Kim Meche

NMLS #121399

Residential Mortgage Loan Officer

Learn More about your mortgage professional:

Read More

Whether you’re buying, selling, refinancing, or building your dream home, you have a lot riding on your loan specialist. Since market conditions and mortgage programs change frequently, you need to make sure you’re dealing with a top professional who can give you quick and accurate financial advice. As an experienced loan officer Kim has the knowledge and expertise you need to explore the many financing options available. After you’ve applied, Kim will call you to discuss the details of your loan, or you may choose to set up an appointment with her. I look forward to working with you.

- https://www.ulending.net/

- 5750 Johnston St Ste 102, Lafayette, LA 70503

Kim Meche

NMLS #121399

Residential Mortgage Loan Officer

Certifications: n/a

Learn More about your mortgage professional:

Read More

Whether you’re buying, selling, refinancing, or building your dream home, you have a lot riding on your loan specialist. Since market conditions and mortgage programs change frequently, you need to make sure you’re dealing with a top professional who can give you quick and accurate financial advice. As an experienced loan officer Kim has the knowledge and expertise you need to explore the many financing options available. After you’ve applied, Kim will call you to discuss the details of your loan, or you may choose to set up an appointment with her. I look forward to working with you.

- https://www.ulending.net/

- 5750 Johnston St Ste 102, Lafayette, LA 70503

credit expertise curated, just for you

Learn Your Way Home

Trending Topics

Browse All

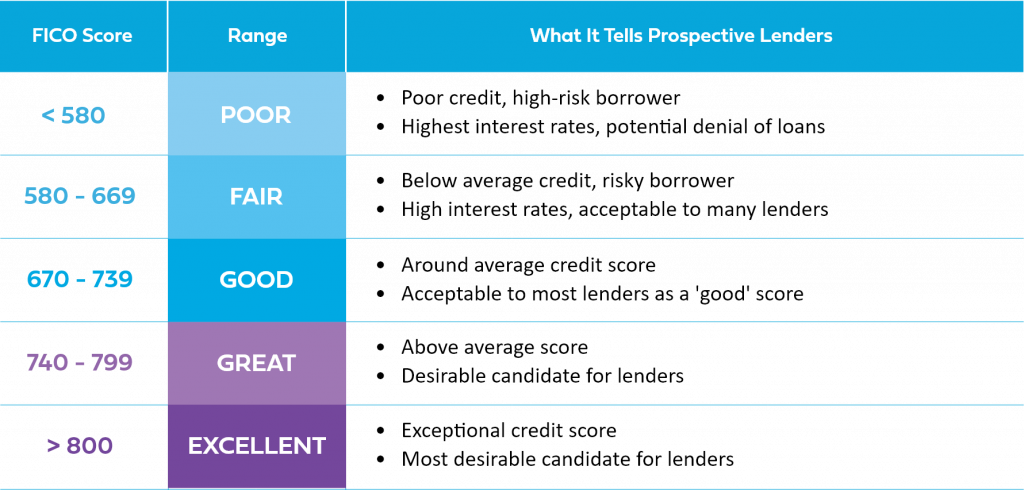

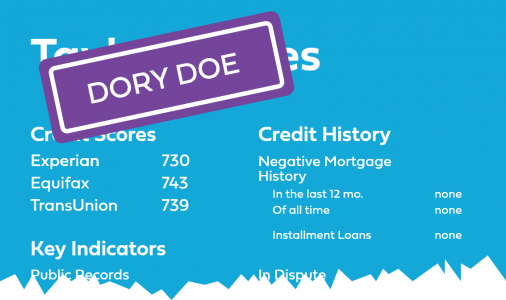

Score & Credit Basics

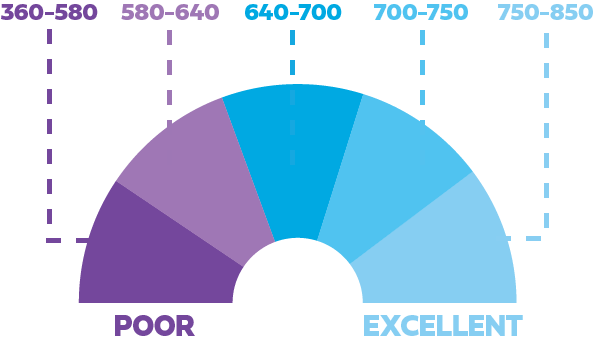

Learn all about credit scores, credit reports, scoring models and more.

