Annie Bloedoorn

NMLS #234524

Mortgage Broker

Learn More about your mortgage professional:

Read More

I have extensive experience in the arena of debt management and credit enhancement. For the past 20 years I have been the owner of Assets Assured Financial Svcs, where I provide mortgage lending to individuals seeking loans in every arena of real-estate. Weather it is purchasing or refinancing a home, land, manufactured home, doing a reverse mortgage, or purchasing or refinancing a commercial property we are positioned to as assist you with your goals. Our slogan is that “You may be delayed but never denied”. If you are serious about home ownership but know you are not credit worthy, we will guide you to your goal. We strongly believe We are Blessed to be a Blessing! Who is our target market YOU!

- https://www.aafsbroker.com/annie-nellie-bloedoorn/

- 110B S. Cedar St, Summerville, SC 29483

Annie Bloedoorn

NMLS #234524

Mortgage Broker

Certifications: n/a

Learn More about your mortgage professional:

Read More

I have extensive experience in the arena of debt management and credit enhancement. For the past 20 years I have been the owner of Assets Assured Financial Svcs, where I provide mortgage lending to individuals seeking loans in every arena of real-estate. Weather it is purchasing or refinancing a home, land, manufactured home, doing a reverse mortgage, or purchasing or refinancing a commercial property we are positioned to as assist you with your goals. Our slogan is that “You may be delayed but never denied”. If you are serious about home ownership but know you are not credit worthy, we will guide you to your goal. We strongly believe We are Blessed to be a Blessing! Who is our target market YOU!

