David Perez

NMLS #224827

Owner & Mortgage Broker

Learn More about your mortgage professional:

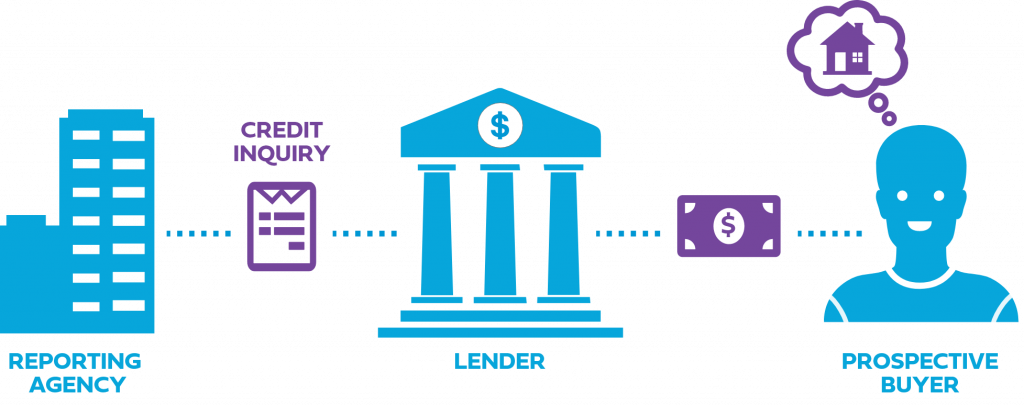

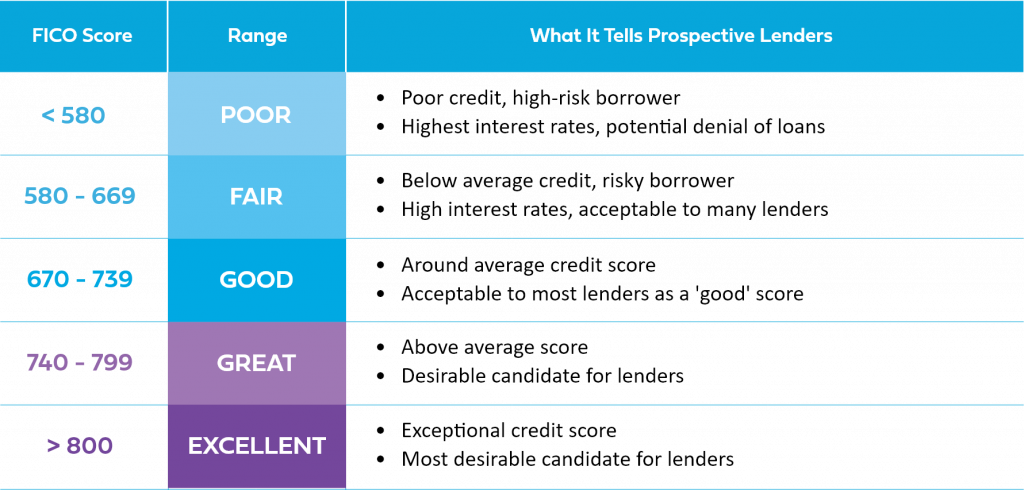

Hi, this is David Perez, Broker/Owner of Direct Partner Mortgage LLC. This is where you can order your full tri-merged residential mortgage credit report and view your true and accurate mortgage fico scores from all three major credit bureaus.

Read More

This will be an important part of the mortgage process and be integrated into your mortgage loan application. Once you’ve ordered your report here, you will not be charged for this report at the closing. I look forward to working with you! Thanks, David

Direct Partner Mortgage, LLC

NMLS #: 2277133

- https://www.directpartnermortgage.com/

- 1310 Rr 620 South #B195 Rm 16, Austin, TX, 78734

David Perez

NMLS #224827

Owner & Mortgage Broker

Certifications: n/a

Learn More about your mortgage professional:

Hi, this is David Perez, Broker/Owner of Direct Partner Mortgage LLC. This is where you can order your full tri-merged residential mortgage credit report and view your true and accurate mortgage fico scores from all three major credit bureaus.

