NMLS

#237527

Company Phone

Address

115 Aikens Center Ste. 20B

Martinsburg, WV 25404

About

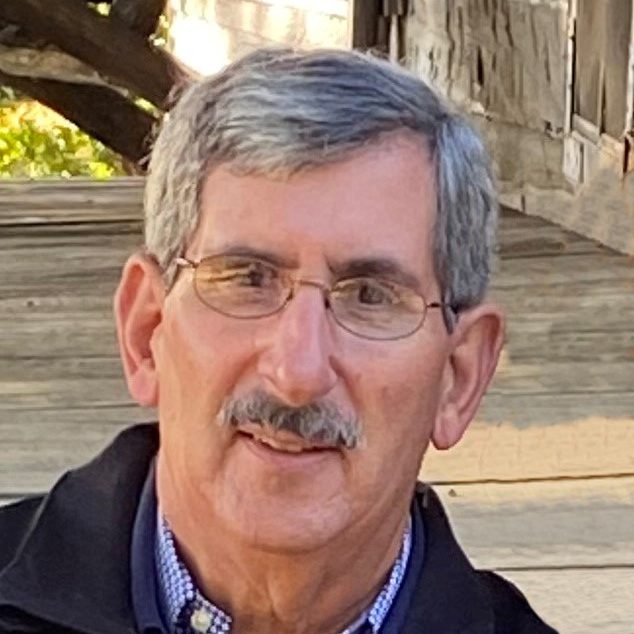

Marc Savitt is the founder and president of Mortgage Financing.com, Inc. DBA: The Mortgage Center. He is a licensed mortgage professional with more than 38 years experience in the residential mortgage industry. Marc has been a frequent expert witness before Congress, having testified at various Congressional hearings for more than 16 years.

For more than 38 years, our policy has been to treat our customers like family. We provide personal, one-on-one service. When you call our office, you never receive an automated greeting. A member of our staff always answers the phone.

Our job is to guide you through the home buying process from application to settlement, and provide you with low interest rates and closing costs. It’s easy to apply on line or you can call our office and speak directly to a licensed mortgage professional.

Our entire staff is licensed through the Nationwide Mortgage Licensing System. Everyone is required to pass a background investigation and credit check. In addition, all staff members are required to pass a written Federal Examination, ensuring you’ll be working with a knowledgeable and skilled professional.

Nationwide Mortgage Licensing System Number (NMLS) 237527

| Mortgagefinancing.com DBA The Mortgage Center is an Equal Housing Lender. |

LEARN Your Way Home with Marc Savitt

Get to know your mortgage professional, browse popular content and gain knowledge that will lead you to qualify for the best possible mortgage rates and terms available!