- https://www.aafsbroker.com/annie-nellie-bloedoorn/

- 110B S. Cedar St, Summerville, SC 29483

credit expertise curated, just for you

Learn Your Way Home

Trending Topics

Browse All

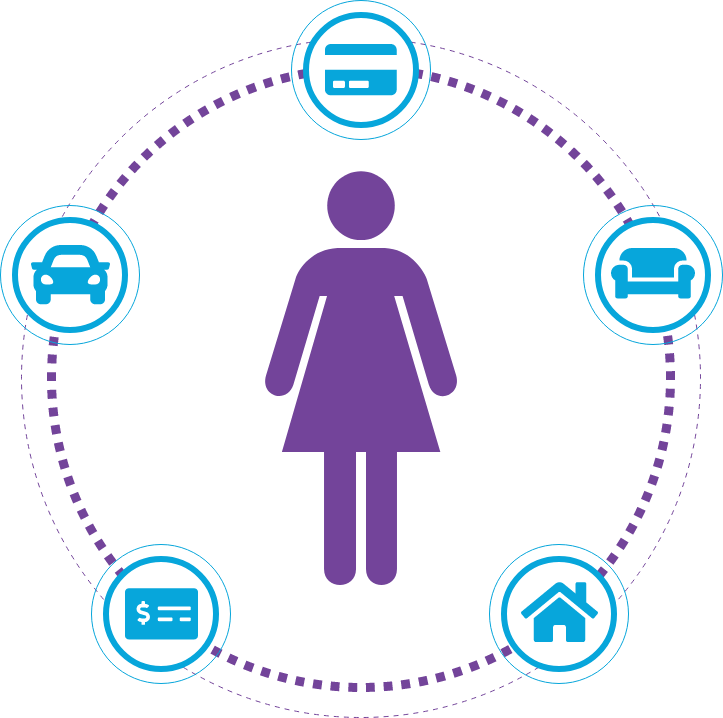