Read More

This will be an important part of the mortgage process and be integrated into your mortgage loan application. Once you’ve ordered your report here, you will not be charged for this report at the closing. I look forward to working with you! Thanks, David

Direct Partner Mortgage, LLC

NMLS #: 2277133

- https://www.directpartnermortgage.com/

- 1310 Rr 620 South #B195 Rm 16, Austin, TX, 78734

credit expertise curated, just for you

Learn Your Way Home

Trending Topics

Browse All

Score & Credit Basics

Learn all about credit scores, credit reports, scoring models and more.

Mortgage Essentials

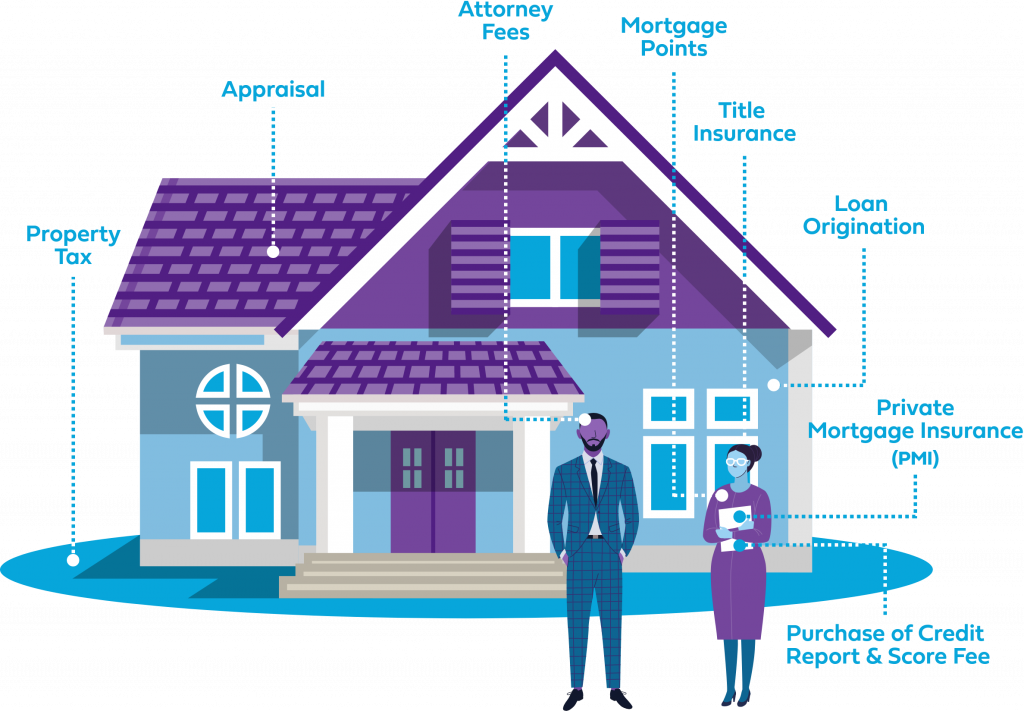

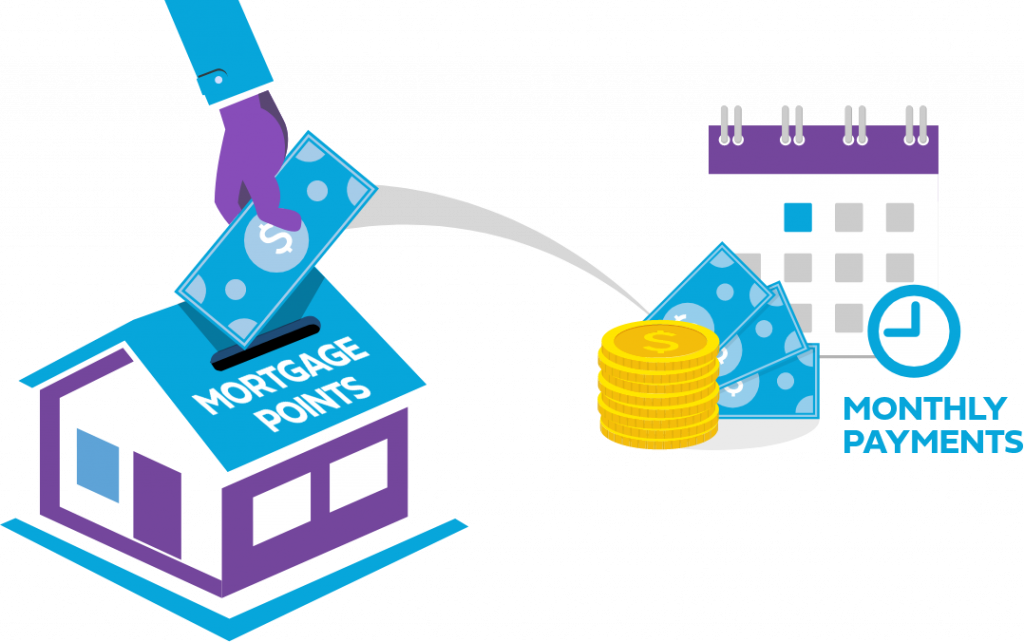

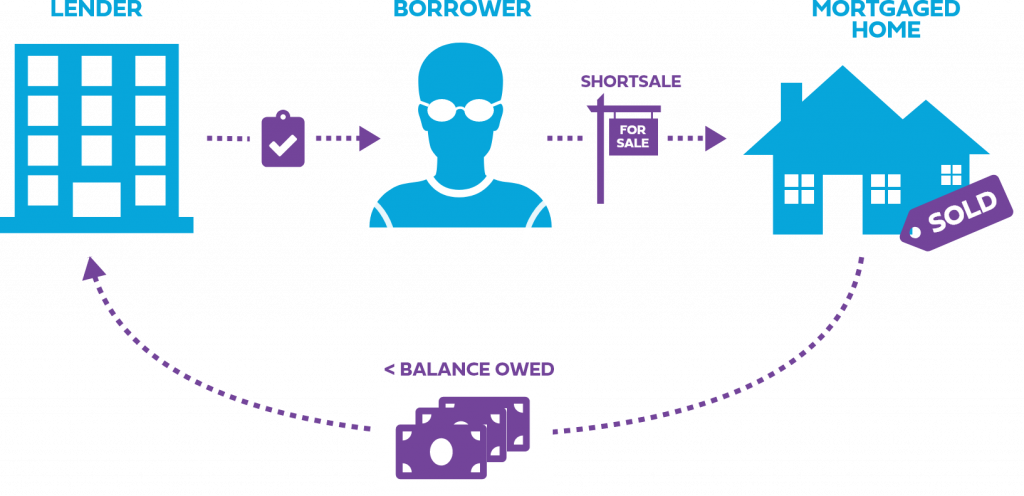

Learn all about mortgage rates, types of loans, cost breakdown, and more.

What Are the Common Types of Mortgage Loans?

How Much Should I Save for a Down Payment & Closing...

What Are Mortgage Points?

What Costs Are Included in My Mortgage Payment?

