Matthew Wierzbinski

NMLS #245088

Broker/Owner

Learn More about your mortgage professional:

Matthew Wierzbinski has been in the lending profession for almost all of his professional life. He is a husband and father of 4 sons. He loves to ski and mountain bike and float down the river occasionally. He is easy to talk to and easier to work with.

Read More

PeakView Mortgage, Inc.

NMLS #: 1764010

- https://www.peakviewmortgage.com

- 203 F Street, Unit A, Salida, CO 81201

Matthew Wierzbinski

NMLS #245088

Broker/Owner

Certifications: CO MLO# 100506308

Learn More about your mortgage professional:

Matthew Wierzbinski has been in the lending profession for almost all of his professional life. He is a husband and father of 4 sons. He loves to ski and mountain bike and float down the river occasionally. He is easy to talk to and easier to work with.

Read More

PeakView Mortgage, Inc.

NMLS #: 1764010

- https://www.peakviewmortgage.com

- 203 F Street, Unit A, Salida, CO 81201

credit expertise curated, just for you

Learn Your Way Home

Trending Topics

Browse All

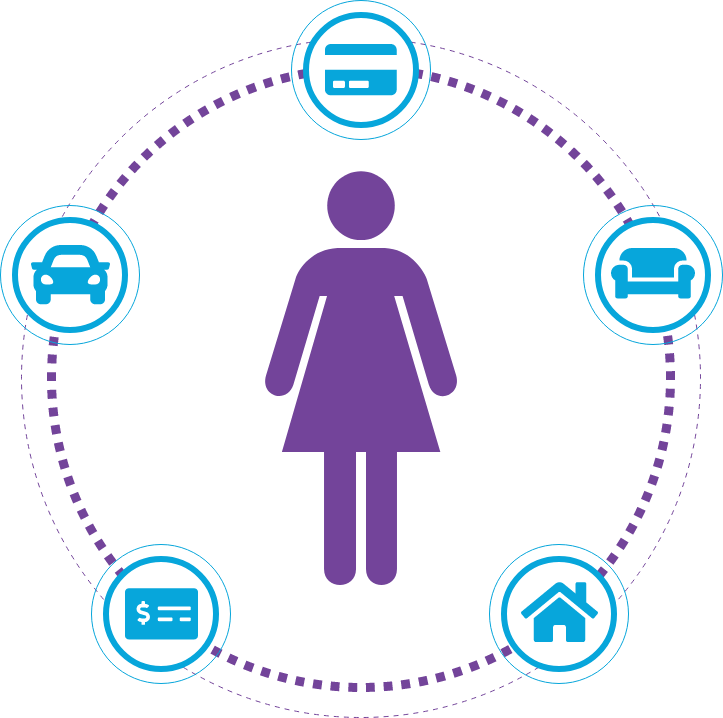

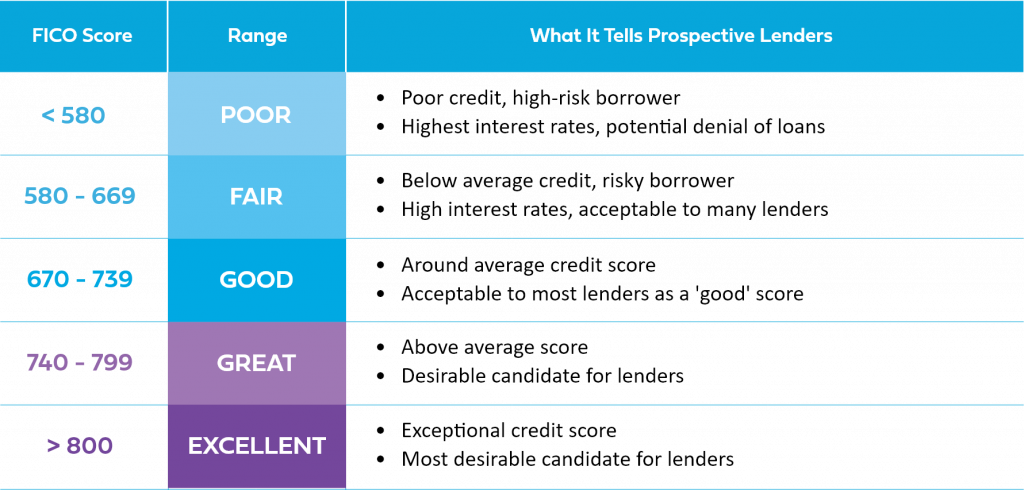

Score & Credit Basics

Learn all about credit scores, credit reports, scoring models and more.