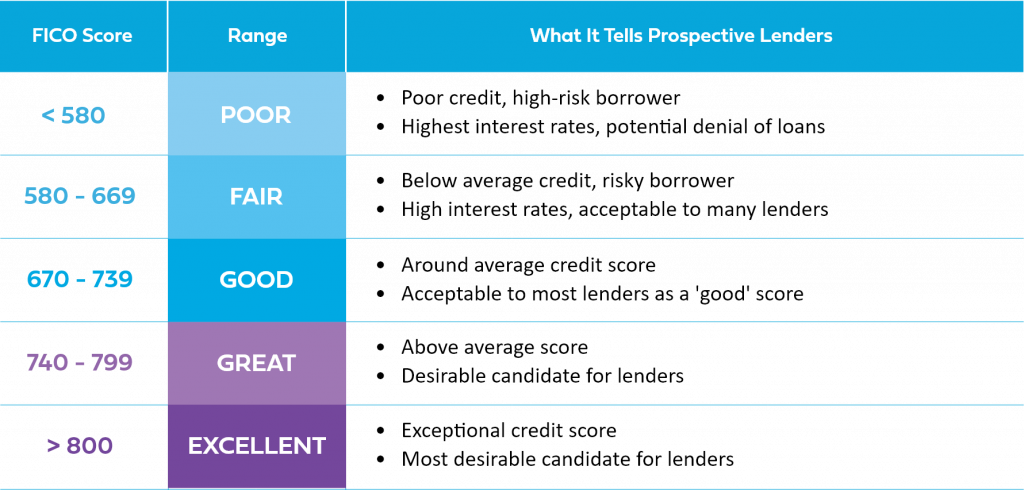

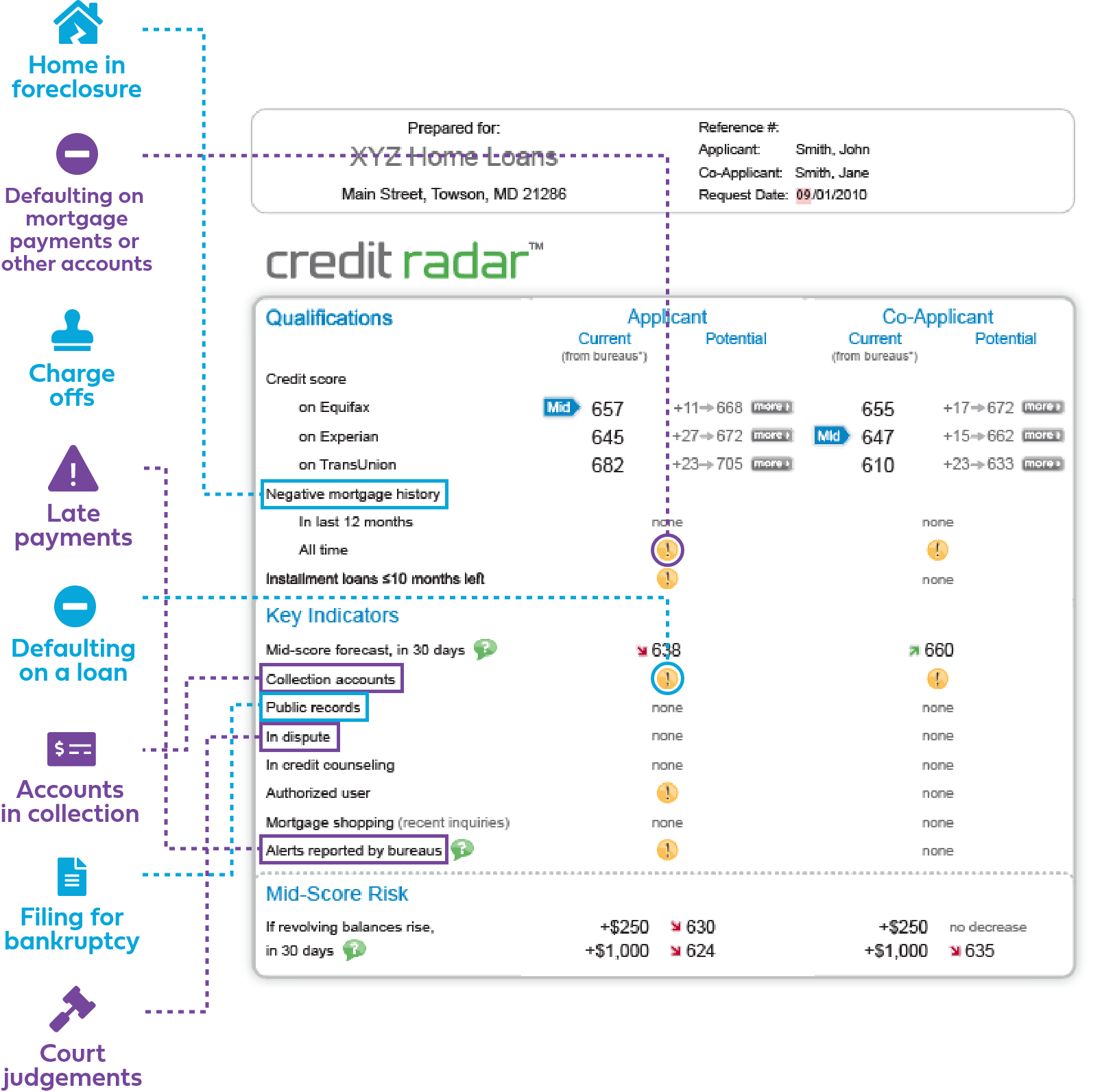

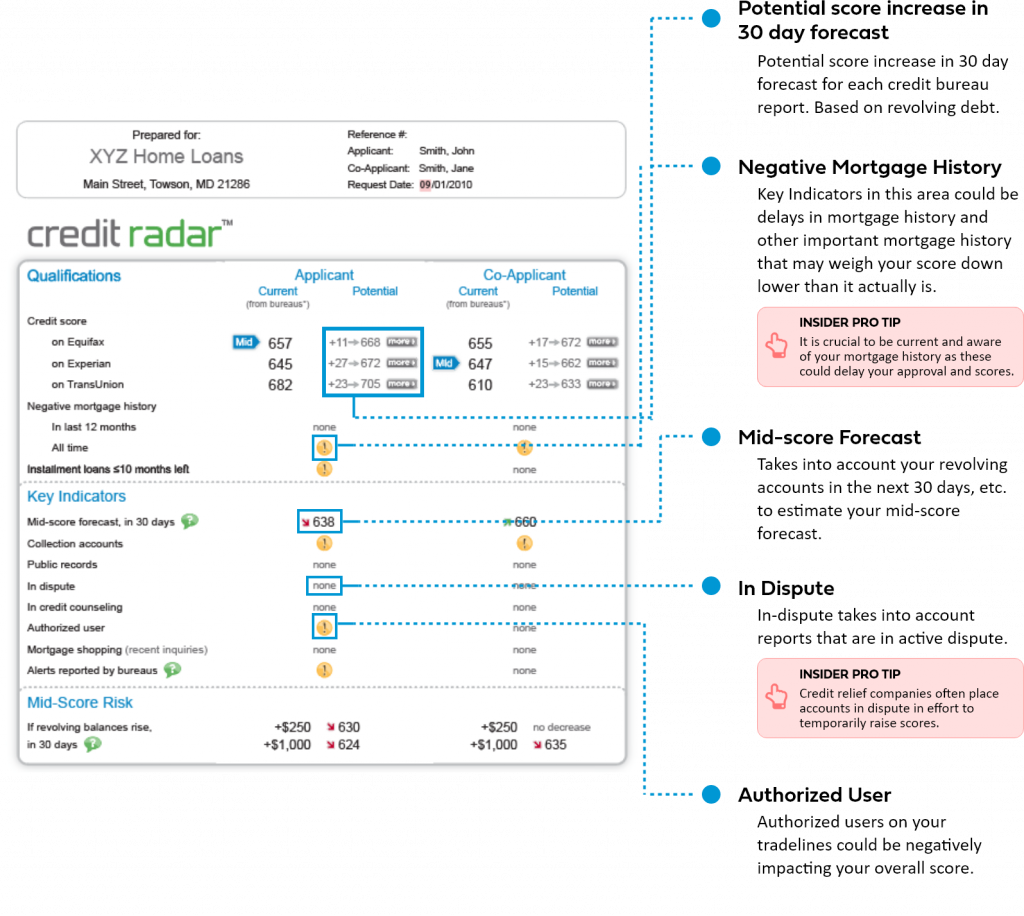

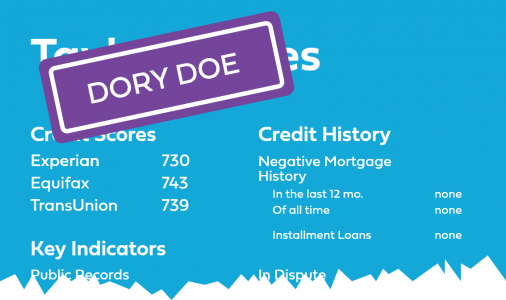

Score & Credit Basics

Learn all about credit scores, credit reports, scoring models and more.