Trending Topics

Browse All

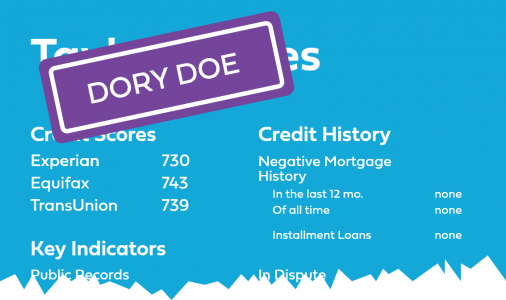

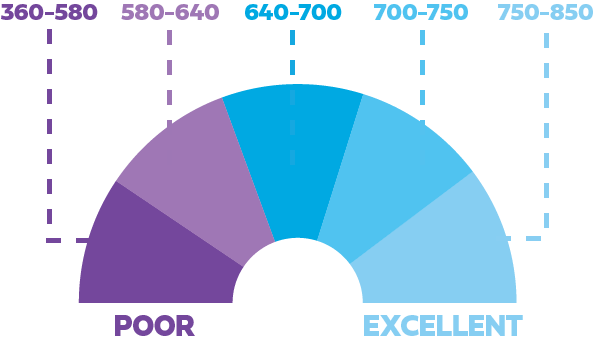

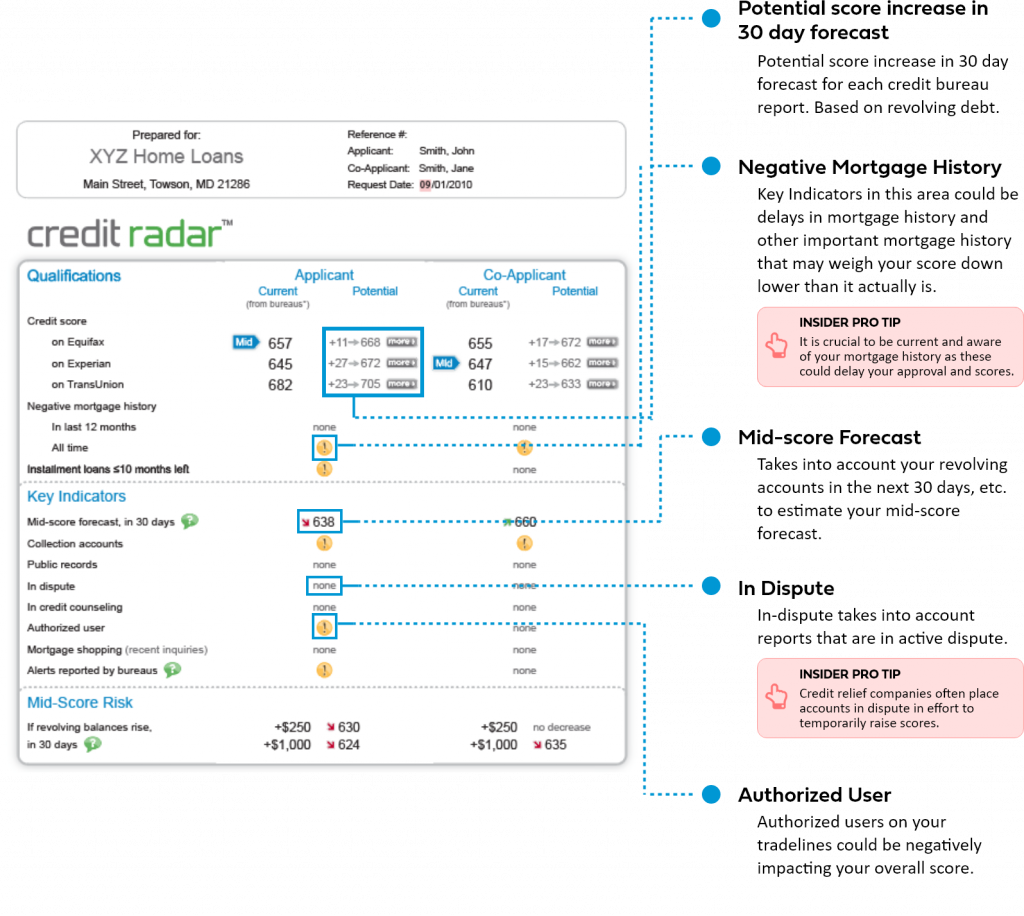

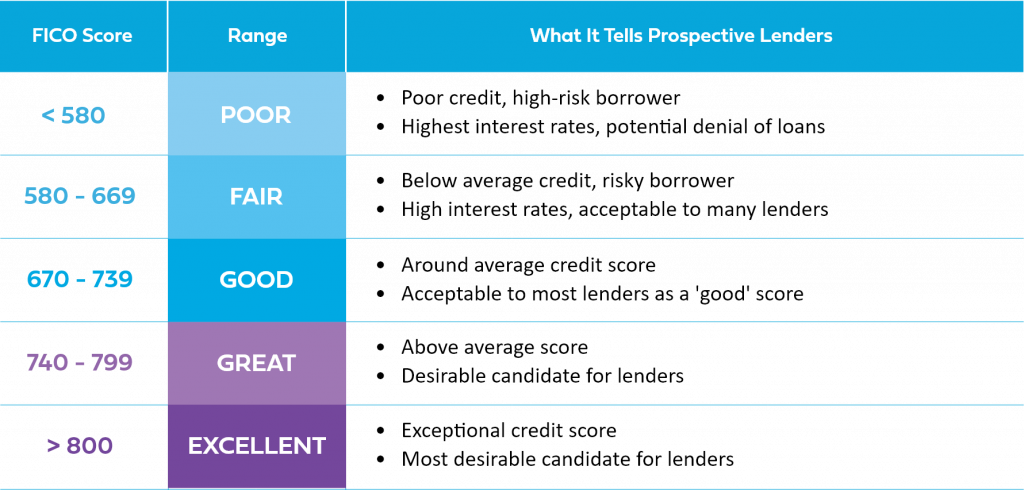

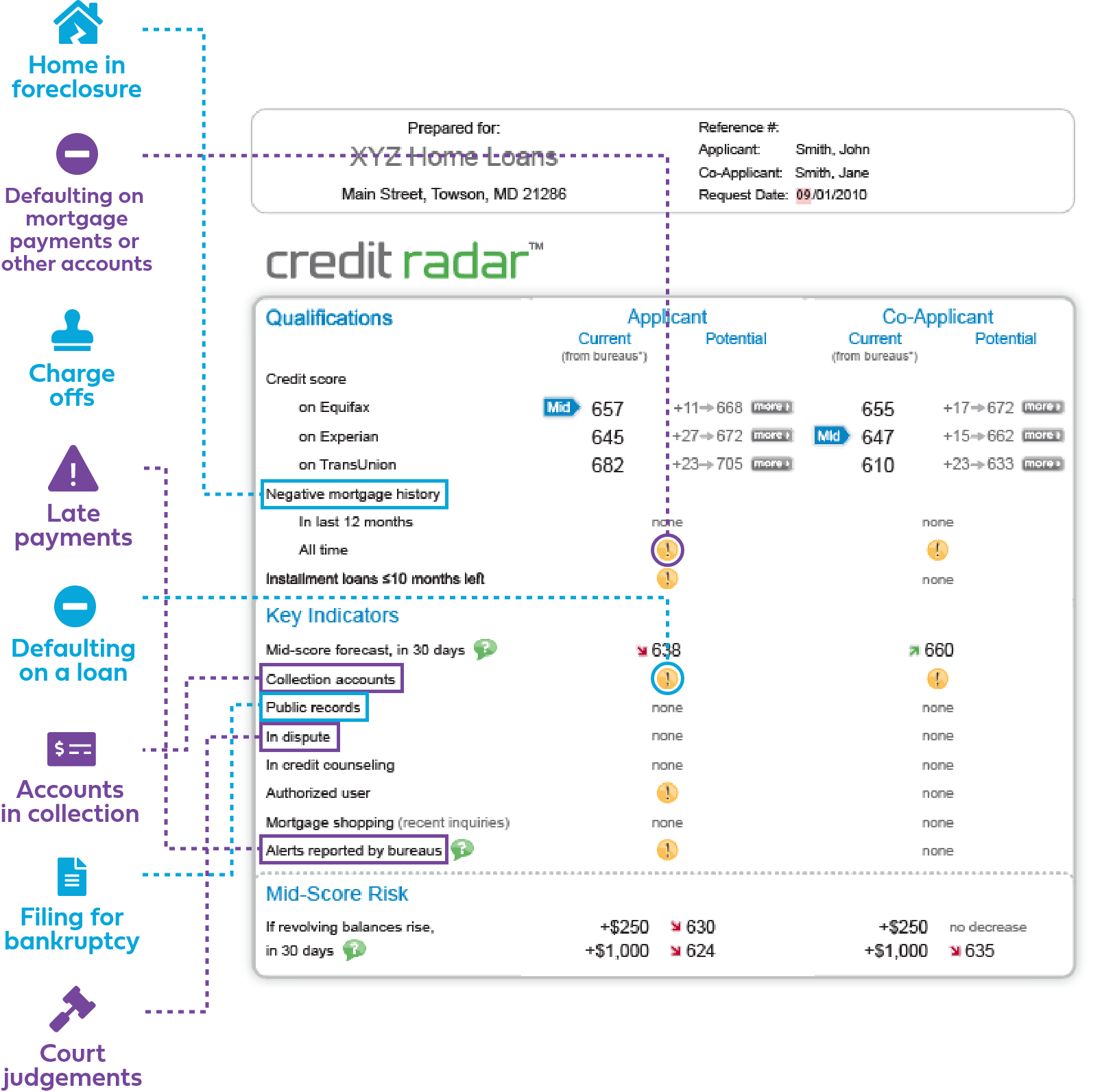

Score & Credit Basics

Learn all about credit scores, credit reports, scoring models and more.