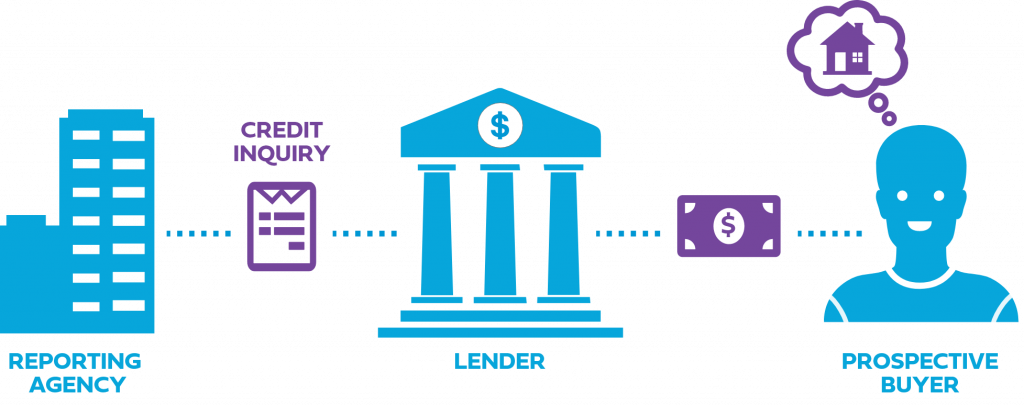

Mortgage Essentials

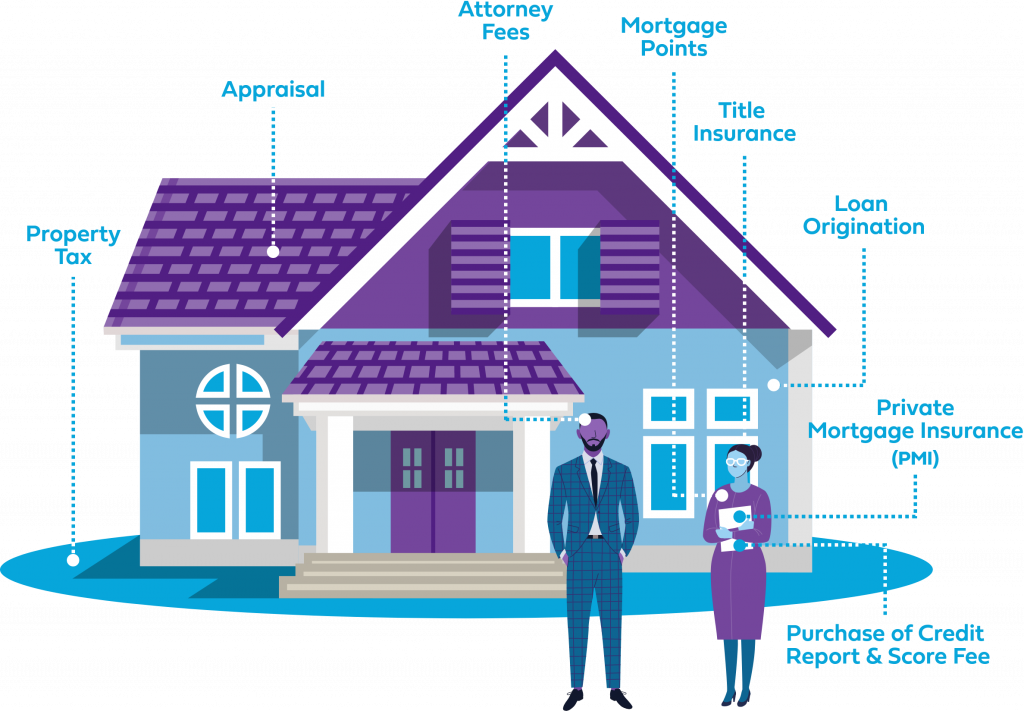

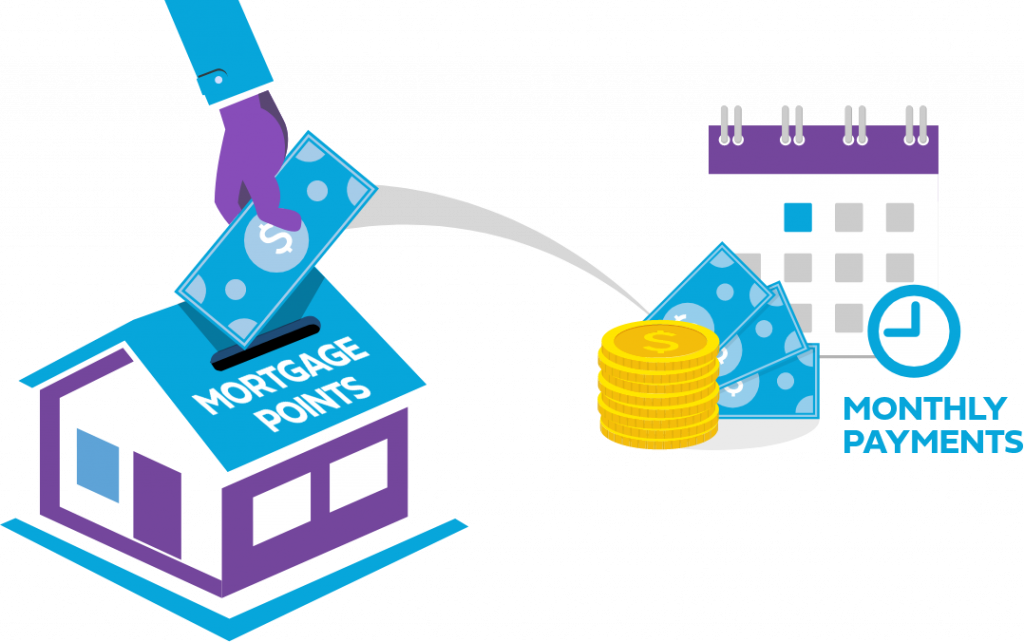

Learn all about mortgage rates, types of loans, cost breakdown, and more.

What Are the Common Types of Mortgage Loans?

How Much Should I Save for a Down Payment & Closing...

What Are Mortgage Points?

What Costs Are Included in My Mortgage Payment?