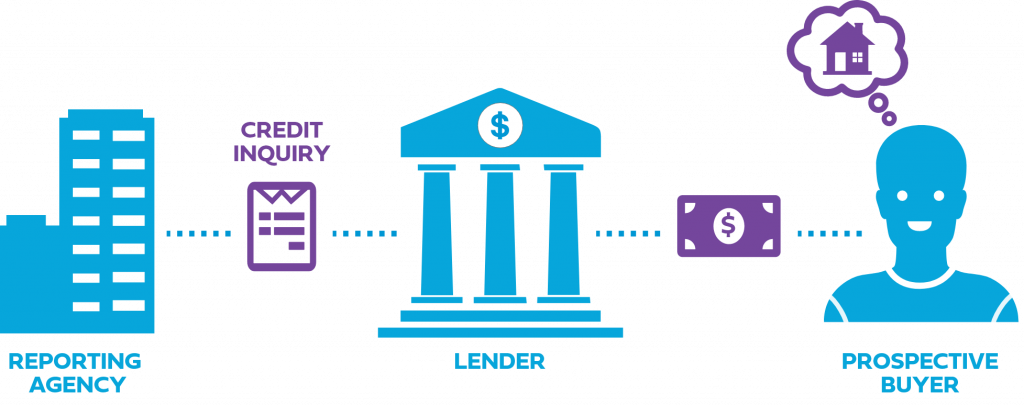

Mortgage Essentials

Learn all about mortgage rates, types of loans, cost breakdown, and more.

What Are the Common Types of Mortgage Loans?

How Much Should I Save for a Down Payment & Closing...

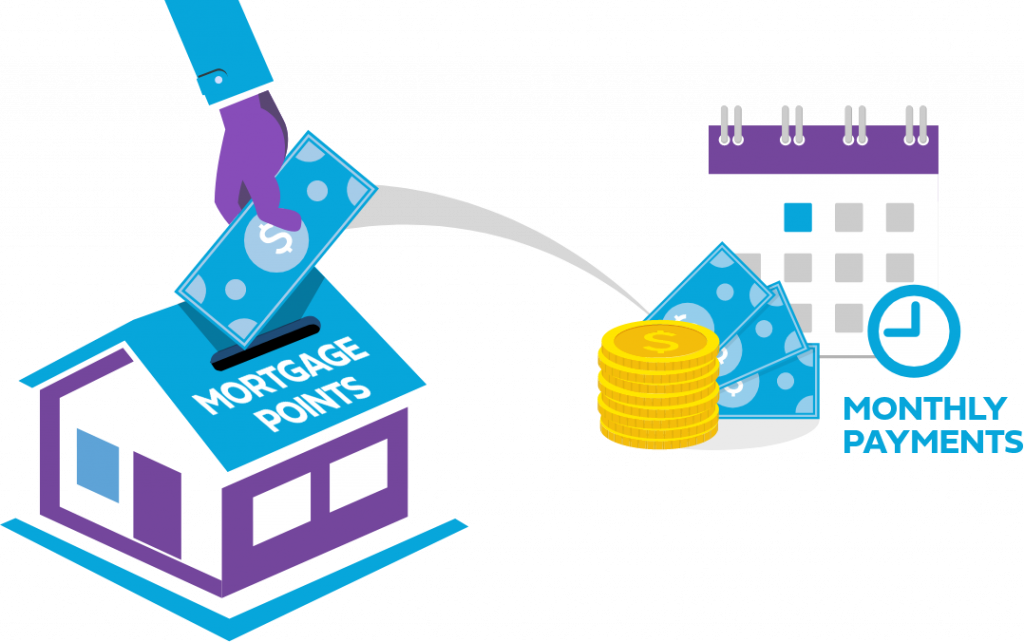

What Are Mortgage Points?