What Exactly Is a Credit Score and How is it Determined?

What is a Credit Report?

When, Where & Why Should I Check My Credit?

What Is an Inquiry?

What Is a Tradeline?

What Is a FICO® Score?

Do Other Scoring Models Exist?

Can My Credit Score Be Improved?

Common Reasons Why Your FICO® Score Is Low

Learned all of

Score & Credit Basics?

Test your Credit IQ with our short, 8 question quiz.

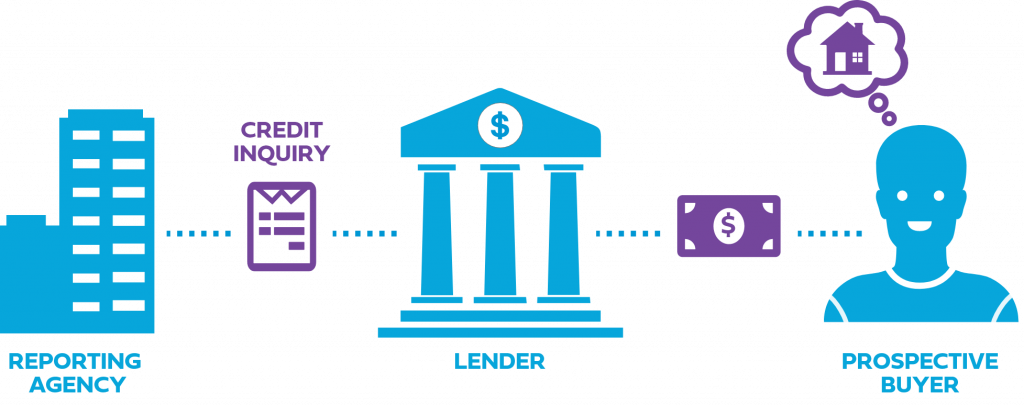

Mortgage Essentials

Learn all about mortgage rates, types of loans, cost breakdown, and more.

What Are the Common Types of Mortgage Loans?