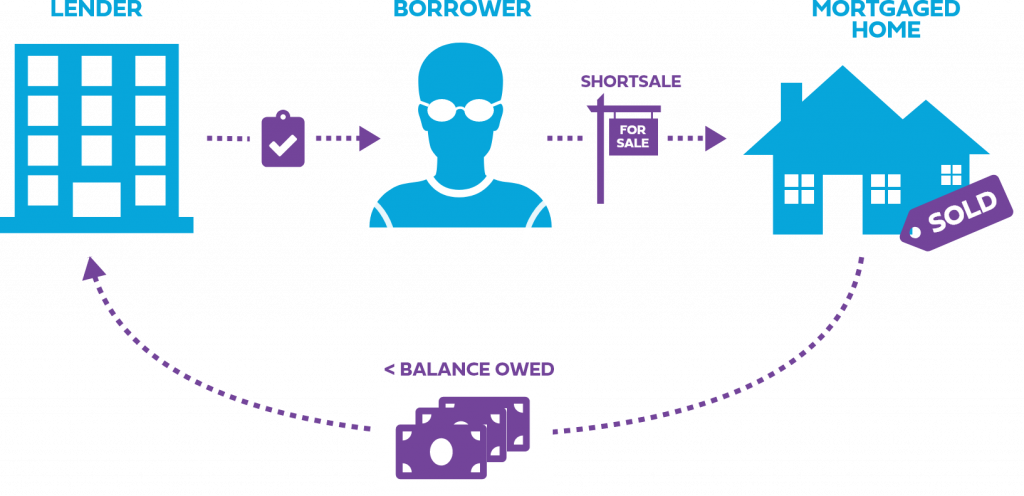

Foreclosures vs. Shortsales

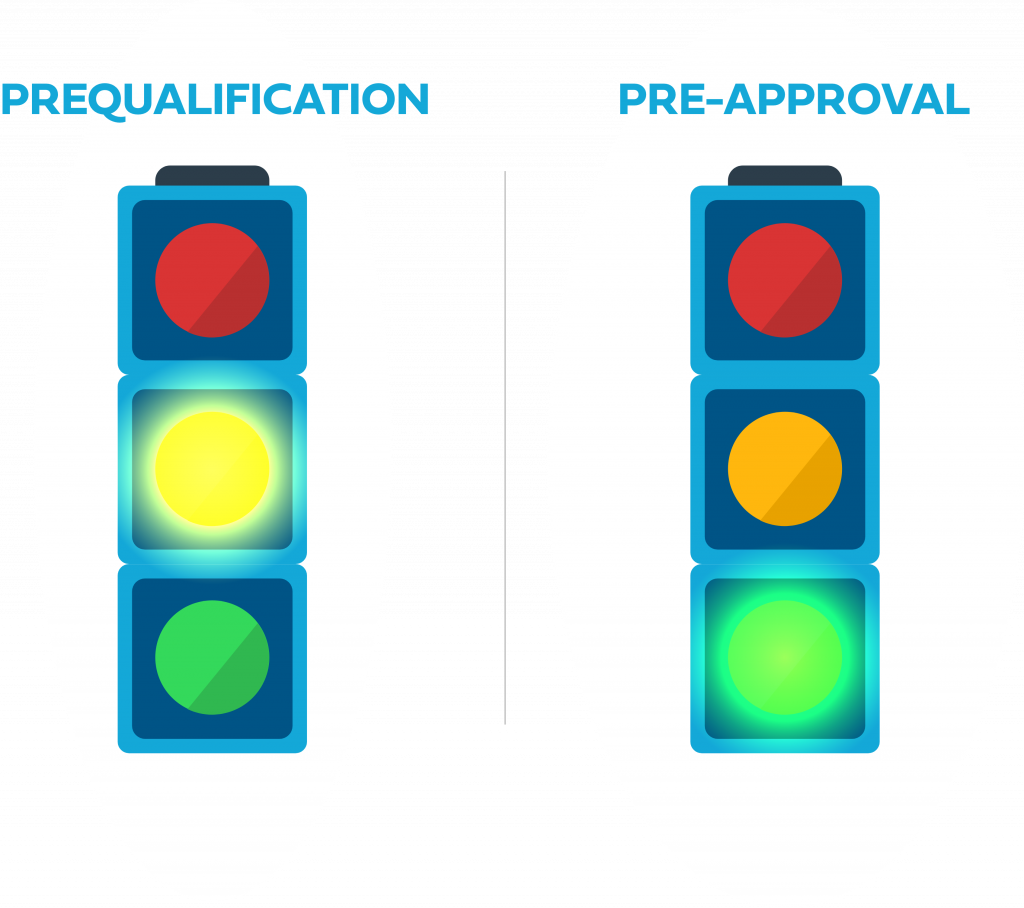

Prequalification vs. Preapproval

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

Buyer Alert