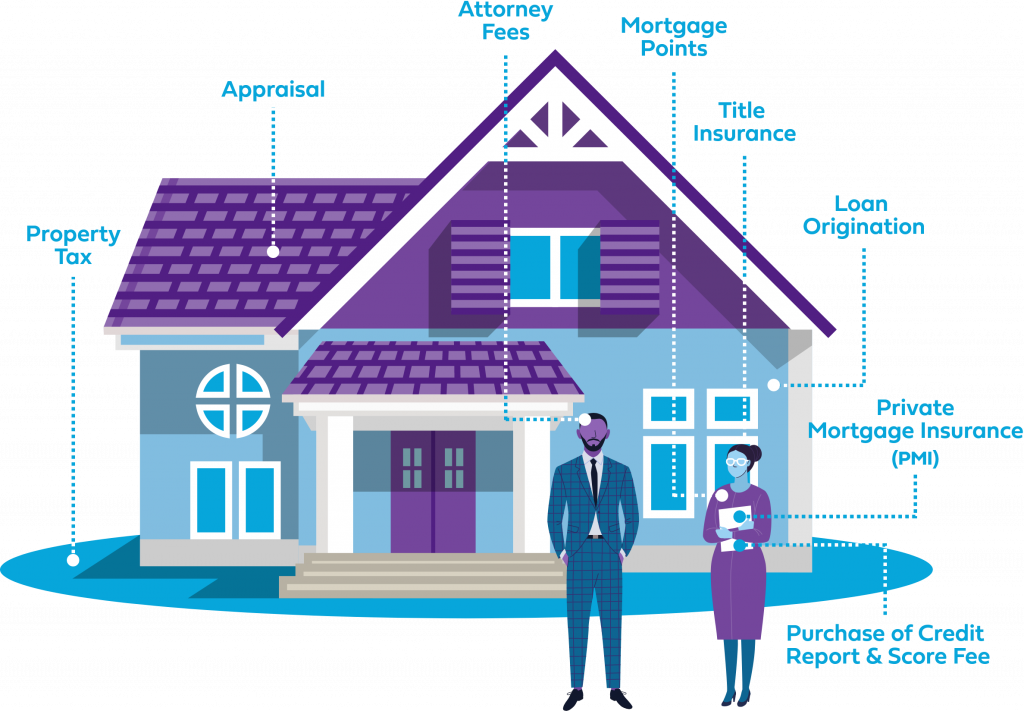

What Costs Are Included in My Mortgage Payment?