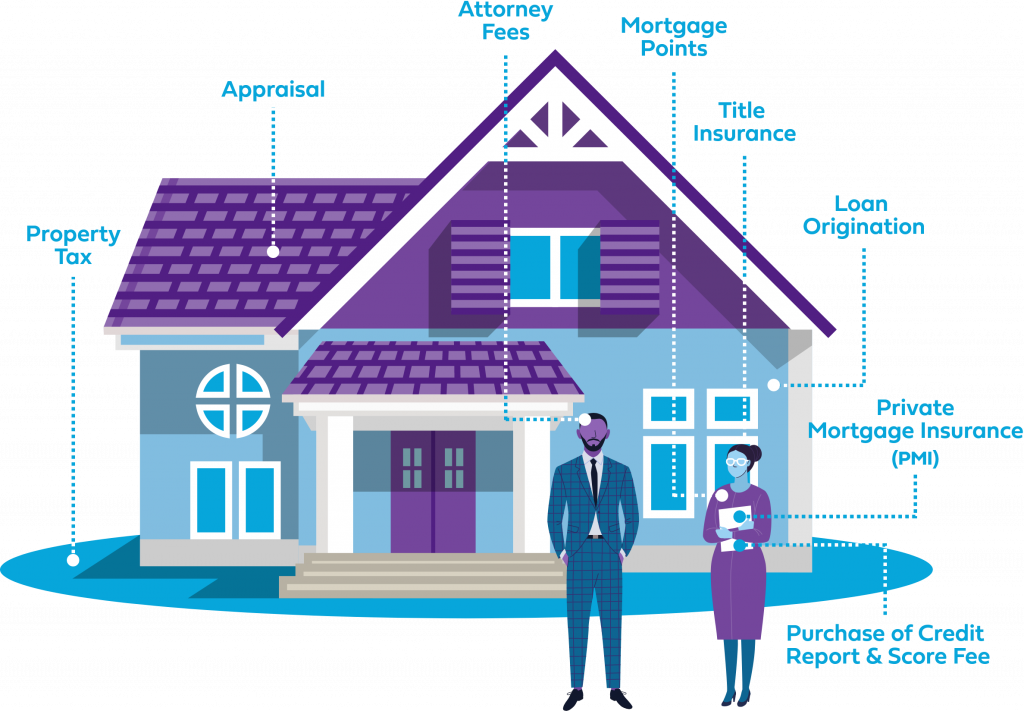

How Much Should I Save for a Down Payment & Closing...

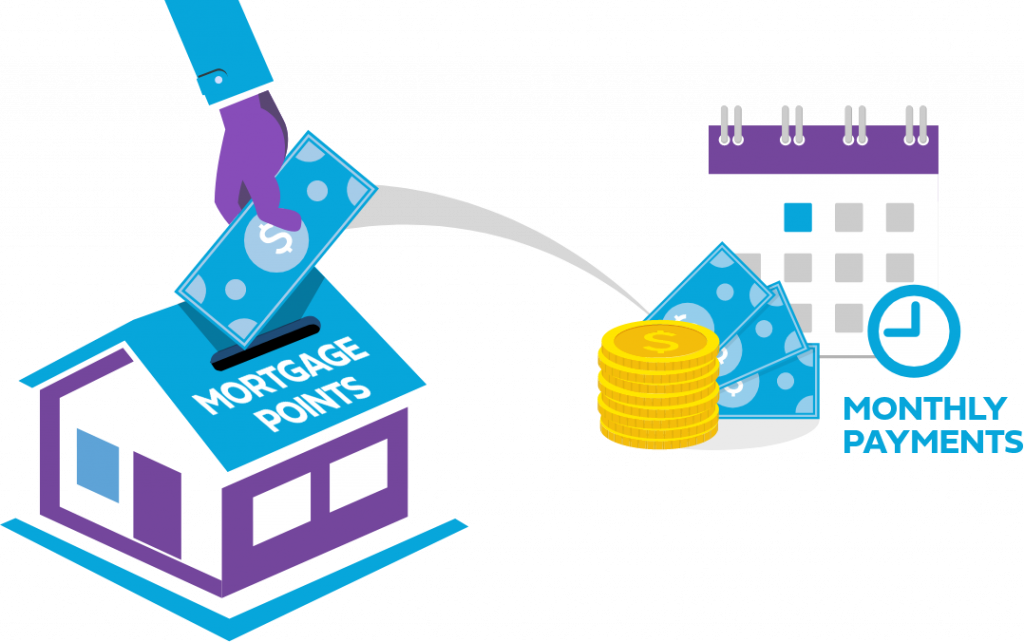

What Are Mortgage Points?

What Costs Are Included in My Mortgage Payment?