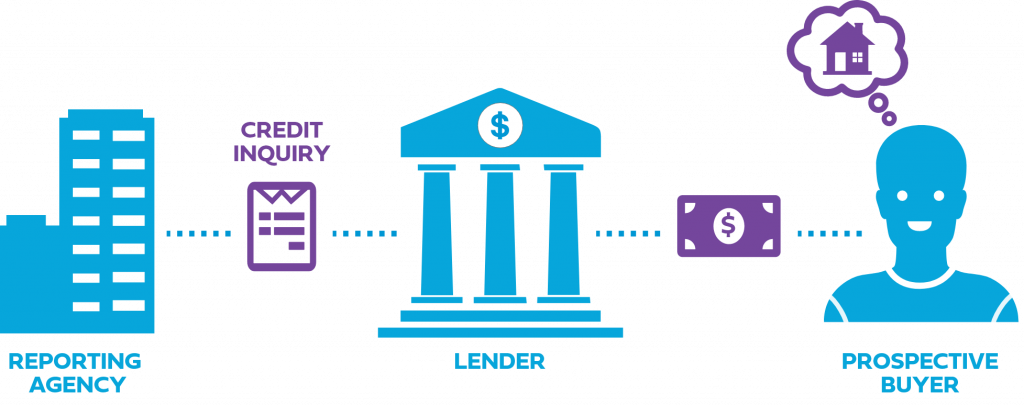

Mortgage Essentials

Learn all about mortgage rates, types of loans, cost breakdown, and more.

What Are the Common Types of Mortgage Loans?

How Much Should I Save for a Down Payment & Closing...

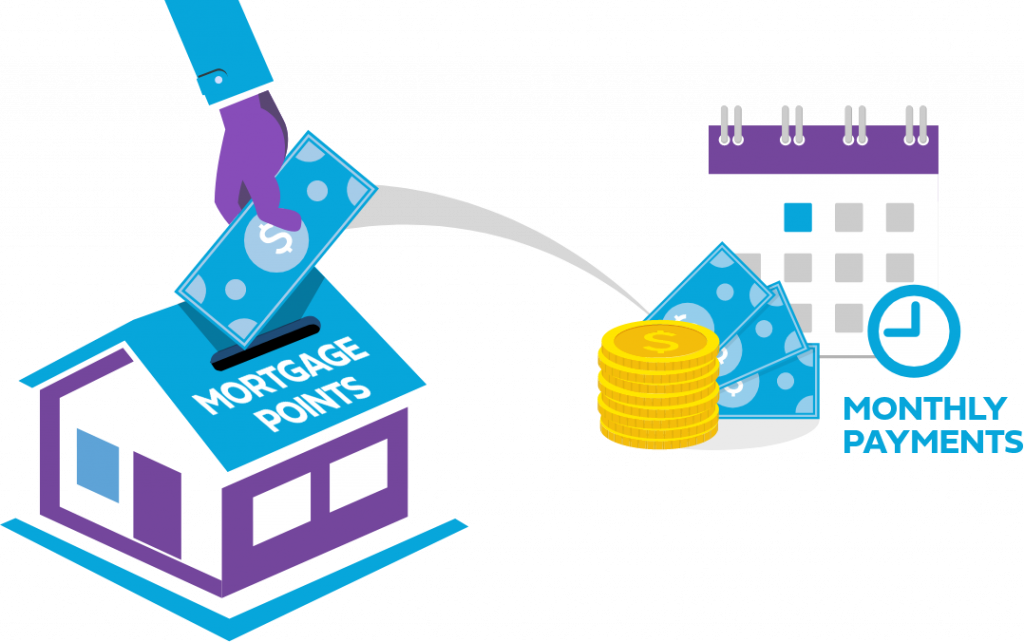

What Are Mortgage Points?