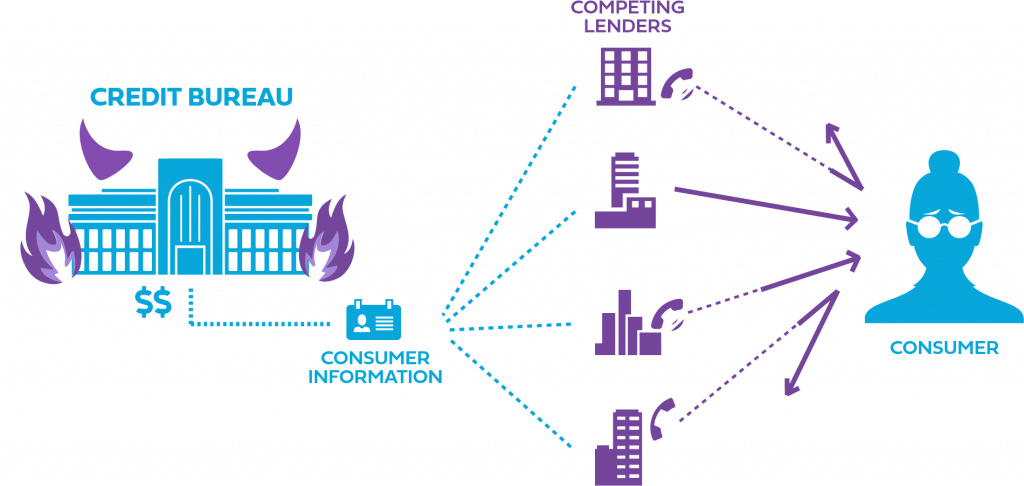

Learn all about trigger leads, things to be aware as a home buyer, mortgage relief, and more.

Credit IQ

Test your credit knowledge with our Credit IQ quizzes. Are you ready to be a homebuyer?

0%

0%

0%