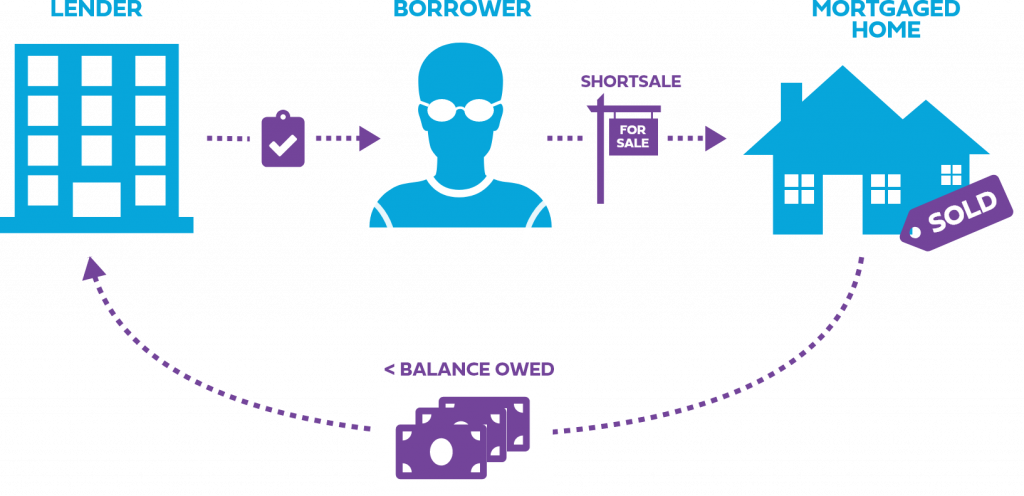

Foreclosures vs. Shortsales

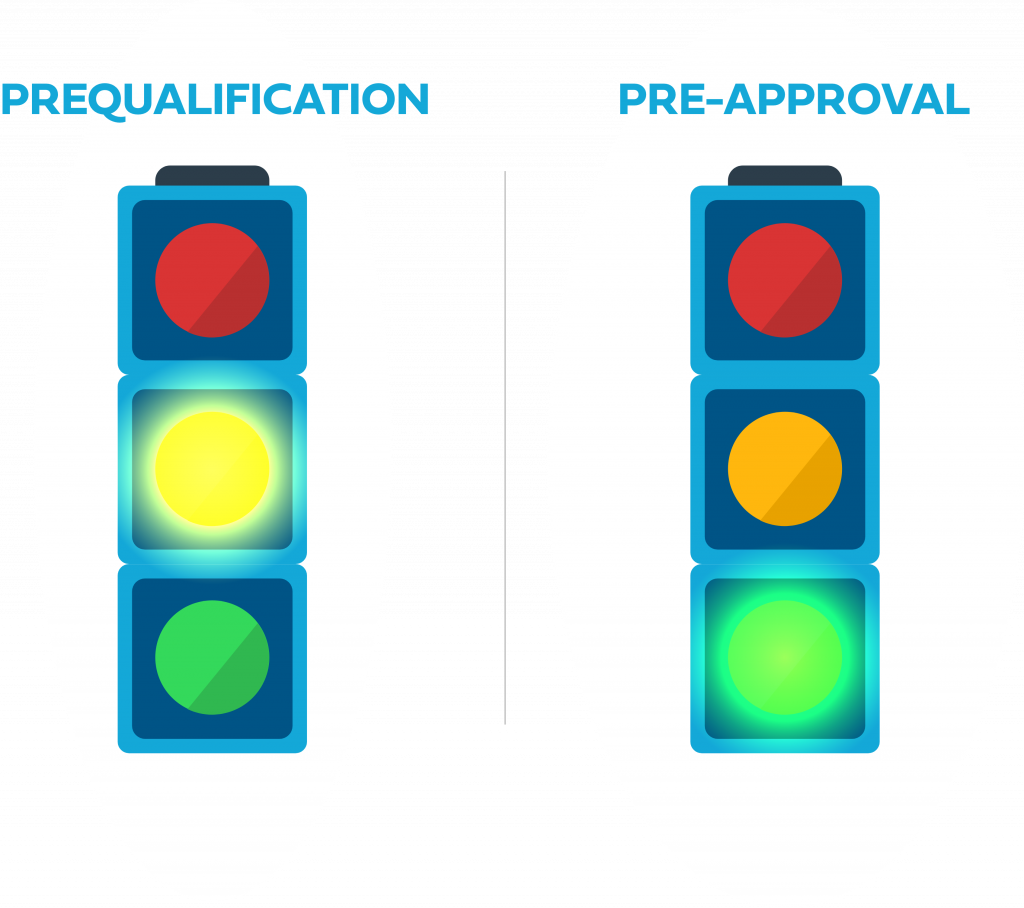

Prequalification vs. Preapproval

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

Learned all of

Mortgage Essentials?