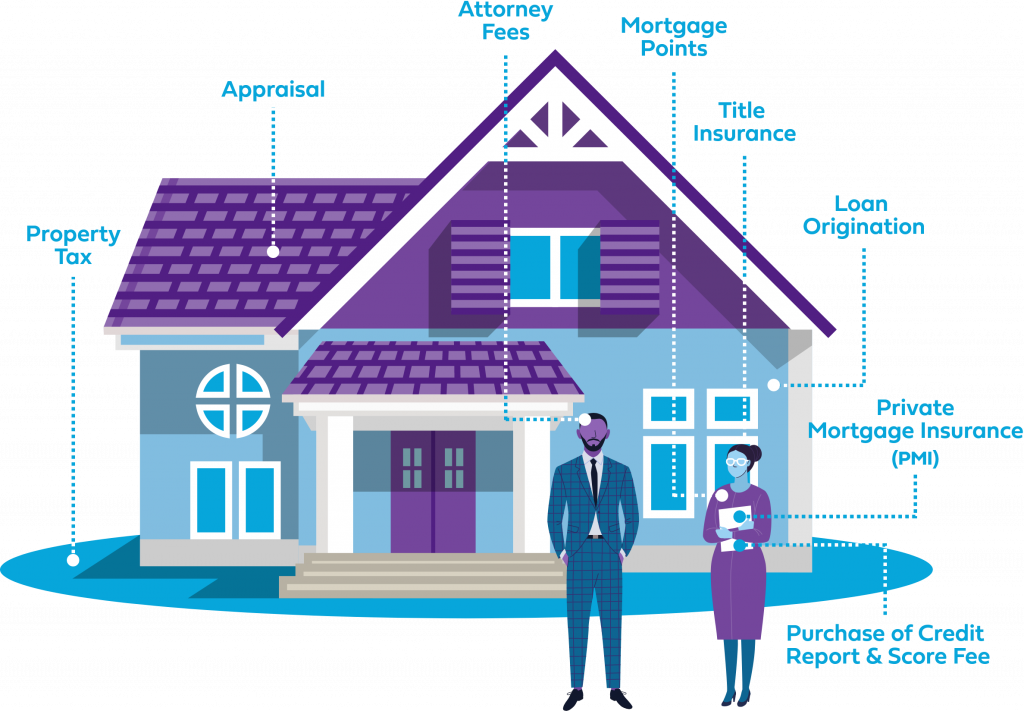

What Costs Are Included in My Mortgage Payment?