Foreclosures vs. Shortsales

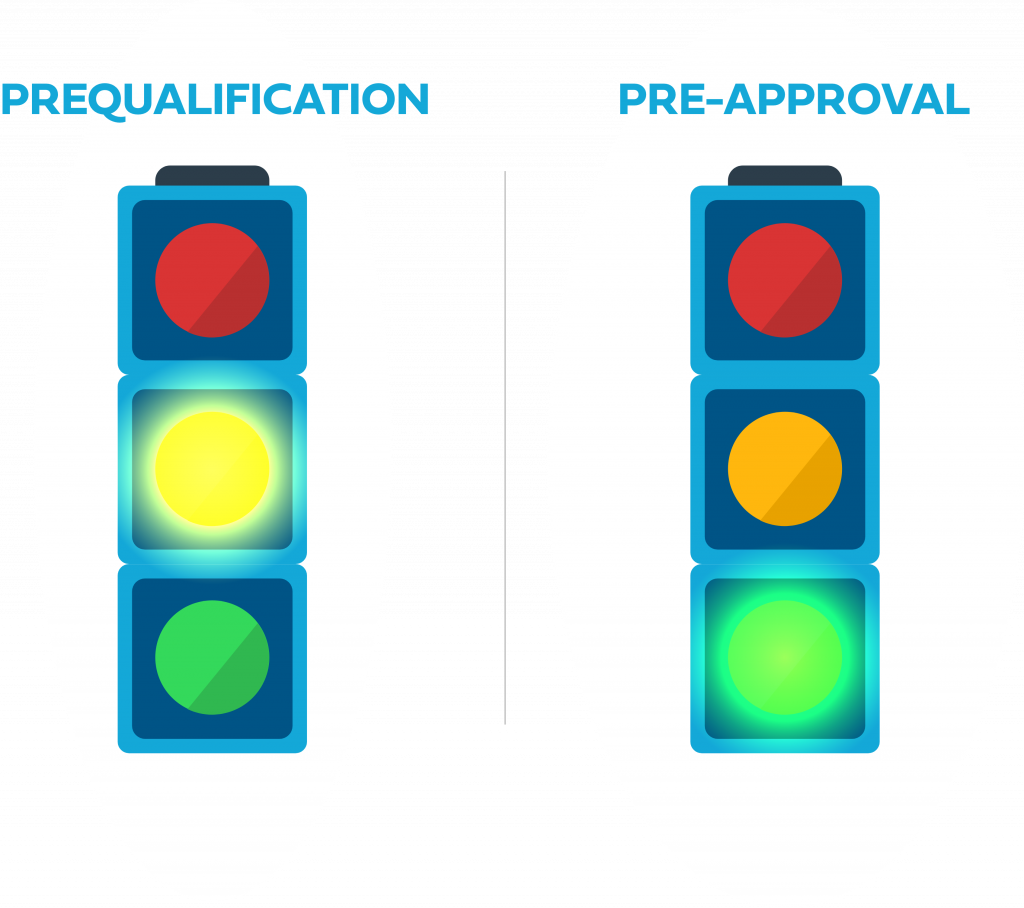

Prequalification vs. Preapproval

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

Buyer Alert

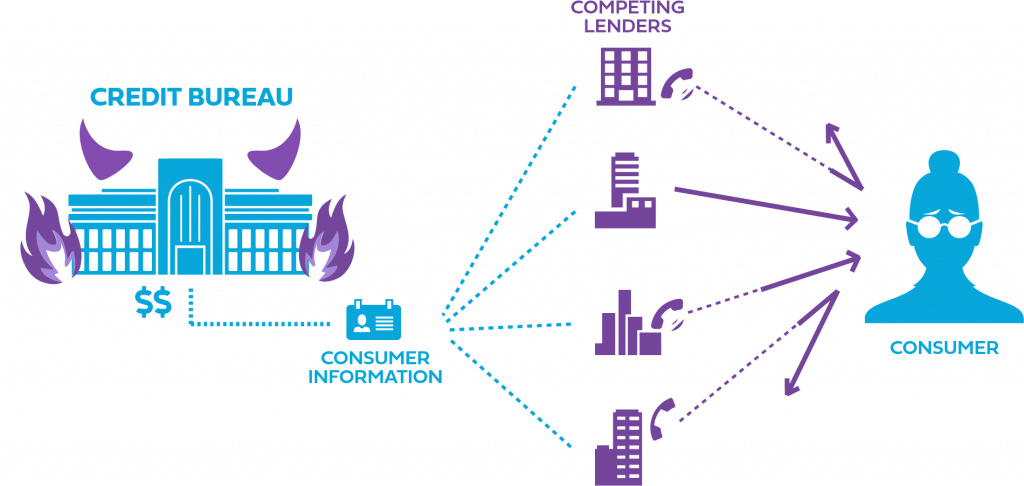

Learn all about trigger leads, things to be aware as a home buyer, mortgage relief, and more.

Credit IQ

Test your credit knowledge with our Credit IQ quizzes. Are you ready to be a homebuyer?

0%

0%

0%