Test your Credit IQ with our short, 9 question quiz.

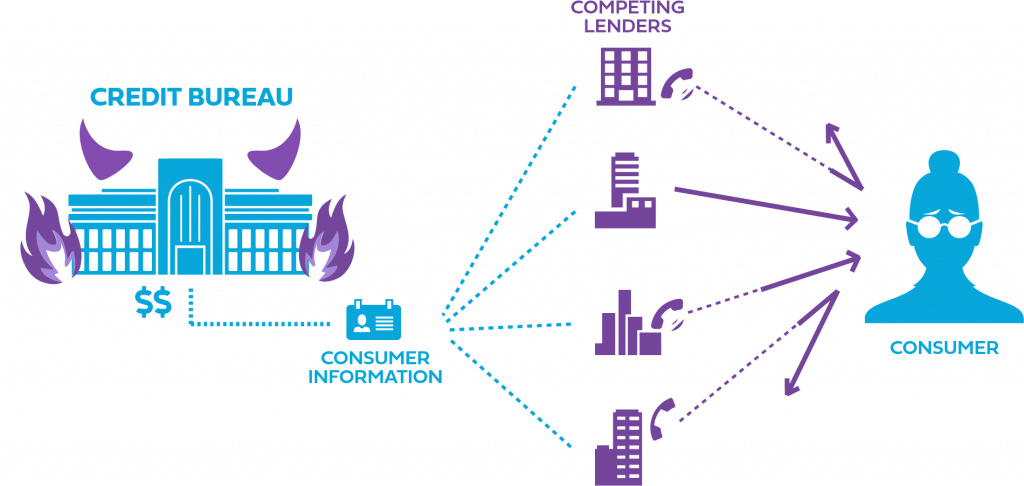

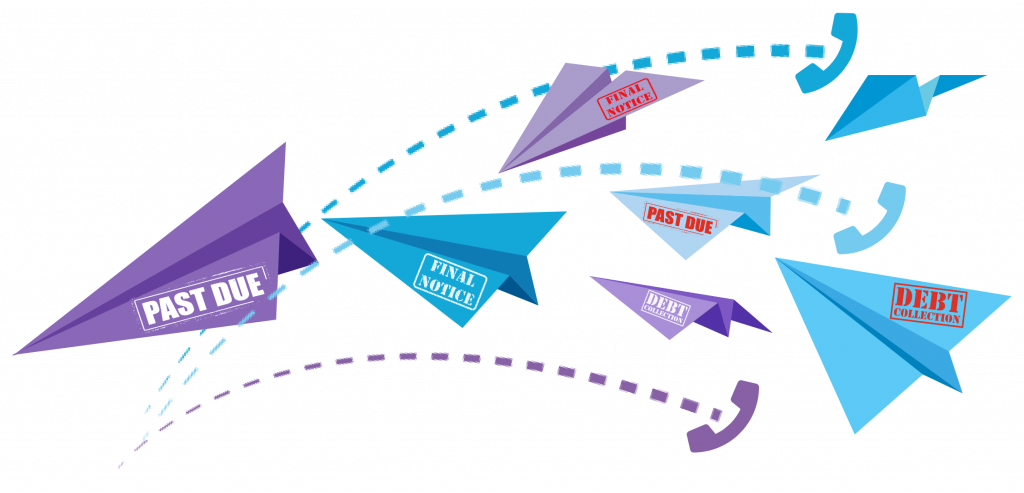

Buyer Alert

Learn all about trigger leads, things to be aware as a home buyer, mortgage relief, and more.

Credit IQ

Test your credit knowledge with our Credit IQ quizzes. Don't worry, they're all 10 questions or less and you'll receive instant results with the ability to try as many times as you'd like.

Score & Credit Basics

Mortgage Essentials

Buyer Alert

Thank you for choosing...

Marc Savitt

and

Mortgage Financing.com, Inc.

Table of Contents