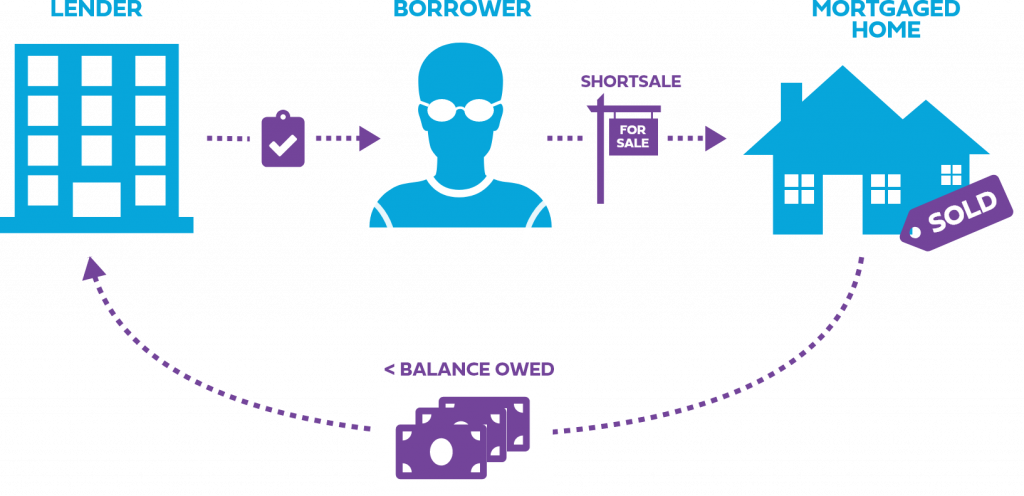

Foreclosures vs. Shortsales

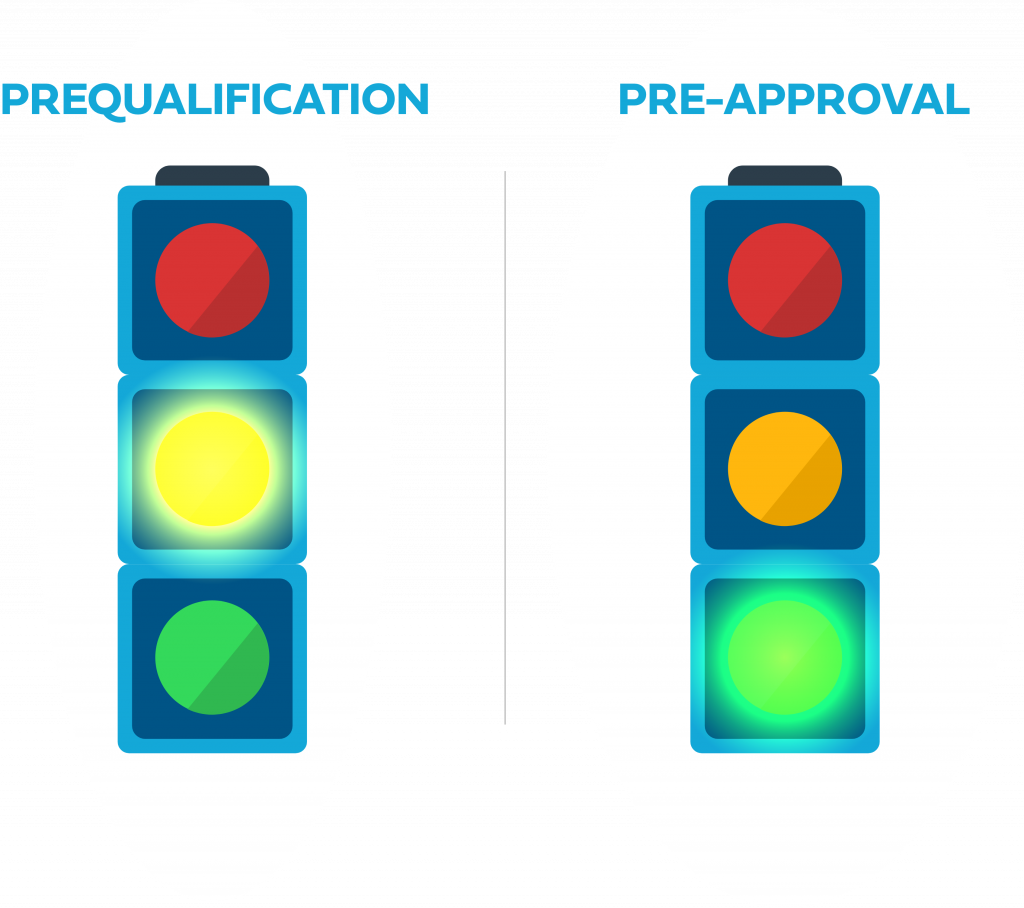

Prequalification vs. Preapproval

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

Buyer Alert

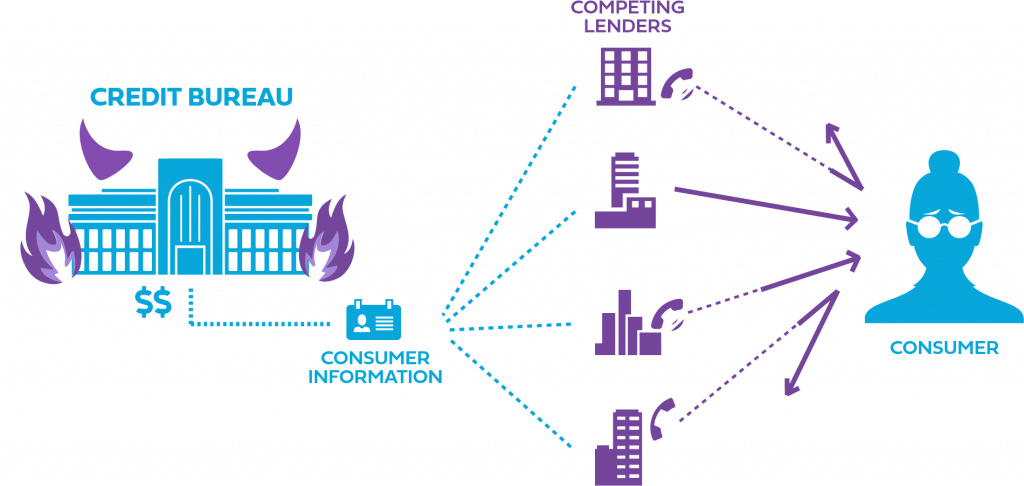

Learn all about trigger leads, things to be aware as a home buyer, mortgage relief, and more.