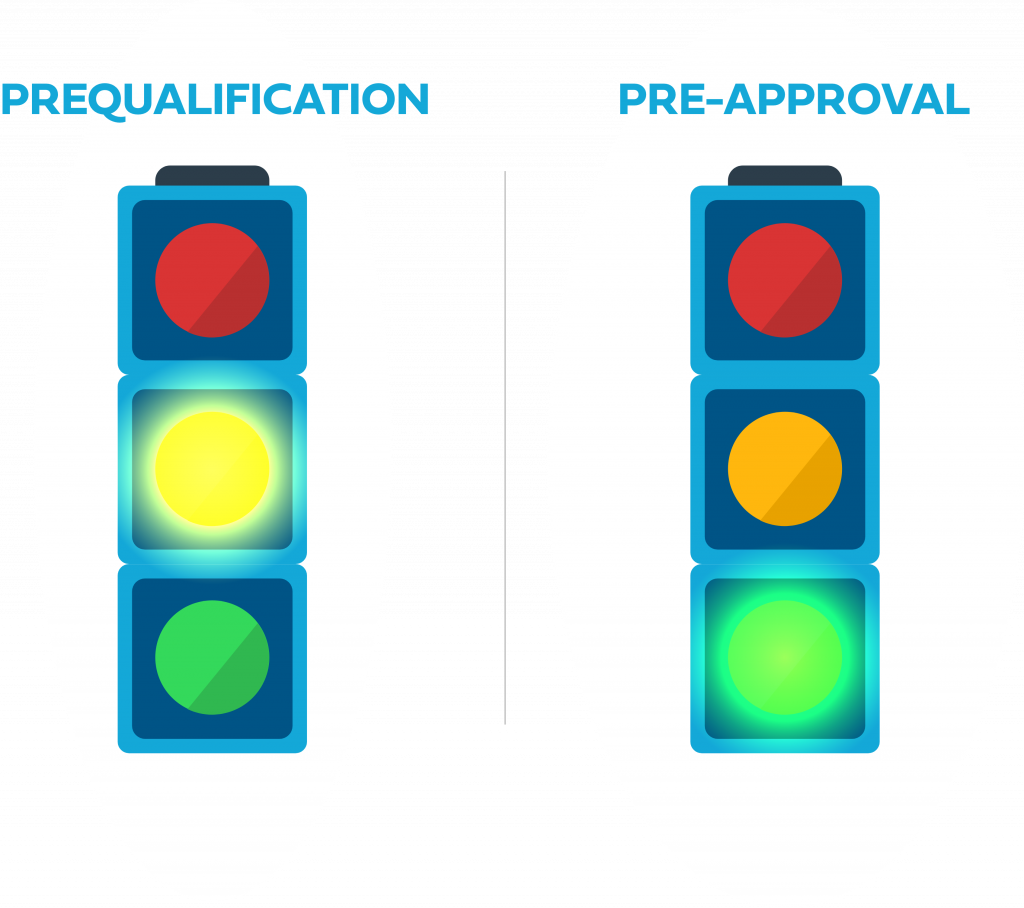

Prequalification vs. Preapproval

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

Buyer Alert

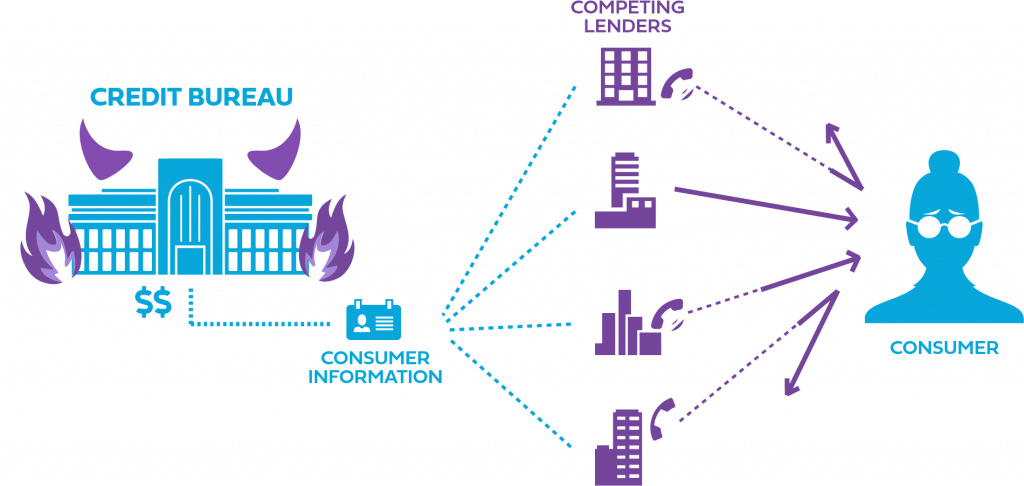

Learn all about trigger leads, things to be aware as a home buyer, mortgage relief, and more.