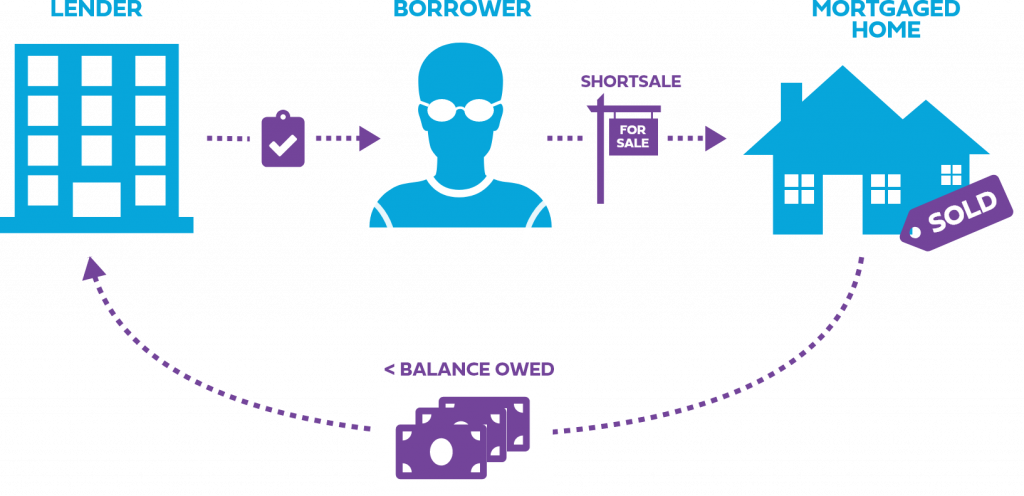

Foreclosures vs. Shortsales

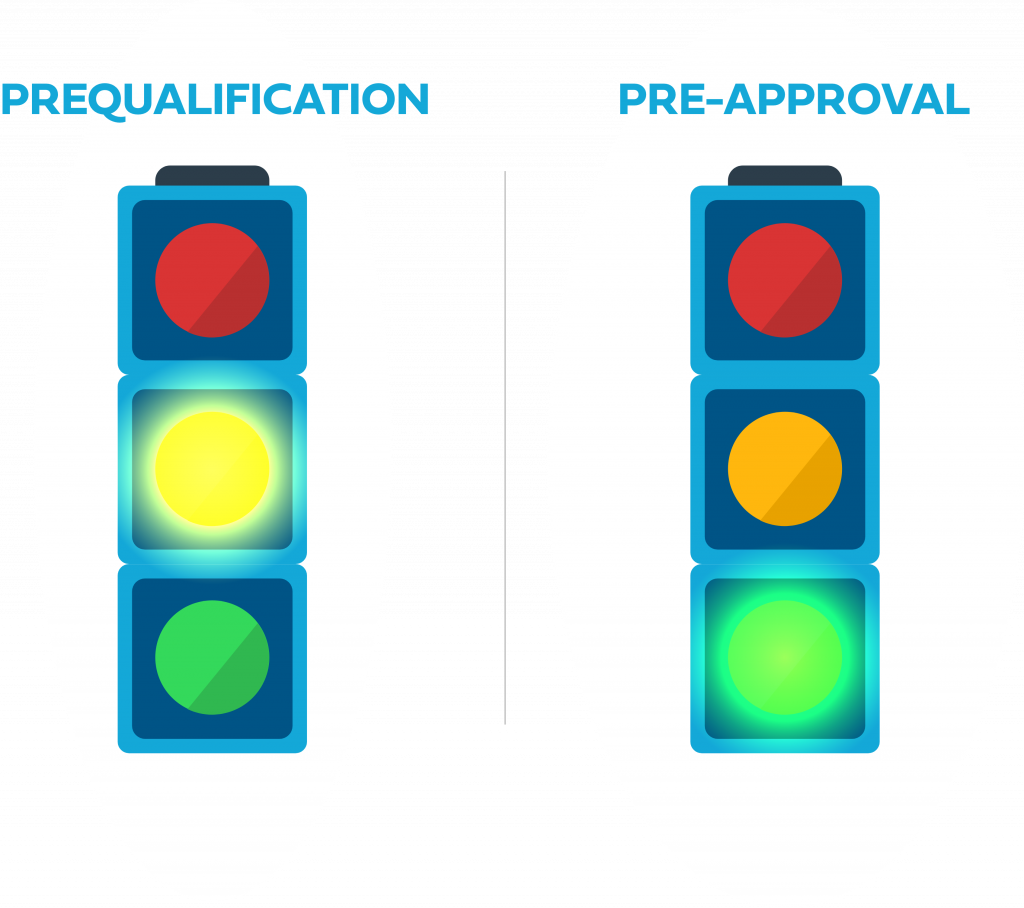

Prequalification vs. Preapproval

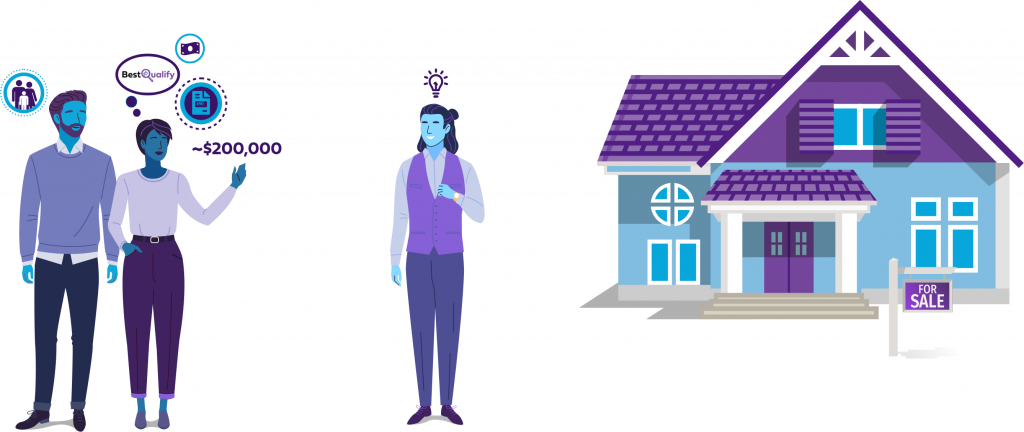

Navigating a Challenging Housing Market

Common New Home Buyer Mortgage Fails

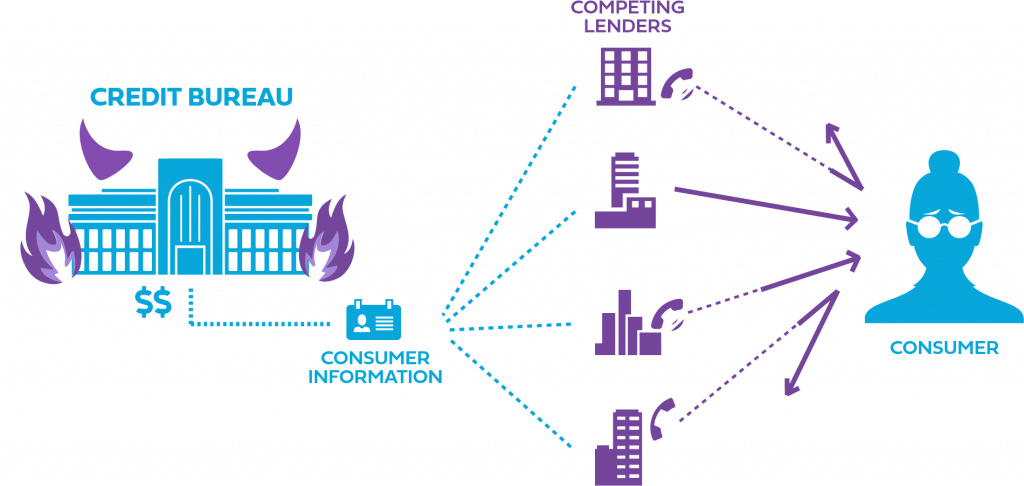

Buyer Alert

Learn all about trigger leads, things to be aware as a home buyer, mortgage relief, and more.